U.S. power companies face supply-chain crisis this summer

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

U.S. Power Grid Supply Shortages strain reliability as heat waves, hurricanes, and drought drive peak demand; transformer scarcity, gas constraints, and renewable delays raise outage risks across ERCOT and MISO, prompting FERC warnings.

Key Points

They are equipment and fuel constraints that, amid extreme weather and peak demand, elevate outage risks.

✅ Transformer shortages delay storm recovery and repairs.

✅ Record gas burn, low hydro tighten generation capacity.

✅ ERCOT and MISO warn of rolling outages in heat waves.

U.S. power companies are facing supply crunches amid the U.S. energy crisis that may hamper their ability to keep the lights on as the nation heads into the heat of summer and the peak hurricane season.

Extreme weather events such as storms, wildfires and drought are becoming more common in the United States. Consumer power use is expected to hit all-time highs this summer, reflecting unprecedented electricity demand across the Eastern U.S., which could strain electric grids at a time when federal agencies are warning the weather could pose reliability issues.

Utilities are warning of supply constraints for equipment, which could hamper efforts to restore power during outages. They are also having a tougher time rebuilding natural gas stockpiles for next winter, after the Texas power system failure highlighted cold-weather vulnerabilities, as power generators burn record amounts of gas following the shutdown of dozens of coal plants in recent years and extreme drought cuts hydropower supplies in many Western states.

"Increasingly frequent cold snaps, heat waves, drought and major storms continue to challenge the ability of our nation’s electric infrastructure to deliver reliable affordable energy to consumers," Richard Glick, chairman of the U.S. Federal Energy Regulatory Commission (FERC), said earlier this month.

Federal agencies responsible for power reliability like FERC have warned that grids in the western half of the country could face reliability issues this summer as consumers crank up air conditioners to escape the heat, with nationwide blackout risks not limited to Texas. read more

Some utilities have already experienced problems due to the heat. Texas' grid operator, the Electric Reliability Council of Texas (ERCOT), was forced to urge customers to conserve energy as the Texas power grid faced another crisis after several plants shut unexpectedly during an early heat wave in mid-May. read more

In mid-June, Ohio-based American Electric Power Co (AEP.O) imposed rolling outages during a heat wave after a storm damaged transmission lines and knocked out power to over 200,000 homes and businesses.

The U.S. Midwest faces the most severe risk because demand is rising while nuclear and coal power supplies have declined. read more

The Midcontinent Independent System Operator (MISO), which operates the grid from Minnesota to Louisiana, warned that parts of its coverage area are at increased risk of temporary outages to preserve the integrity of the grid.

Supply-chain issues have already delayed the construction of renewable energy projects across the country, and the aging U.S. grid is threatening progress on renewables and EVs. Those renewable delays coupled with tight power in the Midwest prompted Wisconsin's WEC Energy Group Inc (WEC.N) and Indiana's NiSource Inc (NI.N) to delay planned coal plant shutdowns in recent months.

BRACING FOR SUPPLY SHORTAGES

Utility operators are conserving their inventory of parts and equipment as they plan to prevent summer power outages during severe storms. Over the last several months, that means operators have been getting creative.

"We’re doing a lot more splicing, putting cables together, instead of laying new cable because we're trying to maintain our new cable for inventory when we need it," Nick Akins, chief executive of AEP, said at the CERAWeek energy conference in March.

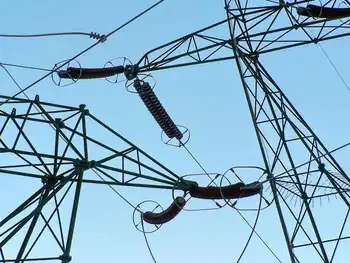

Transformers, which often sit on top of electrical poles and convert high-voltage energy to the power used in homes, are in short supply.

New Jersey-based Public Service Enterprise Group Inc (PSEG) (PEG.N) Chief Executive Ralph Izzo told Reuters the company has had to look at alternate supply options for low voltage transformers.

"You don’t want to deplete your inventory because you don't know when that storm is coming, but you know it's coming," Izzo said.

Some utilities are facing waiting times of more than a year for transformer parts, the National Rural Electric Cooperative Association and the American Public Power Association told U.S. Energy Secretary Jennifer Granholm in a May letter.

Summer is just starting, but U.S. weather so far this year has already been about 21% warmer than the 30-year norm, according to data provider Refinitiv.

"If we have successive days of 100-degree-heat, those pole top transformers, they start popping like Rice Krispies, and we would not have the supply stack to replace them," Izzo said.