Texas After-Labor Day School Start could ease ERCOT's power grid strain by shifting peak demand, lowering air-conditioning loads in schools, improving grid reliability, reducing electricity costs, and curbing emissions during extreme heat the summer months.

Key Points

A proposed calendar shift to start school after Labor Day to lower ERCOT peak demand, costs, and grid risk.

✅ Cuts school HVAC loads during peak summer heat

✅ Lowers costly peaker plant use and electricity rates

✅ Requires calendar changes, testing and activities shifts

As Texas faces increasing demands on its power grid, a new proposal is gaining traction: starting the school year after Labor Day. This idea, reported by the Dallas News, suggests that delaying the start of the academic year could help alleviate some of the pressure on the state’s electricity grid during the peak summer months, potentially leading to both grid stability and financial savings. Here’s an in-depth look at how this proposed change could impact Texas’s energy landscape and education system.

The Context of Power Grid Strain

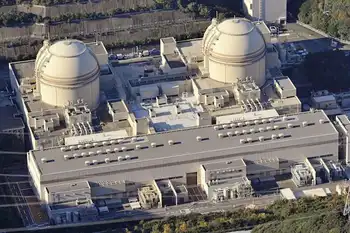

Texas's power grid, operated by the Electric Reliability Council of Texas (ERCOT), has faced significant challenges in recent years. Extreme weather events, record-breaking temperatures, and high energy demand have strained the grid, and some analyses argue that climate change, not demand is the biggest challenge today, leading to concerns about reliability and stability. The summer months are particularly taxing, as the demand for air conditioning surges, often pushing the grid to its limits.

In this context, the idea of adjusting the school calendar to start after Labor Day has been proposed as a potential strategy to help manage electricity demand. By delaying the start of school, proponents argue that it could reduce the load on the power grid during peak usage periods, thereby easing some of the stress on energy resources.

Potential Benefits for the Power Grid

The concept of delaying the school year is rooted in the potential benefits for the power grid. During the hottest months of summer, the demand for electricity often spikes as families use air conditioning to stay cool, and utilities warn to prepare for blackouts as summer takes hold. School buildings, typically large and energy-intensive facilities, contribute significantly to this demand when they are in operation.

Starting school later could help reduce this peak demand, as schools would be closed during the hottest months when the grid is under the most pressure. This reduction in demand could help prevent grid overloads and reduce the risk of power outages, at a time when longer, more frequent outages are afflicting the U.S. power grid, ultimately contributing to a more stable and reliable electricity supply.

Additionally, a decrease in peak demand could help lower electricity costs. Power plants, particularly those that are less efficient and more expensive to operate, are often brought online during periods of high demand. By reducing the peak load, the state could potentially minimize the need for these costly power sources, leading to lower overall energy costs.

Financial and Environmental Considerations

The financial implications of starting school after Labor Day extend beyond just the power grid. By reducing energy consumption during peak periods, the state could see significant savings on electricity costs. This, in turn, could lead to lower utility bills for schools, businesses, and residents alike, a meaningful relief as millions risk electricity shut-offs during summer heat.

Moreover, reducing the demand for electricity from fossil fuel sources can have positive environmental impacts. Lower peak demand may reduce the reliance on less environmentally friendly energy sources, and aligns with calls to invest in a smarter electricity infrastructure nationwide, thereby decreasing greenhouse gas emissions and contributing to overall environmental sustainability.

Challenges and Trade-offs

While the proposal offers potential benefits, it also comes with challenges and trade-offs. Adjusting the school calendar would require significant changes to the academic schedule, potentially affecting extracurricular activities, summer programs, and family plans, and comparisons to California's reliability challenges underscore the complexity. Additionally, there could be resistance from various stakeholders, including parents, educators, and students, who are accustomed to the current school calendar.

There are also logistical considerations to address, such as how a delayed start might impact standardized testing schedules and the academic calendar for higher education institutions. These factors would need to be carefully evaluated to ensure that the proposed changes do not adversely affect educational outcomes or create unintended consequences.

Looking Ahead

The idea of starting Texas schools after Labor Day represents an innovative approach to addressing the challenges facing the state’s power grid. By potentially reducing peak demand and lowering energy costs, and alongside efforts to connect Texas's grid to the rest of the nation, this proposal could contribute to greater grid stability and financial savings. However, careful consideration and planning will be essential to navigate the complexities of altering the school calendar and to ensure that the benefits outweigh the challenges.

As Texas continues to explore solutions for managing its power grid and energy resources, the proposal to shift the school year schedule provides an intriguing possibility. It reflects a broader trend of seeking creative and multifaceted approaches to balancing energy demand, environmental sustainability, and public needs.

In conclusion, starting schools after Labor Day could offer tangible benefits for Texas’s power grid and financial well-being. As discussions on this proposal advance, it will be important to weigh all factors and engage stakeholders to ensure a successful and equitable implementation.

Related News