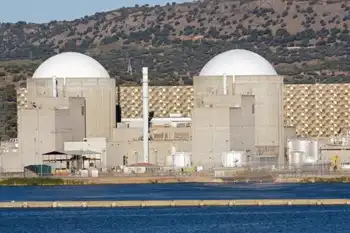

OMERS walks away from AECL talks

By Globe and Mail

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

The Ontario Municipal Employees Retirement System walked away from the negotiating table recently, after signaling in February that it was interested in joining with SNC on a bid for the money-losing AECL, which Ottawa is determined to sell.

For its part, SNC continues to negotiate with Ottawa over the purchase of AECL's commercial division. That process is well advanced — though stalled with the onset of the federal election — and a deal could conclude fairly quickly if the Conservatives return to power.

The nuclear disaster in Japan was one factor in OMERS' retreat because it raises fears that the global market for nuclear reactors will not be as robust as previously expected. But OMERS was also unhappy with SNC's approach to AECL, fearing the Montreal-based engineering firm did not have a long-term strategic vision of the nuclear business, sources close to that talks said.

"There is a real fear they'll just butcher the head count and AECL'll be left with a much reduced capability and just hope for orders," said one industry source close to the deal. But an SNC spokesperson said the company has a long record of acquisitions, it typically looks to those deals as growth opportunities and has not cut staff at acquired companies.

OMERS was a late-comer to the AECL auction, stepping in only after the board of directors at Bruce Power decided against making a bid. Bruce Power — which manages the Bruce nuclear station in southwestern Ontario — is owned by a shareholders group that includes OMERS, TransCanada Ltd. and Cameco Corp.

OMERS was expected to bring some financial clout to a partnership with SNC, as reactor purchasers are increasingly expecting the sellers to help finance deals and assume risks of cost overruns.

But the pension fund was also looking for the federal government to remain in the nuclear business by providing support for research and development, as well as the kind of financial backstops that are often available to international competitors.

The Conservative government — which has allocated billions to cover AECL's overruns in recent years — is unwilling to take on additional financial risk associated with the nuclear vendor.

Ontario was keen to see a partnership between OMERS and SNC. The province expects to purchase at least two new reactors in the coming years and refurbish several others.

The province has been frustrated by the slowness of Ottawa's privatization process, and urged Ottawa to complete a reactor sale to the province — with federal taxpayers' support — before selling AECL. Premier Dalton McGuinty has argued that an Ontario deal would serve as a springboard for the company to enter international markets.

"The feds have really made a mess of this process," Ontario Energy Minister Brad Duguid said in an interview.

"Our expectation and our hope is that the federal government will get their act together on this sooner rather than later. And that this restructuring will be complete soon so that we can have a partner at the other side of the table."

Neither OMERS nor SNC would not comment on the pension fund's about-face.

Many industry observers believe the engineering firm has little interest in bolstering AECL product line with a new generation of reactors, even as globally competitors are introducing and developing others.

Instead, SNC is expected to focus on the business of servicing and refurbishing existing Candu reactors.

SNC has indicated it will not pursue development of the new Advanced Candu Reactor ACR1000, which promises enhanced safety and more operating flexibility. Instead, it will focus efforts on an enhanced version of the Candu 6 workhorse that AECL has built in Canada and Asia. Ontario had initially considered buying the ACR1000, but is now planning to go with the enhanced Candu 6 in order to minimize financial risk associated with the first-of-a-kind construction.

SNC chief executive officer Pierre Duhaime said he remained enthusiastic about AECL's market potential, despite the Crown corporation's setbacks and the pall cast over the industry by the Fukushima Daiichi accident.

He said AECL's Candu nuclear reactors can capture between 10 to 20 per cent of the global market as governments look at smaller reactors that are less capital intensive and can be easily integrated in their energy networks.