Zero-emissions electricity by 2035 is possible

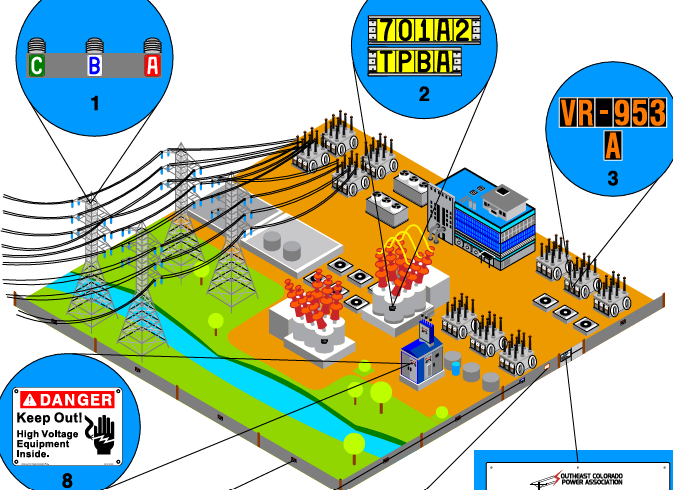

High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Canada Net-Zero Electricity 2035 aligns policy and investments with renewables, wind, solar, hydro, storage, and transmission to power electrification of EVs and heat pumps, guided by a stringent clean electricity standard and carbon pricing.

Key Points

A 2035 plan for a zero-emissions grid using renewables, storage and transmission to electrify transport and homes.

✅ Wind, solar, and hydro backed by battery storage and reservoirs

✅ Interprovincial transmission expands reliability and lowers costs

✅ Stringent clean electricity standard and full carbon pricing

By Tom Green

Senior Climate Policy Advisor

David Suzuki Foundation

Electric vehicles are making inroads in some areas of Canada. But as their numbers grow, will there be enough electrical power for them, and for all the buildings and the industries that are also switching to electricity?

Canada – along with the United States, the European Union and the United Kingdom – is committed to a “net-zero electricity grid by 2035 policy goal”. This target is consistent with the Paris Agreement’s ambition of staying below 1.5 C of global warming, compared with pre-industrial levels.

This target also gives countries their best chance of energy security, as laid out in landmark reports over the past year from the International Energy Agency and the Intergovernmental Panel on Climate Change. A new federal regulation in the form of a clean electricity standard is being developed, but will it be stringent enough to set us up for climate success and avoid dead ends?

Canada starts this work from a relatively low emissions-intensity grid, powered largely by hydroelectricity. However, some provinces such as Alberta, Saskatchewan, Nova Scotia and New Brunswick still have predominantly fossil fuel-powered electricity. Plus, there is a risk of more natural gas generation of electricity in the coming years in most provinces without new federal and provincial regulations.

This means the transition of Canada’s electricity system must solve two problems at once. It must first clean up the existing electricity system, but it must also meet future electricity needs from zero-emissions sources while overall electricity capacity doubles or even triples by 2050.

Canada has enormous potential for renewable generation, even though it remains a solar power laggard in deployment to date. Wind, solar and energy storage are proven, affordable technologies that can be produced here in Canada, while avoiding the volatility of global fossil fuel markets.

As wind and solar have become the cheapest forms of electricity generation in history, we’re already seeing foreign governments and utilities ramp up renewable projects at the pace and scale that would be needed here in Canada, highlighting a significant global electricity market opportunity for Canadian firms at home. In 2020, 280 gigawatts of new capacity was added globally – a 45 per cent increase over the previous year. In Canada, since 2010, annual growth in renewables has so far averaged less than three per cent.

So why aren’t we moving full steam – or electron – ahead? With countries around the world bringing in wind and solar for new generation, why is there so much delay and doubt in Canada, even as analyses explore why the U.S. grid isn’t 100% renewable and remaining barriers?

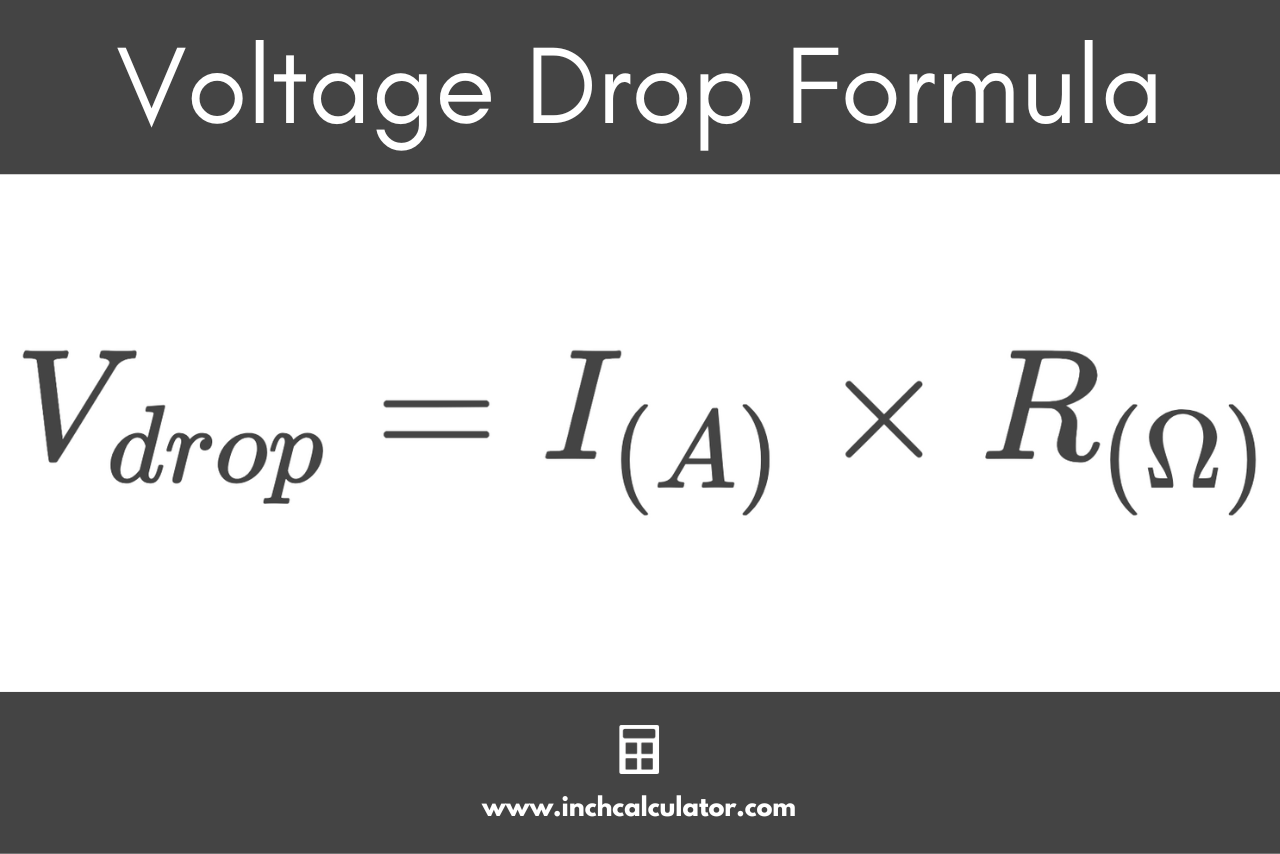

The modelling team drew on a dataset that accounts for how wind and solar potential varies across the country, through the weeks of the year and the hours of each day. The models provide solutions for the most cost-effective new generation, storage and transmission to add to the grid while ensuring electricity generation meets demand reliably every hour of the year.

The David Suzuki Foundation partnered with the University of Victoria to model the electricity grid of the future.

To better understand future electricity demand, a second modelling team was asked to explore a future when homes and businesses are aggressively electrified; fossil fuel furnaces and boilers are retired and replaced with electric heat pumps; and gasoline and diesel cars are replaced by electric vehicles and public transit. It also dialed up investments in energy efficiency to further reduce the need for energy. These hourly electricity-demand projections were fed back to the models developed at the University of Victoria.

The results? It is possible to meet Canada’s needs for clean electricity reliably and affordably through a focus on expanding wind and solar generation capacity, complemented with new transmission connections between provinces, and other grid improvements.

How is it that such high levels of variable wind and solar can be added to the grid while keeping the lights on 24/7? The model took full advantage of the country’s existing hydroelectric reservoirs, using them as giant batteries, storing water behind the dams when wind and solar generation was high to be used later when renewable generation is low, or when demand is particularly high. The model also invested in more transmission to enable expanded electricity trade between provinces and energy storage in the form of batteries to smooth out the supply of electricity.

Not only is it possible, but the renewable pathway is the safe bet.

There’s no doubt it will take unprecedented effort and scale to transform Canada’s electricity systems. The high electrification pathway would require an 18-fold increase over today’s renewable electricity capacity, deploying an unprecedented amount of new wind, solar and energy storage projects every year from now to 2050. Although the scale seems daunting, countries such as Germany are demonstrating that this pace and scale is possible.

The modelling also showed that small modular nuclear reactors (SMRs) are neither necessary nor cost-effective, making them a poor candidate for continued government subsidies. Likewise, we presented pathways with no need for continued fossil fuel generation with carbon capture and storage (CCS) – an expensive technology with a global track record of burning through public funds while allowing fossil fuel use to expand and while capturing a smaller proportion of the smokestack carbon than promised. We believe that Canada should terminate the significant subsidies and supports it is giving to fossil fuel companies and redirect this support to renewable electricity, energy efficiency and energy affordability programming.

The transition to clean electricity would come with new employment for people living in Canada. Building tomorrow’s grid will support more than 75,000 full-time jobs each year in construction, operation and maintenance of wind, solar and transmission facilities alone.

Regardless of the path chosen, all energy projects in Canada take place on unceded Indigenous territories or treaty land. Decolonizing power structures with benefits to Indigenous communities is imperative. Upholding Indigenous rights and title, ensuring ownership opportunities and decision-making and direct support for Indigenous communities are all essential in how this transition takes place.

Wind, solar, storage and smart grid technologies are evolving rapidly, but our understanding of the possibilities they offer for a zero-emissions future, including debates over clean energy’s dirty secret in some supply chains, appears to be lagging behind reality. As the Institut de L’énergie Trottier observed, decarbonization costs have fallen faster than modellers anticipated.

The shape of tomorrow’s grid will largely depend on policy decisions made today. It’s now up to people living in Canada and their elected representatives to create the right conditions for a renewable revolution that could make the country electric, connected and clean in the years ahead.

To avoid a costly dash-to-gas that will strand assets and to secure early emissions reductions, the electricity sector needs to be fully exposed to the carbon price. The federal government’s announcement that it will move forward with a clean electricity standard – requiring net-zero emissions in the electricity sector by 2035 – will help if the standard is stringent.

Federal funding to encourage provinces to expand interprovincial transmission, including recent grid modernization investments now underway will also move us ahead. At the provincial level, electricity system governance – from utility commission mandates to electricity markets design – needs to be reformed quickly to encourage investments in renewable generation. As fossil fuels are swapped out across the economy, more and more of a household’s total energy bill will come from a local electric utility, so a national energy poverty strategy focused on low-income and equity-seeking households must be a priority.

The payoff from this policy package? Plentiful, reliable, affordable electricity that brings better outcomes for community health and resilience while helping to avoid the worst impacts of climate change.