IBM telling clients that recession means reinvention

By Investor's Business Daily

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

The key to maintaining a thriving business is realizing when it must change, says an article in this month's Harvard Business Review by consultant Mark W. Johnson, business guru Clayton Christensen and Henning Kagermann, co-CEO of SAP. "Companies have to focus on learning and adjusting as much as executing," they wrote.

A recent poll of CEOs by IBM (IBM) found that nearly all saw a need to adapt their business models to today's economy, and more than two-thirds expected to make extensive changes.

And IBM hopes that when companies start this reinvention, they'll call on Big Blue. As the largest tech services provider, it has positioned itself to help global businesses shift gears and ride out this recession.

Companies that embrace wrenching changes can emerge from the bad times stronger, says Saul Berman, global lead partner of IBM's strategy and change services consulting practice. In these times, traditional cost cutting isn't enough.

"People need a different kind of cost management," Berman said. "It's just as much about managing capital and exploiting opportunities."

For instance, he says, companies might choose this time to launch a price war to drive weaker competitors from the market. Or they might look to acquire rivals when stock prices become undervalued.

Changing times require new business strategies, Berman says. He cites Hollywood studios seeking to reinvent themselves with more direct-to-consumer films via the Internet and cable TV. Another tactic could involve attracting new forms of movie content from different sources, such as India's Bollywood or Japanese animators.

"This is a time to build future capabilities," Berman said. "The winners are going to reapply certain assets, curtail some things and free up those assets to invest elsewhere."

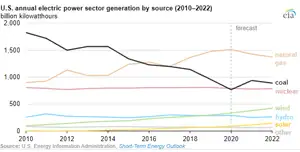

IBM is involved in projects that could usher in major changes for businesses. Berman points to IBM's work last year in helping the Pacific Northwest National Laboratory redesign part of the electrical grid in Washington and Oregon.

That test project used sensors linked to controllers on household appliances. Homeowners in the test got new electric meters, thermostats, water heaters and dryers. The devices were hooked up to the electric grid via IBM software.

Then, any stresses to the grid were automatically adjusted at times of peak energy usage. Peak loads fell by 15% in the course of the year.

In the test, consumers could barter their usage patterns for lower costs. Those who cut their energy consumption during peak times earned savings. Average household energy bills fell by 10%. By implementing this system on a larger scale, utilities in the region expect to be able to avoid spending some $70 billion over the next 20 years on new energy-generation and transmission systems.

IBM is also pitching the recession as a good time for global companies to consider outsourcing more tasks. This can cut costs and make companies more flexible, says John Lutz, general manager of IBM's managed business process services. His team handles accounting, human resources, customer relations and supply chain management for corporate clients.

Companies don't need to create mini versions of themselves in each country they do business in, Lutz says. They can outsource functions to various parts of the globe.

"We help clients go down the path from having a multinational presence in a lot of places to being globally integrated," he said.

IBM has operations worldwide — the U.S., Brazil, Poland, India, the Philippines and elsewhere — that serve clients in different ways. Their specialties are based on local costs, expertise, available talent and client delivery needs.

"People now want their companies to become much more blended and integrated," Lutz said. "The idea of stacking everything up in every region is going away."

In recent years, IBM has helped Unilever (UL) unify its far-flung technology networks across Europe. The food processor wanted to run all its operations for the whole continent on a single software platform. That would let Unilever open and close operations quickly, based on changing demands and costs.

Unilever has said the shift let it reduce its finance staff in Europe from 1,800 people to near 1,000. IBM runs those finance duties from its outsourcing centers in Bangalore, India, and Krakow, Poland.

Companies that keep a cool head can benefit from the growing global uncertainty, according to consultants Lowell Bryant and Diana Farrell of McKinsey & Co. Managers should be flexible and allow for multiple strategic actions, they say.

"Every plan should embrace all of the functions, business units, and geographies of a company and show how it can make the most of a specific economic environment," they wrote in the McKinsey Quarterly.