Alberta Utility Rate Rider will add a modest fee to electricity bills and natural gas charges as the AUC recovers outstanding debt from the COVID-19 deferral program via AESO and the Balancing Pool.

Key Points

A temporary surcharge on Alberta power and gas bills to recover unpaid COVID-19 deferral debt, administered by the AUC.

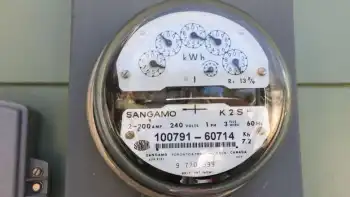

✅ Applies per kWh and per GJ based on consumption

✅ Recovers unpaid balances from 2020-21 bill deferrals

✅ Collected via AESO and the Balancing Pool under AUC oversight

The province says Alberta ratepayers should expect to see an extra fee on their utility bills in the coming months.

That fee is meant to recover the outstanding debt owed to gas and electricity providers resulting from last year's three-month utility deferral program offered to struggling Albertans during the pandemic.

The provincial government announced the utility deferral program in March 2020 then formalized it with legislation, alongside a consumer price cap on power bills that shaped later policy decisions.

The program allowed residential, farm and small commercial customers who used less than 250,000 kilowatt hours of electricity per year — or consumed less than 2,500 gigajoules per year — to postpone their bills amid the COVID-19 pandemic.

According to the province, 350,000 customers, or approximately 13 per cent of the natural gas and electricity consumer base, took advantage of the program.

Customers had a year to repay providers what they owed. That deadline ended June 18, 2021.

The Alberta Utilities Commission (AUC), which regulates the utilities sector and natural gas and electricity markets and oversees a rate of last resort framework, said the vast majority of consumers have squared up.

But for those who didn't, provincial legislation dictates that Alberta ratepayers must cover any unpaid debt. The legislation exempts Medicine Hat utility customers for electricity and gas co-operative customers for gas.

"When the program was announced, it was very clear that it was a deferral program and that the monies would need to be paid back," said Geoff Scotton, a spokesperson with the Alberta Utilities Commission.

"Now we're in the situation where the providers, in good faith, who enabled those payment deferrals, need to be made whole. That's really the goal here."

Amount to be determined

Margeaux Maron, a spokesperson for Associate Minister of Natural Gas and Electricity Dale Nally, said based on early estimates, $13 to $16 million of $92 million in deferred payments remain outstanding.

As a result, the province expects the average Albertan will end up paying, unlike jurisdictions offering a lump-sum credit, a fraction of a dollar extra per monthly gas and electricity bill over a handful of months.

Scotton said at this point, there are too many unknown factors to know the exact size of the rate rider. However, he said he expects it to be modest.

Scotton said affected parties first have until the end of this week to notify the AUC exactly how much they are still owed.

Those parties include the Alberta Electric System Operator and the Balancing Pool, who essentially acted as bankers with respect to the distribution and transmission of the utilities to customers who deferred their payments.

Regulated service providers may also seek reimbursement on administrative and carrying costs, even as issues like a BC Hydro fund surplus spark debate elsewhere.

Then, Scotton said, once the outstanding amounts are known, the AUC will hold a public proceeding, similar to a Nova Scotia rate case, to determine the amount and the duration of the rate rider to be applied to each natural gas and electricity bill.

The amount will be based on consumption: per kilowatt hour for electricity and per gigajoule for natural gas.

That means larger businesses will end up paying more than the average Albertan.

Scotton said the AUC will expedite the hearing process and it expects to have a decision by the end of the summer.

Rate rider a 'surprise'

Joel MacDonald with Energyrates.ca — an organization which compares energy rates across the country — said it's not the amount of the rate rider that bothers him, but the fact that the repayment process wasn't made clear at the onset of the program.

"It came to us as a bit of a surprise," MacDonald said.

He said what was sold as a deferral program seems more like an electricity rebate program, or an "ability to pay" program.

"As opposed to the retailers looking into collection methods, anything that wasn't paid is basically just being forced upon all Alberta consumers," MacDonald said.

The expectation set out in the deferral legislation and regulations state utility providers such as Enmax and Epcor are expected to use reasonable efforts to try to collect the unpaid balances. It must then detail those reasonable efforts to the AUC.

A spokesperson for Enmax said it first works with its customers to find manageable payment arrangements and connects them with support services if they are unable to pay.

Then, if payment can't be arranged, it said it will work with a collection agency, which may even result in disconnection of service.

The spokesperson said only after all efforts have failed would Enmax seek reimbursement through this program.

Use tax revenues?

MacDonald also questioned why a government program isn't being paid for through general tax revenues.

He compared the utility deferral program to a mortgage subsidy program.

"Imagine that [Canada Mortgage And Housing Corporation] said, 'Hey, we had to give mortgage deferrals and some of these people never paid back their deferrals, so we're going to add an extra $300 to everyone's mortgage,'" he said.

"You'd expect that to come off of some sort of general taxation — not being assigned to other people's mortgages, right?"

In response, Maron said due to the current fiscal challenges facing the government — and the expected minimal costs to consumers, and even as a consumer price cap on electricity remains in place — it was determined that a rate rider would be an appropriate mechanism to repay bad debt associated with the program.

Scotton said rate riders aren't unusual — they're used to fine-tune rates for a set period of time.

He said under normal circumstances, regulated service providers can apply to the AUC to impose a rate rider to recover unexpected costs. And in some instances, they can provide a credit.

But in this situation, he said the debt is aggregated and, in turn, being collected more broadly.

Related News