New Toronto plant will deliver power to the people

By Toronto Sun

Electrical Testing & Commissioning of Power Systems

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

But if you like air conditioning, it's the key to keeping the lights on in the next sweltering heat wave.

Technically it's the Portlands Energy Centre. A $730-million, 550-megawatt natural gas energy plant that will bring power to the City of Toronto's electricity grid.

That's the good news. The bad news is it's an environmentalist's and a waterfront planner's worst nightmare.

This is really about industrializing Toronto's waterfront, critics like Mayor David Miller say.

The optics are brutal, with the plant going up next door to the now-shuttered Hearn generating plant.

Yes, it's near the water. It's also at the end of the portlands where the "concrete campus," as it's being called, will be built. A new Canadian Tire opens nearby this fall.

So why build it here? Convenience. Because there are already power lines and a hydro substation built to move power from the old hydro plant which can be adapted for this one.

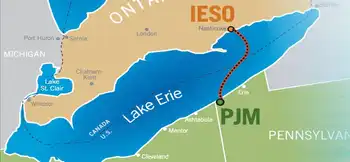

Most importantly, it doesn't use the existing, maxed-out power lines. Toronto has two circuits into the city, one from the east, one from the west, and that's it.

On a hot, humid day, with air conditioners around the city blowing full blast, Toronto's power grid operates at full tilt. On June 26, the Independent Electricity Service Operator (IESO) begged Torontonians to ease off on the A/C because the transmission lines couldn't bring any more power into the city.

With three Pickering nuclear plant units out of service, there was no way to generate extra power locally, either.

"All the power for Toronto - with all due respect to the windmill - is produced outside the city," the IESO's Terry Young said.

Toronto's transmission system is aging and Young said it's important to find ways to take the stress off.

Putting power where it's needed helps reduce stress on the entire grid.

Toronto is the only major city in North America not producing power within its city limits, Young said.

(New York City requires 75% of its electricity generation to occur within its five boroughs.)

We'd be in the dark already without the incredible efforts of Torontonians, Toronto Hydro and the Ontario Power Authority to conserve energy, taking hundreds of megawatts of demand off the system.

The problem is that at the same time, dozens of new condo buildings have been constructed, bringing with them massive air conditioning demands.

"Air conditioning is one of the biggest draws of power," Young said. "Ontario used to use the highest amount of energy in the winter. Now, it's the summer."

Toronto is adding a city the size of Peterborough to its population every four years. It takes a lot of power to keep up.

The IESO projects without new power generation in the city, there would be brownouts and possibly blackouts by next summer.

"There are very few options," Young said. "Newly-generated power can't make it into the city because the transmission lines are overloaded. The only way is to reduce demand, but sometimes demand spikes in the blink of an eye."

When that happens, either the hydro companies cut the voltage or there are blackouts. That doesn't mean you have to like the new power plant.

Just ask Coun. Paula Fletcher. She detests the view emerging from Commissioners St., across the turning basin. It used to be just the Hearn.

"If you look across, it's blocked off the view of a beautiful waterfront," Fletcher says. "It could have been in the Hearn."

That "beautiful view" line is a bit rich. But why not in the Hearn?

Well, the engineers took us inside the old building, pointed up at a bunch of things and said, "See?"

(It would take a smarter person than me to figure it out, but the technical mumbo jumbo sounded good.)

Fletcher says the power seekers believe there's a supply problem. She believes there's a demand problem.

She advocates green buildings and smart technology, such as having buildings store power overnight, then use it to help the power grid during peak hours.

Still, Fletcher and her cronies need to know, as much as we conserve, our thirst for energy doesn't seem to end. And as our population grows, I'll take another power plant over blackouts any day.