Japanese utilities buy into vast offshore wind farm in UK

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Japan Offshore Wind Investment signals Japanese utilities entering UK offshore wind, as J-Power and Kansai Electric buy into Innogy's Triton Knoll, leveraging North Sea expertise, 9.5MW turbines, and 15-year fixed-rate contracts.

Key Points

Japanese utilities buying UK offshore wind stakes to import expertise, as J-Power and Kansai join Innogy's Triton Knoll.

✅ $900M deal: J-Power 25%, Kansai Electric ~16% in Innogy unit

✅ Triton Knoll: 860MW, up to 90 9.5MW turbines, 15-year fixed PPA

✅ Goal: Transfer North Sea expertise to develop Japan offshore wind

Two of Japan's biggest power companies will buy around 40% of a German-owned developer of offshore wind farms in the U.K., seeking to learn from Britain's lead in this sector, as highlighted by a UK offshore wind milestone this week, and bring the know-how back home.

Tokyo-based Electric Power Development, better known as J-Power, will join Osaka regional utility Kansai Electric Power in investing in a unit of Germany's Innogy.

The deal, estimated to be worth around $900 million, will give J-Power a 25% stake and Kansai Electric a roughly 16% share. It will mark the first investment in an offshore wind project by Japanese power companies, as other markets shift strategies, with Poland backing wind over nuclear signaling broader momentum.

Innogy plans to start up the 860-megawatt Triton Knoll offshore wind project -- one of the biggest of its kind in the world -- in the North Sea in 2021. The vast installation will have up to 90 9.5MW turbines and sell its output to local utilities under a 15-year fixed-rate contract.

J-Power, which supplies mainly fossil-fuel-based electricity to Japanese regional utilities, will set up a subsidiary backed by the government-run Development Bank of Japan to participate in the Innogy project. Engineers will study firsthand construction and maintenance methods.

While land-based wind turbines are proliferating worldwide, offshore wind farms have progressed mainly in Europe, though U.S. offshore wind competitiveness is improving in key markets. Installed capacity totaled more than 18,000MW at the end of 2017, which at maximum capacity can produce as much power as 18 nuclear reactors.

Japan has hardly any offshore wind farms in commercial operation, and has little in the way of engineering know-how in this field or infrastructure for linking such installations to the land power grid, with a recent Japan grid blackout analysis underscoring these challenges. But there are plans for a total of 4,000MW of offshore wind power capacity, including projects under feasibility studies.

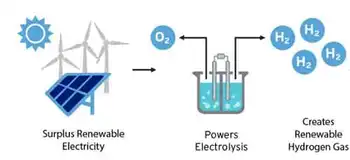

J-Power set up a renewable energy division in June to look for opportunities to expand into wind and geothermal energy in Japan, and efforts like a Japan hydrogen energy system are emerging to support decarbonization. Kansai Electric also seeks know-how for increasing its reliance on renewable energy, even as it hurries to restart idled nuclear reactors.

They are not the only Japanese investors is in this field. In Asia, trading house Marubeni will invest in a Taiwanese venture with plans for a 600MW offshore wind farm.