Duke Energy fights rising pollution bill

By Knight Ridder Tribune

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

The bill, sponsored by Sens. Joe Lieberman of Connecticut, an independent, and John Warner of Virginia, a Republican, would place a national cap on carbon dioxide emissions from coal-fired plants, believed by many to be a major cause of global warming. It would also create a complex system for buying and selling pollution credits - special permission from the government for companies to pollute.

But it doesn't give enough exemptions to Duke and other utilities that rely heavily on coal, the company says. That's a deal breaker for Duke, which says the measure could send average power rates up 32 percent by 2020.

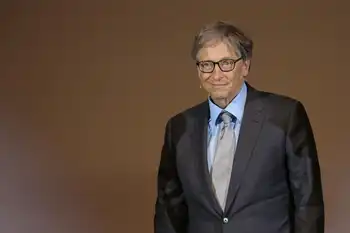

Chief executive Jim Rogers said the bill amounted to an unfair tax on producing power from coal. "They are, in my judgment, not being straightforward," he said. "They are using Washington-speak to describe what is really a carbon tax."

The bill would hit sectors of the economy that cover about 70 percent of the nation's carbon dioxide output, mainly from industry and other sources, such as cars. Exempted would be agriculture and residential emissions, which largely come from home heating with natural gas. The bill would set up a national cap-and-trade system for carbon dioxide, which would allow companies that pollute less and beat the cap to sell credits to those that exceed it.

Over time, the cap, initially based on carbon dioxide output from 2005, would be lowered and tougher to beat. The credits, traded on a national exchange, would become more rare and more expensive. Such systems are designed to make it more expensive over time to pollute, forcing companies to develop and pay for pollution-control technology.

There currently isn't a reliable way to reduce carbon dioxide emissions from coal-fired plants, short of shutting them down, Rogers said. So the industry needs exemptions for several years while it figures out the technology, and it shouldn't be taxed in the process, he said.

The Charlotte utility is among the nation's most prolific carbon dioxide emitters, the third largest user of coal. Duke relies on the fuel for 52 percent of its power generation in the Carolinas and 98 percent in its three Midwest territories - Indiana Kentucky and Ohio.

Several global warming bills are floating around Congress that would give utilities the allowances Duke is after. But the Lieberman bill was approved by a subcommittee November 1, and it appears to have some traction. The public criticism from Duke is a different tactic for Rogers, who has sought to be in the vanguard in setting carbon-regulation legislation.

He was among the first executives to call for carbon dioxide regulations and to blame the gas as cause of global warming. He knows his way around Capitol Hill as a former regulatory lawyer and has spent weeks since taking over as CEO early last year testifying before Congress and lobbying lawmakers on the issue.

David McIntosh, a Lieberman aide, said Duke's estimate of an up-to-32-percent increase for rates is inflated and that the bill follows guidelines by USCAP, a group of industry executives. Rogers was among those executives in January as they called for a national cap-and-trade system.

"That's not just any old interest group," McIntosh said. Rogers was successful in lobbying Congress for similar exemptions when it set up a cap and pollution credit system in the late 1980s to reduce sulfur dioxide emissions, a chief ingredient of acid rain. That program has been successful, Rogers pointed out.