Hydro-Quebec hydropower exports deliver low-carbon electricity to New England, sparking debate on greenhouse gas accounting, grid attributes, and REC-style certificates as Quebec modernizes monitoring to verify emissions, integrate renewables, and meet ambitious climate targets.

Key Points

Low-carbon electricity to New England, with improved emissions tracking and verifiable grid attributes.

✅ Deep, narrow reservoirs cut lifecycle GHGs in cold boreal waters

✅ Attribute certificates trace source, type, and carbon intensity

✅ Contracts require facility-level tagging for compliance

For 40 years, through the most vicious interprovincial battles, even as proposals for bridging the Alberta-B.C. gap aimed to improve grid resilience, Canadians could agree on one way Quebec is undeniably superior to the rest of the country.

It’s hydropower, and specifically the mammoth dam system in Northern Quebec that has been paying dividends since it was first built in the 70s. “Quebec continues to boast North America’s lowest electricity prices,” was last year’s business-as-usual update in one trade publication, even as Newfoundland's rate strategy seeks relief for consumers.

With climate crisis looming, that long-ago decision earns even more envy and reflects Canada's electricity progress across the grid today. Not only do they pay less, but Quebeckers also emit the least carbon per capita of any province.

It may surprise most Canadians, then, to hear how most of New England has reacted to the idea of being able to buy permanently into Quebec’s power grid.

Hydro-Québec’s efforts to strike major export deals have been rebuffed in the U.S., by environmentalists more than anyone. They question everything about Quebec hydropower, including asking “is it really low-carbon?”

These doubts may sound nonsensical to regular Quebeckers. But airing them has, in fact, pushed Hydro-Québec to learn more about itself and adopt new technology.

We know far more about hydropower than we knew 40 years ago, including whether it’s really zero-emission (it’s not), how to make it as close to zero-emission as possible, and how to account for it as precisely as new clean energies like solar and wind, underscoring how cleaning up Canada's electricity is vital to meeting climate pledges.

The export deals haven’t gone through yet, but they’ve already helped drag Hydro-Québec—roughly the fourth-biggest hydropower system on the planet—into the climate era.

Fighting to export

One of the first signs of trouble for Quebec hydro was in New Hampshire, almost 10 years ago. People there began pasting protest signs on their barns and buildings. One citizens’ group accused Hydro of planning a “monstrous extension cord” across the state.

Similar accusations have since come from Maine, Massachusetts and New York.

The criticism isn’t coming from state governments, which mostly want a more permanent relationship with Hydro-Québec. They already rely on Quebec power, but in a piecemeal way, topping up their own power grid when needed (with the exception of Vermont, which has a small permanent contract for Quebec hydropower).

Last year, Quebec provided about 15 percent of New England’s total power, plus another substantial amount to New York, which is officially not considered to be part of New England, and has its own energy market separate from the New England grid.

Now, northeastern states need an energy lynch pin, rather than a top-up, with existing power plants nearing the end of their lifespans. In Massachusetts, for example, one major nuclear plant shut down this year and another will be retired in 2021. State authorities want a hydro-based energy plan that would send $10 billion to Hydro-Québec over 20 years.

New England has some of North America’s most ambitious climate goals, with every state in the region pledging to cut emissions by at least 80 percent over the next 30 years.

What’s the downside? Ask the citizens’ groups and nonprofits that have written countless op-eds, organized petitions and staged protests. They argue that hydropower isn’t as clean as cutting-edge clean energy such as solar and wind power, and that Hydro-Québec isn’t trying hard enough to integrate itself into the most innovative carbon-counting energy system. Right as these other energy sources finally become viable, they say, it’s a step backwards to commit to hydro.

As Hydro-Québec will point out, many of these critics are legitimate nonprofits, but others may have questionable connections. The Portland Press Herald in Maine reported in September 2018 that a supposedly grassroot citizens’ group called “Stand Up For Maine” was actually funded by the New England Power Generators Association, which is based in Boston and represents such power plant owners as Calpine Corp., Vistra Energy and NextEra Energy.

But in the end, that may not matter. Arguably the biggest motivator to strike these deals comes not from New England’s needs, but from within Quebec. The province has spent more than $10 billion in the last 15 years to expand its dam and reservoir system, and in order to stay financially healthy, it needs to double its revenue in the next 10 years—a plan that relies largely on exports.

With so much at stake, it has spent the last decade trying to prove it can be an energy of the future.

“Learning as you go”

American critics, justified or not, have been forcing advances at Hydro for a long time.

When the famously huge northern Quebec hydro dams were built at James Bay—construction began in the early 1970s—the logic was purely economic. The term “climate change” didn’t exist. The province didn’t even have an environment department.

The only reason Quebec scientists started trying to measure carbon emissions from hydro reservoirs was “basically because of the U.S.,” said Alain Tremblay, a senior environmental advisor at Hydro Quebec.

Alain Tremblay, senior environmental advisor at Hydro-Québec. Photograph courtesy of Hydro-Québec

In the early 1990s, Hydro began to export power to the U.S., and “because we were a good company in terms of cost and efficiency, some Americans didn't like that,” he said—mainly competitors, though he couldn’t say specifically who. “They said our reservoirs were emitting a lot of greenhouse gases.”

The detractors had no research to back up that claim, but Hydro-Québec had none to refute it, either, said Tremblay. “At that time we didn’t have any information, but from back-of-the envelope calculations, it was impossible to have the emissions the Americans were expecting we have.”

So research began, first to design methods to take the measurements, and then to carry them out. Hydro began a five-year project with a Quebec university.

It took about 10 years to develop a solid methodology, Tremblay said, with “a lot of error and learning-as-you-go.” There have been major strides since then.

“Twenty years ago we were taking a sample of water, bringing it back to the lab and analyzing that with what we call a gas chromatograph,” said Tremblay. “Now, we have an automated system that can measure directly in the water,” reading concentrations of CO2 and methane every three hours and sending its data to a processing centre.

The tools Hydro-Québec uses are built in California. Researchers around the world now follow the same standard methods.

At this point, it’s common knowledge that hydropower does emit greenhouse gases. Experts know these emissions are much higher than previously thought.

Workers on the Eastmain-1 project environmental monitoring program. Photography courtesy of Alain Tremblay.

But Hydro-Québec now has the evidence, also, to rebut the original accusations from the early 1990s and many similar ones today.

“All our research from Université Laval [found] that it’s about a thousand years before trees decompose in cold Canadian waters,” said Tremblay.

Hydro reservoirs emit greenhouse gases because vegetation and sometimes other biological materials, like soil runoff, decay under the surface.

But that decay depends partly on the warmth of the water. In tropical regions, including the southern U.S., hydro dams can have very high emissions. But in boreal zones like northern Quebec (or Manitoba, Labrador and most other Canadian locations with massive hydro dams), the cold, well-oxygenated water vastly slows the process.

Hydro emissions have “a huge range,” said Laura Scherer, an industrial ecology professor at Leiden University in the Netherlands who led a study of almost 1,500 hydro dams around the world.

“It can be as low as other renewable energy sources, but it can also be as high as fossil fuel energy,” in rare cases, she said.

While her study found that climate was important, the single biggest factor was “sizing and design” of each dam, and specifically its shape, she said. Ideally, hydro dams should be deep and narrow to minimize surface area, perhaps using a natural valley.

Hydro-Québec’s first generation of dams, the ones around James Bay, were built the opposite way—they’re wide and shallow, infamously flooding giant tracts of land.

Alain Tremblay, senior environmental advisor at Hydro-Québec testing emission levels. Photography courtesy of Alain Tremblay

Newly built ones take that new information into account, said Tremblay. Its most recent project is the Romaine River complex, which will eventually include four reservoirs near Quebec’s northeastern border with Labrador. Construction began in 2016.

The site was picked partly for its topography, said Tremblay.

“It’s a valley-type reservoir, so large volume, small surface area, and because of that there’s a pretty limited amount of vegetation that’s going to be flooded,” he said.

There’s a dramatic emissions difference with the project built just before that, commissioned in 2006. Called Eastmain, it’s built near James Bay.

“The preliminary results indicate with the same amount of energy generated [by Romaine] as with Eastmain, you’re going to have about 10 times less emissions,” said Tremblay.

Tracing energy to its source

These signs of progress likely won’t satisfy the critics, who have publicly argued back and forth with Hydro about exactly how emissions should be tallied up.

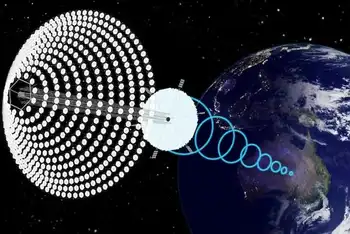

But Hydro-Québec also faces a different kind of growing gap when it comes to accounting publicly for its product. In the New England energy market, a sophisticated system “tags” all the energy in order to delineate exactly how much comes from which source—nuclear, wind, solar, and others—and allows buyers to single out clean power, or at least the bragging rights to say they bought only clean power.

Really, of course, it’s all the same mix of energy—you can’t pick what you consume. But creating certificates prevents energy producers from, in worst-case scenarios, being able to launder regular power through their clean-power facilities. Wind farms, for example, can’t oversell what their own turbines have produced.

What started out as a fraud prevention tool has “evolved to make it possible to also track carbon emissions,” said Deborah Donovan, Massachusetts director at the Acadia Center, a climate-focused nonprofit.

But Hydro-Québec isn’t doing enough to integrate itself into this system, she says.

It’s “the tool that all of our regulators in New England rely on when we are confirming to ourselves that we’ve met our clean energy and our carbon goals. And…New York has a tool just like that,” said Donovan. “There isn’t a tracking system in Canada that’s comparable, though provinces like Nova Scotia are tapping the Western Climate Initiative for technical support.”

Hydro Quebec Chénier-Vignan transmission line crossing the Outaouais river. Photography courtesy of Hydro-Québec

Developing this system is more a question of Canadian climate policy than technology.

Energy companies have long had the same basic tracking device—a meter, said Tanya Bodell, a consultant and expert in New England’s energy market. But in New England, on top of measuring “every time there’s a physical flow of electricity” from a given source, said Bodell, a meter “generates an attribute or a GIS certificate,” which certifies exactly where it’s from. The certificate can show the owner, the location, type of power and its average emissions.

Since 2006, Hydro-Québec has had the ability to attach the same certificates to its exports, and it sometimes does.

“It could be wind farm generation, even large hydro these days—we can do it,” said Louis Guilbault, who works in regulatory affairs at Hydro-Québec. For Quebec-produced wind energy, for example, “I can trade those to whoever’s willing to buy it,” he said.

But, despite having the ability, he also has the choice not to attach a detailed code—which Hydro doesn’t do for most of its hydropower—and to have it counted instead under the generic term of “system mix.”

Once that hydropower hits the New England market, the administrators there have their own way of packaging it. The market perhaps “tries to determine emissions, GHG content,” Guilbault said. “They have their own rules; they do their own calculations.”

This is the crux of what bothers people like Donovan and Bodell. Hydro-Québec is fully meeting its contractual obligations, since it’s not required to attach a code to every export. But the critics wish it would, whether by future obligation or on its own volition.

Quebec wants it both ways, Donovan argued; it wants the benefits of selling low-emission energy without joining the New England system of checks and balances.

“We could just buy undifferentiated power and be done with it, but we want carbon-free power,” Donovan said. “We’re buying it because of its carbon content—that’s the reason.”

Still, the requirements are slowly increasing. Under Hydro-Québec’s future contract with Massachusetts (which still has several regulatory steps to go through before it’s approved) it’s asked to sell the power’s attributes, not just the power itself. That means that, at least on paper, Massachusetts wants to be able to trace the energy back to a single location in Quebec.

“It’s part of the contract we just signed with them,” said Guilbault. “We’re going to deliver those attributes. I’m going to select a specific hydro facility, put the number in...and transfer that to the buyers.”

Hydro-Québec says it’s voluntarily increasing its accounting in other ways. “Even though this is not strictly required,” said spokeswoman Lynn St. Laurent, Hydro is tracking its entire output with a continent-wide registry, the North American Renewables Registry.

That registry is separate from New England’s, so as far as Bodell is concerned, the measure doesn’t really help. But she and others also expect the entire tracking system to grow and mature, perhaps integrating into one. If it had been created today, in fact, rather than in the 1990s, maybe it would use blockchain technology rather than a varied set of administrators, she said.

Counting emissions through tracking still has a long way to go, as well, said Donovan, and it will increasingly matter in Canada's race to net-zero as standards tighten. For example, natural gas is assigned an emissions number that’s meant to reflect the emissions when it’s consumed. But “we do not take into account what the upstream carbon emissions are through the pipeline leakage, methane releases during fracking, any of that,” she said.

Now that the search for exactitude has begun, Hydro-Québec won’t be exempt, whether or not Quebeckers share that curiosity. “We don’t know what Hydro-Québec is doing on the other side of the border,” said Donovan.

Related News