High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Our customized live online or in‑person group training can be delivered to your staff at your location.

PG&E Wildfire Blackouts highlight California power shutoffs as high winds and suspected transmission line faults trigger evacuations, CPUC investigations, and grid safety reviews, with utilities weighing risk, compliance, and resilience during Santa Ana conditions.

PG&E Wildfire Blackouts are outages during wind-driven fire threats linked to power lines, spurring CPUC investigations.

✅ Wind and line faults suspected amid Lafayette evacuations

✅ CPUC to probe shutoffs, notifications, and compliance

✅ Utilities plan more outages as Santa Ana winds return

Pacific Gas & Electric Co. power lines may have started two wildfires over the weekend in the San Francisco Bay Area, the utility said Monday, even though widespread blackouts were in place to prevent downed lines from starting fires during dangerously windy weather.

The fires described in PG&E reports to state regulators match blazes that destroyed a tennis club and forced evacuations in Lafayette, about 20 miles (32 kilometres) east of San Francisco.

The fires began in a section of town where PG&E had opted to keep the lights on. The sites were not designated as a high fire risk, the company said.

Powerful winds were driving multiple fires across California and forcing power shut-offs intended to prevent blazes, even as electricity prices are soaring across the state as well.

More than 900,000 power customers -- an estimated 2.5 million people -- were in the dark at the height of the latest planned blackout, nearly all of them in PG&E's territory in Northern and central California. By Monday evening a little less than half of those had their service back. But some 1.5 million people in 29 counties will be hit with more shut-offs starting Tuesday because another round of strong winds is expected, a reminder of grid stress during heat waves that test capacity, the utility said.

Southern California Edison had cut off power to 25,000 customers and warned that it was considering disconnecting about 350,000 more as power supply lapses and Santa Ana winds return midweek.

PG&E is under severe financial pressure after its equipment was blamed for a series of destructive wildfires and its 2018 Camp Fire guilty plea compounded liabilities during the past three years. Its stock dropped 24% Monday to close at $3.80 and was down more than 50% since Thursday.

The company reported last week that a transmission tower may have caused a Sonoma County fire that has forced 156,000 people to evacuate.

PG&E told the California Public Utilities Commission that a worker responded to a fire in Lafayette late Sunday afternoon and was told firefighters believed contact between a power line and a communication line may have caused it.

A worker went to another fire about an hour later and saw a fallen pole and transformer. Contra Costa Fire Department personnel on site told the worker they were looking at the transformer as a potential ignition source, a company official wrote.

Separately, the company told regulators that it had failed to notify 23,000 customers, including 500 with medical conditions, before shutting off their power earlier this month during windy weather.

Before a planned blackout, power companies are required to notify customers and take extra care to get in touch with those with medical problems who may not be able to handle extended periods without air conditioning or may need power to run medical devices.

PG&E said some customers had no contact information on file. Others were incorrectly thought to be getting electricity.

After that outage, workers discovered 43 cases of wind-related damage to power lines, transformers and other equipment.

Jennifer Robison, a PG&E spokeswoman, said the company is working with independent living centres to determine how best to serve people with disabilities.

The company faced a growing backlash from regulators and lawmakers, and a judge's order on wildfire risk spending added pressure as well.

U.S. Rep. Josh Harder, a Democrat from Modesto, said he plans to introduce legislation that would raise PG&E's taxes if it pays bonuses to executives while engaging in blackouts.

The Public Utilities Commission plans to open a formal investigation into the blackouts and the broader climate policy debate surrounding reliability within the next month, allowing regulators to gather evidence and question utility officials. If rules are found to be broken, they can impose fines up to $100,000 per violation per day, said Terrie Prosper, a spokeswoman for the commission.

The commission said Monday it also plans to review the rules governing blackouts, will look to prevent utilities from charging customers when the power is off and will convene experts to find grid improvements that might lessen blackouts during next year's fire season, as debates over rate stability in 2025 continue across PG&E's service area.

The state can't continue experiencing such widespread blackouts, "nor should Californians be subject to the poor execution that PG&E in particular has exhibited," Marybel Batjer, president of the California Public Utilities Commission, said in a statement.

NECEC Clean Energy Connect advances with Maine DEP permits, Hydro-Québec contracts, and rigorous transmission line mitigation, including tapered vegetation, culvert upgrades, and forest conservation, delivering low-carbon power, broadband fiber, and projected ratepayer savings.

A Maine transmission project delivering Hydro-Québec power with strict DEP mitigation, lower bills, and added broadband.

✅ DEP permits mandate tapered vegetation, culvert upgrades, land conservation

✅ Hydro-Québec to supply 9.55 TWh/yr via MA contracts; bill savings 2-4%

✅ Added broadband fiber in Somerset and Franklin; local tax benefits

The Maine DEP reviewed the Clean Energy Connect project for more than two years, while regional interest in cross-border transmission continued to grow, before issuing permits that included additional environmental mitigation elements.

"Collectively, the requirements of the permit require an unprecedented level of environmental protection and compensatory land conservation for the construction of a transmission line in the state of Maine," DEP said in a May 11 statement.

Requirements include limits on transmission corridor width, forest preservation, culvert replacement and vegetation management projects, while broader grid programs like vehicle-to-grid integration enhance clean energy utilization across the region.

"In our original proposal we worked hard to develop a project that provided robust mitigation measures to protect the environment," NECEC Transmission CEO Thorn Dickinson said in a statement. "And through this permitting process, we now have made an exceedingly good project even better for Maine."

NECEC will be built on land owned or controlled by Central Maine Power. The 53 miles of new corridor on working forest land will use a new clearing technique for tapered vegetation, while the remainder of the project follows existing power lines.

Environmentalists said they agreed with the decision, and the mitigation measures state regulators took, noting similar momentum behind new wind investments in other parts of Canada.

"Building new ways to deliver low-carbon energy to our region is a critical piece of tackling the climate crisis," CLF Senior Attorney Phelps Turner said in a statement. "DEP was absolutely right to impose significant environmental conditions on this project and ensure that it does not harm critical wildlife areas."

Once complete, Turner said the transmission line will allow the region "to retire dirty fossil fuel plants in the coming years, which is a win for our health and our climate."

The Massachusetts Department of Public Utilities in June 2019 advanced the project by approving contracts for the state's utilities to purchase 9,554,940 MWh annually from Hydro-Quebec. Officials said the project is expected to provide approximately 2% to 4% savings on monthly energy bills.

Total net benefits to Massachusetts ratepayers over the 20-year contract, including both direct and indirect benefits, are expected to be approximately $4 billion, according to the state's estimates.

NECEC "will also deliver significant economic benefits to Maine and the region, including lower electricity prices, increased local real estate taxes and reduced energy costs with examples like battery-backed community microgrids demonstrating local resilience, expanded fiber optic cable for broadband service in Somerset and Franklin counties and funding of economic development for Western Maine," project developers said in a statement.

Coinmint Plattsburgh Dispute spotlights cryptocurrency mining, hydropower electricity rates, a $1M security deposit, Public Service Commission rulings, municipal utility policies, and seasonal migration to Massena data centers as Bitcoin price volatility pressures operations.

Legal and energy-cost dispute over crypto mining, a $1,019,503 deposit, and operations in Plattsburgh and Massena.

✅ PSC allows higher rates and requires large security deposits.

✅ Winter electricity spikes drove a $1M deposit calculation.

✅ Coinmint shifted capacity to Massena data centers.

A few years ago, there was a lot of buzz about the North Country becoming the next Silicon Valley of cryptocurrency, even as Maine debated a 145-mile line that could reshape regional power flows. One of the companies to flock here was Coinmint. The cryptomining company set up shop in Plattsburgh in 2017 and declared its intentions to be a good citizen.

Today, Coinmint is fighting a legal battle to avoid paying the city’s electric utility more than $1 million owed for a security deposit. In addition to that dispute, a local property manager says the firm was evicted from one of its Plattsburgh locations.

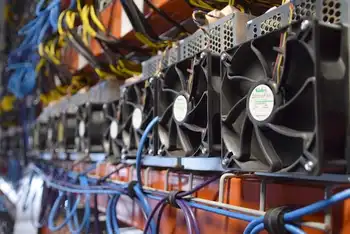

Companies like Coinmint chose to come to the North Country because of the relatively low electricity prices here, thanks in large part to the hydropower dam on the St. Lawrence River in Massena, and regionally, projects such as the disputed electricity corridor have drawn attention to transmission costs and access. Coinmint operates its North Country Data Center facilities in Plattsburgh and Massena. In both locations, racks of computer servers perform complex calculations to generate cryptocurrency, such as bitcoin.

When cryptomining began to take off in Plattsburgh, the cost of one bitcoin was skyrocketing. That brought hype around the possibility of big business and job creation in the North Country. But cryptomininers like Coinmint were using massive amounts of energy in the winter of 2017-2018, and that season, electric bills of everyday Plattsburgh residents spiked.

Many cryptomining firms operate in a state of flux, beholden to the price of Bitcoin and other cryptocurrencies, even as the end to the 'war on coal' declaration did little to change utilities' choices. When the price of one bitcoin hit $20,000 in 2017, it fell by 30% just days later. That’s one reason why the price of electricity is so critical for companies like Coinmint to turn a profit.

Plattsburgh puts the brakes on “cryptocurrency mining”

In early 2018, Plattsburgh passed a moratorium on cryptocurrency mining operations, after residents complained of higher-than-usual electric bills.

“Your electric bill’s $100, then it’s at $130. Why? It’s because these guys that are mining the bitcoins are riding into town, taking advantage of a situation,” said resident Andrew Golt during a 2018 public hearing.

Coinmint aimed to assuage the worries of residents and other businesses. “At the end of the day we want to be a good citizen in whatever communities we’re in,” Coinmint spokesman Kyle Carlton told NCPR at that 2018 meeting.

“We’re open to working with those communities to figure out whatever solutions are going to work.”

The ban was lifted in Feb. 2019. However, since it didn’t apply to companies that were already mining cryptocurrency in Plattsburgh, Coinmint has operated in the city all along.

Coinmint challenges attempt to protect ratepayers

New rules passed by the New York Public Service Commission in March 2018 allow municipal power authorities including Plattsburgh’s to charge big energy users such as Coinmint higher electricity rates, amid customer backlash in other utility deals. The new rules also require them to put down a security deposit to ensure their bills get paid.

But Coinmint disputes that deposit charge. The company has been embroiled in a legal fight for nearly a year against Plattsburgh Municipal Lighting Department (PMLD) in an attempt to avoid paying the electric utility’s security deposit bill of $1,019,503. That bill is based on an estimate of what would cover two months of electricity use if a company were to leave town without paying its electric bills.

Coinmint would not discuss the dispute on the record with NCPR. Legal documents show the firm argues the deposit charge is inflated, based on a flawed calculation resulting in a charge hundreds of thousands of dollars higher than what it should be.

“Essentially they’re arguing that they should only have to put up some average of their monthly bills without accounting for the fact that winter bills are significantly higher than the average,” said Ken Podolny, an attorney representing the Plattsburgh utility.

The company took legal action in February 2019 against PMLD in the hopes New York’s energy regulator, the Public Service Commission, would agree with Coinmint that the deposit charge was too high. An informal commission hearing officer disagreed, and ruled in October the charge was calculated correctly.

Coinmint appealed the ruling in November and a hearing on the appeal could come as soon as February.

Less than a week after Coinmint lost its initial challenge of the deposit charge, the company made a splashy announcement trumpeting its plans to “migrate its Plattsburgh, New York infrastructure to its Massena, New York location for the 2019-2020 winter season.”

The announcement made no mention of the appeal or the recent ruling against Coinmint. The company attributed its new plan to “exceptionally-high” electricity rates in Plattsburgh, as hydropower transmission projects elsewhere in New England faced their own controversies.

"We recognize some in the Plattsburgh community have blamed our operation for pushing rates higher for everyone so, while we disagree with that assessment, we hope this seasonal migration will have a positive impact on rates for all our neighbors,” said Coinmint cofounder Prieur Leary in the press statement.

“In the event that doesn't happen, we trust the community will look for the real answers for these high costs." Prieur Leary has since been removed from the corporate team page on the company’s website.

The company still operates in Plattsburgh at one of its locations in the city. As for staff, while at least two Coinmint employees have moved from Plattsburgh to Massena, where the company operates a data center inside a former Alcoa aluminum plant, it is unclear how many people in total have made the move.

Coinmint left its second Plattsburgh location in 2019. The company would not discuss that move on the record, yet the circumstances of the departure are murky.

The local property manager of the industrial park site told NCPR, “I have no comment on our evicted tenant Coinmint.” The property owner, California’s Karex Property Management Services, also would not comment regarding the situation, noting that “all staff have been told to not discuss anything regarding our past tenant Coinmint.”

Today, Bitcoin and other cryptocurrencies are worth a fraction of what they were back in 2017 when Coinmint came to the North Country, and now, amid a debate over Bitcoin's electricity use shaping market sentiment, the future of the entire industry here remains uncertain.

CPEC Power Producers drive China-Pakistan energy cooperation under the Belt and Road Initiative, delivering clean, reliable electricity, investment transparency, and grid stability while countering allegations, cutting circular debt, and easing load-shedding nationwide.

CPEC Power Producers are BRI-backed energy projects supplying clean, reliable power and stabilizing Pakistan's grid.

✅ Supply one-third of load during COVID-19 peak, ensuring reliability

✅ Reduce circular debt and mitigate nationwide load-shedding

✅ Operate under BRI with transparent, long-term investment

Chinese government has rejected the allegations against the CPEC Power Producers (CPPs) amid broader coal reduction goals in the power sector.

Chinese government has made it clear that a mammoth cooperation with Pakistan in the energy sector is continuing, aligned with its broader electricity outlook through 2060 and beyond.

A letter written by Chinese ambassador to minister of Energy Omar Ayub Khan has said that major headway has been seen in recent days in the perspective of CPEC projects, alongside China's nuclear energy development at home. But he wants to invite the attention of government of Pakistan to the recent allegations leveled against the CPEC Power Producers (CPPs).

The Chinese ambassador further said Energy is a major area of cooperation under the CPEC and the CPPs have provided large amount of clean, reliable and affordable electricity to the Pakistani consumers and have guaranteed one-third of the power load during the COVID-19 pandemic, even as China grappled with periodic power cuts domestically. However many misinformed analysis and media distortion about the CPPs have been made public to create confusion about the CPEC, amid global solar sector uncertainty influencing narratives. Therefore, the Port Qasim Electric Power Company, Huaneng Shandong Ruyi Energy Limited and the China Power Hub Generation Company Limited as leading CPPs have drafted their own reports in this regard to present the real facts about the investors and operators. The conclusion is the CPPs have contributed to overcoming of loadshedding and the reduction of the power circular debt.

Reports of the two companies have also been attached with the letter wherein it has been laid out that CPEC as a pilot project under the Belt and Road Initiative, which also includes regional nuclear energy cooperation efforts, is an important platform for China and Pakistan to build a stronger economic and development partnership.

Chinese companies have expressed strong reservations over report of different committees besides voicing protest over it. They have made it clear they are ready to present the real situation before the competent authorities and committee, and in parallel with electricity infrastructure initiatives abroad, because all the work is being carried out by Chinese companies in power sector in fair and transparent manner.

PG&E Wildfire Assistance Program offers court-approved aid and emergency grants for Northern California wildfires and Camp Fire victims, covering unmet needs, housing, and essentials; apply online by November 15, 2019 under Chapter 11-funded eligibility.

A $105M, court-approved aid fund offering unmet-needs payments and emergency support for 2017-2018 wildfire victims.

✅ $5,000 Basic Unmet Needs per household, self-certified

✅ Supplemental aid for extreme circumstances after basic grants

✅ Apply online; deadline November 15, 2019; identity required

Beginning today, August 15, 2019, those displaced by the 2017 Northern California wildfires and 2018 Camp fire can apply for aid through an independently administered Wildfire Assistance Program funded by Pacific Gas and Electric Company (PG&E). PG&E’s $105 million fund, approved by the judge in PG&E’s Chapter 11 cases and related bankruptcy plan, is intended to help those who are either uninsured or need assistance with alternative living expenses or other urgent needs. The court-approved independent administrator is set to file the eligibility criteria as required by the court and will open the application process.

“Our goal is to get the money to those who most need it as quickly as possible. We will prioritize wildfire victims who have urgent needs, including those who are currently without adequate shelter,” said Cathy Yanni, plan administrator. Yanni is partnering with local agencies and community organizations to administer the fund, and PG&E also supports local communities through property tax contributions to counties.

“We appreciate the diligent work of the fund administrator in quickly establishing a way to distribute these funds and ensuring the program supports those with the most immediate needs. PG&E is focused on helping those impacted by the devastating wildfires in recent years and strengthening our energy system to reduce wildfire risks and prevent utility-caused catastrophic fires. We feel strongly that helping these communities now is the right thing to do,” said Bill Johnson, CEO and President of PG&E Corporation.

Applicants can request a “Basic Unmet Needs” payment of $5,000 per household for victims who establish basic eligibility requirements and self-certify that they have at least $5,000 of unmet needs that have not been compensated by the Federal Emergency Management Agency (FEMA). Payments are to support needs such as water, food, prescriptions, medical supplies and equipment, infant formula and diapers, personal hygiene items, and transportation fuels beyond what FEMA covered in the days immediately following the declared disasters, aligning with broader health and safety actions the company has taken.

Those who receive basic payments may also qualify for a “Supplemental Unmet Needs” payment. These funds will be available only after “Basic Unmet Needs” payments have been issued. Supplemental payments will be available to individuals and families who currently face extreme or extraordinary circumstances as compared to others who were impacted by the 2017 and 2018 wildfires, including areas affected by power line-related fires across California.

To qualify for the payments, applicants’ primary residence must have been within the boundary of the 2017 Northern California wildfires or the 2018 Camp fire in Butte County. Applicants also must establish proof of identity and certify that they are not requesting payments for an expense already paid for by FEMA.

Applicants can find more information and apply for assistance at https://www.norcalwildfireassistanceprogram.com/. The deadline to file for aid is November 15, 2019.

The $105 million being provided by PG&E was made available from the company’s cash reserves. PG&E will not seek cost recovery from its customers, and its rates are set to stabilize in 2025 according to recent guidance.

Spain Electricity Prices surge to record highs as the wholesale market hits €339.84/MWh, driven by gas costs and CO2 permits, impacting PVPC regulated tariffs, free-market contracts, and household energy bills, OMIE data show.

Rates in Spain's wholesale market that shape PVPC tariffs and free-market bills, moving with gas prices and CO2 costs.

✅ Record €339.84/MWh; peak 20:00-21:00; low 04:00-05:00 (OMIE).

✅ PVPC users and free-market contracts face higher bills.

✅ Drivers: high gas prices and rising CO2 emission rights.

Electricity in Spain's wholesale market will rise in price once more as European electricity prices continue to surge. Once again, it will set a historical record in Spain, reaching €339.84/MWh. With this figure, it is already the fifth time that the threshold of €300 has been exceeded.

This new high is a 6.32 per cent increase on today’s average price of €319.63/MWh, which is also a historic record, while Germany's power prices nearly doubled over the past year. Monday’s energy price will make it 682.65 per cent higher than the corresponding date in 2020, when the average was €43.42.

According to data published by the Iberian Energy Market Operator (OMIE), Monday’s maximum will be between the hours of 8pm and 9pm, reaching €375/MWh, a pattern echoed by markets where Electric Ireland price hikes reflect wholesale volatility. The cheapest will be from 4am to 5am, at €267.99.

The prices of the ‘pool’ have a direct effect on the regulated tariff – PVPC – to which almost 11 million consumers in the country are connected, and serve as a reference for the other 17 million who have contracted their supply in the free market, where rolling back prices is proving difficult across Europe.

These spiraling prices in recent months, which have fueled EU energy inflation, are being blamed on high gas prices in the markets, and carbon dioxide (CO2) emission rights, both of which reached record highs this year.

According to an analysis by Facua-Consumidores en Acción, if the same rates were maintained for the rest of the month, the last invoice of the year would reach €134.45 for the average user. That would be 94.1 per cent above the €69.28 for December 2020, while U.S. residential electricity bills rose about 5% in 2022 after inflation adjustments.

The average user’s bill so far this year has increased by 15.1 per cent compared to 2018, as US electricity prices posted their largest jump in 41 years. Thus, compared to the €77.18 of three years ago, the average monthly bill now reaches €90.87 euros. However, the Government continues to insist that this year households will end up paying the same as in 2018.

As Ruben Sanchez, the general secretary of Facua commented, “The electricity bill for December would have to be negative for President Sanchez, and Minister Ribera, to fulfill their promise that this year consumers will pay the same as in 2018 once the CPI has been discounted”.

Stay informed with our FREE Newsletter — get the latest news, breakthrough technologies, and expert insights, delivered straight to your inbox.

Advantages To Instructor-Led Training – Instructor-Led Course, Customized Training, Multiple Locations, Economical, CEU Credits, Course Discounts.

Request For QuotationWhether you would prefer Live Online or In-Person instruction, our electrical training courses can be tailored to meet your company's specific requirements and delivered to your employees in one location or at various locations.