Germany Hydrogen-Ready Power Plants Tender accelerates the energy transition by enabling clean energy generation, decarbonization, and green hydrogen integration through retrofit and new-build capacity, resilient infrastructure, flexible storage, and grid reliability provisions.

Key Points

Germany tender to build or convert plants for hydrogen, advancing decarbonization, energy security, and clean power.

✅ Hydrogen-ready retrofits and new-build generation capacity

✅ Supports decarbonization, grid reliability, and flexible storage

✅ Future-proof design for green hydrogen supply integration

Germany, a global leader in energy transition and environmental sustainability, has recently launched an ambitious call for tenders aimed at developing hydrogen-ready power plants. This initiative is a significant step in the country's strategy to transform its energy infrastructure and support the broader goal of a greener economy. The move underscores Germany’s commitment to reducing greenhouse gas emissions and advancing clean energy technologies.

The Need for Hydrogen-Ready Power Plants

Hydrogen, often hailed as a key player in the future of clean energy, offers a promising solution for decarbonizing various sectors, including power generation. Unlike fossil fuels, hydrogen produces zero carbon emissions when used in fuel cells or burned. This makes it an ideal candidate for replacing conventional energy sources that contribute to climate change.

Germany’s push for hydrogen-ready power plants reflects the country’s recognition of hydrogen’s potential in achieving its climate goals. Traditional power plants, which typically rely on coal, natural gas, or oil, emit substantial amounts of CO2. Transitioning these plants to utilize hydrogen can significantly reduce their carbon footprint and align with Germany's climate targets.

The Details of the Tender

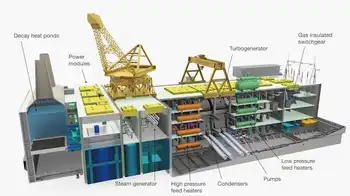

The recent tender call is part of Germany's broader strategy to incorporate hydrogen into its energy mix, amid a nuclear option debate in climate policy. The tender seeks proposals for power plants that can either be converted to use hydrogen or be built with hydrogen capability from the outset. This approach allows for flexibility and innovation in how hydrogen technology is integrated into existing and new energy infrastructures.

One of the critical aspects of this initiative is the focus on “hydrogen readiness.” This means that power plants must be designed or retrofitted to operate with hydrogen either exclusively or in combination with other fuels. The goal is to ensure that these facilities can adapt to the growing availability of hydrogen and seamlessly transition from conventional fuels without significant additional modifications.

By setting such requirements, Germany aims to stimulate the development of technologies that can handle hydrogen’s unique properties and ensure that the infrastructure is future-proofed. This includes addressing challenges related to hydrogen storage, transportation, and combustion, and exploring concepts like storing electricity in natural gas pipes for system flexibility.

Strategic Implications for Germany

Germany’s call for hydrogen-ready power plants has several strategic implications. First and foremost, it aligns with the country’s broader energy strategy, which emphasizes the need for a transition from fossil fuels to cleaner alternatives, building on its decision to phase out coal and nuclear domestically. As part of its commitment to the Paris Agreement and its own climate action plans, Germany has set ambitious targets for reducing greenhouse gas emissions and increasing the share of renewable energy in its energy mix.

Hydrogen plays a crucial role in this strategy, particularly for sectors where direct electrification is challenging. For instance, heavy industry and certain industrial processes, such as green steel production, require high-temperature heat that is difficult to achieve with electricity alone. Hydrogen can fill this gap, providing a cleaner alternative to natural gas and coal.

Moreover, this initiative helps Germany bolster its leadership in green technology and innovation. By investing in hydrogen infrastructure, Germany positions itself as a pioneer in the global energy transition, potentially influencing international standards and practices. The development of hydrogen-ready power plants also opens up new economic opportunities, including job creation in engineering, construction, and technology sectors.

Challenges and Opportunities

While the push for hydrogen-ready power plants presents significant opportunities, it also comes with challenges. Hydrogen production, especially green hydrogen produced from renewable sources, remains relatively expensive compared to conventional fuels. Scaling up production and reducing costs are critical for making hydrogen a viable alternative for widespread use.

Furthermore, integrating hydrogen into existing power infrastructure, alongside electricity grid expansion, requires careful planning and investment. Issues such as retrofitting existing plants, ensuring safe handling of hydrogen, and developing efficient storage and transportation systems must be addressed.

Despite these challenges, the long-term benefits of hydrogen integration are substantial, and a net-zero roadmap indicates electricity costs could fall by a third. Hydrogen can enhance energy security, reduce reliance on imported fossil fuels, and support global climate goals. For Germany, this initiative is a step towards realizing its vision of a sustainable, low-carbon energy system.

Conclusion

Germany’s call for hydrogen-ready power plants is a forward-thinking move that reflects its commitment to sustainability and innovation. By encouraging the development of infrastructure capable of using hydrogen, Germany is taking a significant step towards a cleaner energy future. While challenges remain, the strategic focus on hydrogen underscores Germany’s leadership in the global transition to a low-carbon economy. As the world grapples with the urgent need to address climate change, Germany’s approach serves as a model for integrating emerging technologies into national energy strategies.

Related News