Grid needs major upgrades now

By Kennebec Journal

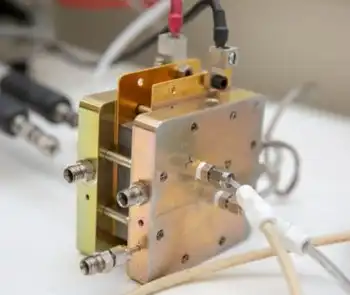

Electrical Testing & Commissioning of Power Systems

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Central Maine Power's proposal for this reliability program follows an exhaustive study of the company's grid and its links to systems in Canada and the other New England states. That work showed the need for immediate, major investments to improve grid reliability based on the loads that flow across the system today. CMP's plan will bring Maine into compliance with mandatory federal standards for grid reliability and reduce economic and social risks of grid failures in the future.

Maine's bulk power grid dates from the late 1960s when coal, nuclear, oil and large hydro plants supplied most of the region's electricity. The grid has served us well, but 40 years forward, Maine is a different place.

Our electricity usage has doubled. Population has increased by nearly one-third, and people and jobs have moved south and toward the coast.

Our sources of electricity have changed as well, and the technology of energy generation is evolving in ways that will make us more dependent on the next grid we build.

Today's emerging renewable resources, such as wind, wave, tidal and solar power, depend on highly variable weather conditions, and they often require sites in remote mountains or where the ocean's energy can be tapped.

That these resources are so variable and scattered does not make them less vital to our future, but it does require a transmission network capable of matching rapid and major variations in production with sometimes-distant customers. A stronger, modern grid is an essential investment for the renewable energy development that Maine seeks.

Maine is not an electrical island. Our grid is linked with neighboring systems on all sides for access to electricity markets and system reliability. For example, Maine actually imports electricity from other New England states and Canada about 30 percent of the time.

Also, the reliability of our grid affects all the other New England states, so electricity customers in all six states will share the cost of the MPRP in proportion to their share of the regional load. The MPRP will cost $1.5 billion, but Maine's share will be only 8 percent of that because we use just 8 percent of the electricity carried on the New England grid. The other five New England states will pay the other 92 percent, or about $1.38 billion.

The MPRP will also provide a needed boost for Maine's economy. It will create over 3,300 jobs during the peak years of construction and bring nearly $289 million into our state's economy by the time it is built.

A reliable supply of electricity is a necessity and expectation in a modern economy. Looking back, Maine has benefited immensely from the investments that were made 40 years ago, and many of our hopes for a stronger economy, cleaner environment, and more secure energy future will depend on the investments we are about to make. The MPRP is the right choice for Maine.

GridSolar partners were invited to state their case for their project. Instead, they attacked the Maine Power Reliability Program (MPRP). GridSolar's public filings are already light on facts. Their unwillingness to provide substantive information to readers betrays their own lack of confidence in the merits of their proposal.

GridSolar is hugely more expensive to Maine customers because they will pay 100 percent of the costs. For the MPRP, customers will only pay 8 percent of the costs, and residents in other New England states will pay the rest. GridSolar claims that it would sell energy at 3 cents per kWh for 20 years but neglects to mention that it would do so only if CMP's customers pay more than a billion dollars of the project's capital costs.

GridSolar will require 10,000 acres of land to build the solar plantations that it proposes. GridSolar criticizes CMP for use of eminent domain authority, but this attack is simply another example of GridSolar's indifference to the facts.

Central Maine Power has not used its eminent domain authority a single time to secure more than 400 parcels to date. In fact, GridSolar has requested eminent domain authority from the Maine PUC because it knows that it can't guarantee acquisition of 10,000 acres without it. CMP welcomes the addition of renewable resources to Maine. MPRP is vital to make that happen.

To suggest, as GridSolar does, that solar power can serve as a replacement for MPRP is a little like saying that once you have hybrid cars you don't need roads. Maine needs a realistic plan to meet our goals for reliable power, renewable resources and energy security.