Russia to Ban Bitcoin Mining Amid Electricity Deficit

CSA Z463 Electrical Maintenance -

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Russia Bitcoin Mining Ban highlights electricity deficits, grid stability concerns, and sustainability challenges, prompting stricter cryptocurrency regulation as mining operations in Siberia face shutdowns, relocations, and renewed focus on energy efficiency and resource allocation.

Key Points

Policy halting Bitcoin mining in key regions to ease electricity deficits, stabilize the grid, and prioritize energy.

✅ Targets high-load regions like Siberia facing electricity deficits

✅ Protects residential and industrial energy security, limits outages

✅ Prompts miner relocations, regulation, and potential renewables

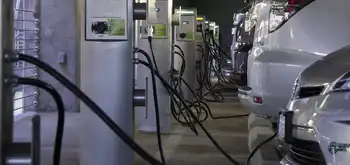

In a significant shift in its stance on cryptocurrency, Russia has announced plans to ban Bitcoin mining in several key regions, primarily due to rising electricity deficits. This move highlights the ongoing tensions between energy management and the growing demand for cryptocurrency mining, which has sparked a robust debate about sustainability and resource allocation in the country.

Background on Bitcoin Mining in Russia

Russia has long been a major player in the global cryptocurrency landscape, particularly in Bitcoin mining. The country’s vast and diverse geography offers ample opportunities for mining, with several regions boasting low electricity costs and cooler climates that are conducive to operating the high-powered computers used for mining, similar to Iceland's mining boom in cold regions.

However, the boom in mining activities has put a strain on local electricity grids, as seen with BC Hydro suspensions in Canada, particularly as demand for energy continues to rise. This situation has become increasingly untenable, leading government officials to reconsider the viability of allowing large-scale mining operations.

Reasons for the Ban

The decision to ban Bitcoin mining in certain regions stems from a growing electricity deficit that has been exacerbated by both rising temperatures and increased energy consumption. Reports indicate that some regions are struggling to meet domestic energy needs, and jurisdictions like Manitoba's pause on crypto connections reflect similar grid concerns, particularly during peak consumption periods. Officials have expressed concern that continuing to support cryptocurrency mining could lead to blackouts and further strain on the electrical infrastructure.

Additionally, this ban is seen as a measure to redirect energy resources toward more critical sectors, including residential heating and industrial needs. By curbing Bitcoin mining, the government aims to prioritize the energy security of its citizens and maintain stability within its energy markets and the wider global electricity market dynamics.

Regional Impact

The regions targeted by the ban include areas that have seen a significant influx of mining operations, often attracted by the low costs of electricity. For instance, Siberia, known for its abundant natural resources and inexpensive power, has become a major center for miners. The ban is likely to have profound implications for local economies that have come to rely on the influx of investments from cryptocurrency companies.

Many miners are expected to be affected financially as they may have to halt operations or relocate to regions with more favorable regulations. This could lead to job losses and a decline in local business activities that have sprung up around the mining industry, such as hardware suppliers and tech services.

Broader Implications for Cryptocurrency in Russia

This ban reflects a broader trend within Russia’s approach to cryptocurrencies. While the government has been cautious about outright banning digital currencies, it has simultaneously sought to regulate the industry more stringently. Recent legislation has aimed to establish a legal framework for cryptocurrencies, focusing on taxation and oversight while navigating the balance between innovation and regulation.

As other countries around the world grapple with the implications of cryptocurrency mining, Russia’s decision adds to the narrative of the challenges associated with energy consumption in this sector. The international community is increasingly aware of the environmental impact of Bitcoin mining, which has come under fire for its significant energy use and carbon footprint.

Future of Mining in Russia

Looking ahead, the future of Bitcoin mining in Russia remains uncertain. While some regions may implement strict bans, others could potentially embrace a more regulated approach to mining, provided it aligns with energy availability and environmental considerations. The country’s vast landscape offers opportunities for innovative solutions, such as utilizing renewable energy sources, even as India's solar growth slows amid rising coal generation, to power mining operations.

As global attitudes toward cryptocurrency evolve, Russia will likely continue to adapt its policies in response to both domestic energy needs and international pressures, including Europe's shift away from Russian energy that influence policy choices. The balance between fostering a competitive cryptocurrency market and ensuring energy sustainability will be a key challenge for Russian policymakers moving forward.

Russia’s decision to ban Bitcoin mining in key regions marks a pivotal moment in the intersection of cryptocurrency and energy management. As the nation navigates its energy deficits, the implications for the mining industry and the broader cryptocurrency landscape will be significant. This move not only underscores the need for responsible energy consumption in the digital age but also reflects the complexities of integrating emerging technologies within existing frameworks of governance and infrastructure. As the situation unfolds, all eyes will be on how Russia balances innovation with sustainability in its approach to cryptocurrency.

_1557567480.webp)