Vancouver is plugged-in for EVs

By Globe and Mail

CSA Z463 Electrical Maintenance

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Vancouver is a spectacular city, but car-friendly it is not. That's by design. Cars are at best a necessary evil here, at least among a large and vocal subset of the city's residents.

Decades ago, the likes of former mayor and later B.C. premier Mike Harcourt made sure Vancouver would not have overhead highways like Toronto's Gardiner, nor have city expressways like Calgary's Crowfoot Trail. Not here. You want to drive from A to B in Vancouver, you go stoplight to stoplight.

Harcourt has not been alone with this sort of thing, either. Virtually all city politicians since the 1970s have bought into this anti-car mentality.

As I zip past the Cambie Street city hall, where Mayor Gregor Robertson works, it's obvious that something is afoot here and it's more than an ad-hoc effort. Something resembling a plan is taking shape.

For instance, construction of the new Canada Line to the airport and Richmond has just ended, making Vancouver the first city in Canada with downtown-to-airport rapid transit.

And now Robertson, a former NDP member of the legislature and co-founder of organic juice company Happy Planet, has led Vancouver city council this summer to approve unanimously new regulations for electric vehicle charging stations.

The idea here is to begin addressing one of the major barriers to electric cars: recharging infrastructure. Vancouver is the first major city in North America to make developers include plug-ins for electric cars in at least 20 per cent of parking stalls in new condominium and apartment buildings, along with some city-owned parking lots. Price tag: between $500 and $2,000 a stall.

The city is also in serious discussions with companies involved in building and selling electric vehicles. Manufacturers such as Nissan and Mitsubishi have planted the flag here, along with others. And that's why I'm driving an i-MiEV on city streets. A car just like this will be in regular city service by November.

Mayor Robertson, of course, is a big fan. He says electric vehicles are becoming more common around the world and the city needs to be a leader in supporting them. Indeed, the city already requires one- and two-family homes to have plug-in vehicle capacity. After dealing with apartments and condominiums, the next step is to provide for electric vehicle charging locations in parking lots and even at various street locations.

Right now there is no place on the street for me to charge up my i-MiEV, but Mitsubishi Canada wants Vancouver to fix this. So the company has cut a deal to provide Vancouver with two production-ready, highway-capable cars. One will be used by the city, the other by BC Hydro. Fleet testing under real-world conditions should provide answers to questions about the practicality of zero emissions cars on a day-to-day basis.

The Vancouver initiative is, supporters say, the equivalent to: If we build it, they will come. That is, if the city fosters an electric vehicle infrastructure, people will buy the electric vehicles.

Groups like the Vancouver Electric Vehicle Association say it's a no-brainer. Once the charging infrastructure is in place, buyers will be jolted into action. There is nothing at all wacky about this idea, they say.

The Urban Development Institute says otherwise. This organization, which represents developers, says it's too soon to predict if electric cars will sweep the continent. Its members want developers to install outlets voluntarily, which of course means almost none of them would.

BC Hydro says the province, not just Vancouver, needs to think ahead and plan for a future 15 years hence when an estimated 10 to 16 per cent of vehicles on provincial roads will be electric. BC Hydro may be on to something.

Everyone of any substance in the auto industry now believes electric cars will be a big part of the new car fleet – one day. But one day seems too far away for many politicians, from Robertson to Ontario Premier Dalton McGuinty to U.S. President Barack Obama. They all seem bent on pushing the car business into the brave new world of electrics right now.

Obama just weeks ago unveiled $2.4-billion (US) in stimulus grants to jump start an electric vehicle industry in the United States – and the U.S. government also plans to give buyers a $7,500 electric vehicle subsidy. Ontario plans to offer rebates of up to $10,000 (Canadian) on the purchase of electric cars after July 1, 2010. Also, Ontario plans to make driving electric cars and the like easier by giving such cars access to high-occupancy lanes on expressways and special parking spaces at GO Transit and government lots.

Critics say all this amounts to social engineering and bad economics, adding that the subsidy is nothing more than a bribe to get consumers to buy into an emerging though unproven technology.

It could prove to be a pricey one for taxpayers, too. Dennis DesRosiers of DesRosiers Automotive Consultants, an opponent of subsidies, says Ontario could be on the hook for as much as $3.5-billion if 5 per cent of the seven million vehicles now on Ontario's roads are replaced by subsidized electric vehicles.

For the auto industry, the infrastructure problem is one the politicians need to solve. Many car companies also favour electric car subsidies of one kind or another, though few are willing to publicly endorse them. Above all, however, what is flummoxing the industry now is battery technology.

Smaller, lighter, safer and longer-lasting lithium-ion batteries are the key component of electric vehicles. But the technology is unproven in automobiles and the cost is huge: about $7,500 (US) for a car-sized battery pack.

Proponents say the cost barrier, and others such as heat management and durability, can be overcome. There is good reason to make this happen, too.

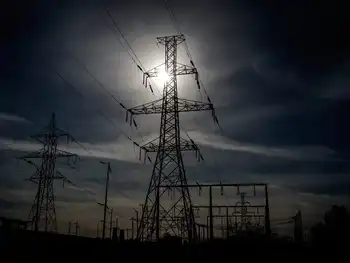

Electric car lovers say the vehicles have immense charm, use energy more efficiently, don't stink and don't make any noise. If governments, industry and utilities work together building smart power grids distributing “clean” electricity – power from low- or non-polluting sources – then electric cars hooked into a smart network will not only be pollution-free, but also serve as massive energy storage units themselves, while the car is not being driven.

Still, only the truly committed will live with an electric car that demands a lot of compromises – one that drives like a golf cart, with limited range, pokey acceleration, a slow-charging battery and little room for people and cargo. The i-MiEV is an early and promising answer to all those negatives.

The emissions-free compact i-MiEV is a four-door electric car that went on sale in Japan this summer. Its advanced lithium-ion battery allows the car to travel up to 160 km on a single charge, though 100-120 is more reasonable in real-world usage.

The i-MiEV is perfectly suitable for the streets of Vancouver. It's quick enough and there is space for four adults, with a small trunk at the rear. For a large chunk of city commuters, it's all the car they'd need.

Will it come to Canada? Perhaps.

Obviously testing is going on here, as well as in the United States. Worldwide, Mitsubishi plans to ship the i-MiEV in limited quantities to Britain, New Zealand, Hong Kong and Singapore starting this year. By 2020, Mitsubishi says it expects electric vehicles will make up 20 per cent of its overall production volume.

Mitsubishi is hardly alone here, too. Reports from Japan say Honda plans to develop an electric car to launch in the United States by about 2015. Other auto makers such as Toyota and Volkswagen have also announced plans to launch electric cars in the next few years.

Luxury brands such as Daimler and BMW are working on electric car programs, too. And Detroit's automakers all have electric vehicle programs in place, including the much-touted Chevrolet Volt and a coming transit van from Ford.

But of all the world's big automakers, perhaps none has made as large a public commitment to electrics as Nissan. Nissan CEO Carlos Ghosn is betting a huge chunk of his company's future on electric cars (EVs).

Nissan has unveiled a prototype EV on an all-new EV platform. The Leaf electric vehicle is, according to Nissan, the world's first electric car designed for affordability and real-world requirements.

That is, there is seating for five adults, a range of more than 160 km, batteries capable of being recharged in 30 minutes on the road in a “quick charge” facility (or eight hours on a home charger), and a price tag comparable to a well-equipped mid-size car – say $25,000-$28,000 at most.

The Leaf will be launched late next year in Japan, North America and Europe.

Nissan isn't just spending hundreds of millions of dollars creating an EV platform, either. The company is also spending hundreds of millions more on battery plants in Europe, North America and Asia. And Nissan is working out alliances with governments and private suppliers to create a reliable, sensible recharging infrastructure for EVs.

Vancouver is clearly a city that you'd call “friendly” to Nissan's EV plans, and those of other auto makers. But it's a fantastic gamble on the part of both car companies and governments.

No one can say with certainty how popular EVs will be, how quickly consumers will embrace them and how profitable auto companies can ever be at building and selling them. No one knows.

One Massachusetts Institute of Technology study says that by 2016 there will be 10 million electric cars sold in the world each year. Nissan, and its French affiliate, Renault, have said that, by 2020, 10 per cent of the world car market will be electric.

However, Automotive forecaster CSM Worldwide has a different view. CSM thinks that by 2015 electric and hybrid sales will hit 2.9 million a year. Pure electric, or battery cars, and plug-in hybrids will total about 400,000 a year in 2015 for a global market share of 0.5 per cent. Forecaster J.D. Power and Associates agrees with that.

The truth is, everyone is making only educated guesses about how many EVs will be sold next year, let alone in 2016 and beyond.

But we know this for certain: if EVs do catch on, at least drivers in Vancouver will have lots of places to plug theirs in.