Could Vestas follow Samsung in Ontario?

By Toronto Star

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Industry sources said officials from Denmark-based Vestas were in Ontario recently to size up local infrastructure and potential sites for manufacturing, which would be geared to making offshore and onshore wind turbines for the Canadian and U.S. markets – including offshore wind projects planned for the Great Lakes.

Sites in Hamilton, Niagara, Kingston and Belleville are among those being considered, sources said.

Just last month a South Korean consortium led by industrial giant Samsung C&T announced a $7 billion plan to manufacture and deploy wind and solar gear in Ontario over six years, an initiative that's supposed to create 16,000 jobs.

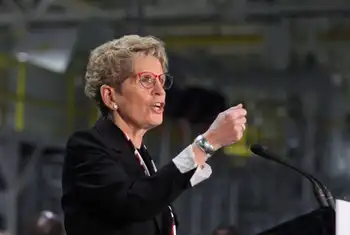

A decision by a heavyweight such as Vestas to lay roots in Ontario would further bolster the McGuinty government's strategy of attracting green jobs to the province.

Vestas appears to be heading in that direction. Last fall it chose Toronto as the location of its North American head office for offshore wind sales.

Meanwhile, it has been lining up potential customers. Toronto-based Trillium Power is expected to announce that Vestas will be the exclusive supplier of up to 740 turbines for four offshore wind projects it wants to develop in the Great Lakes.

The first project, Trillium Power Wind 1, will be a 710-megawatt wind farm 25 kilometres from the shores of Prince Edward County in Lake Ontario. Vestas has also agreed to act as project manager.

"They saw an opportunity to tie up our four projects," said John Kourtoff, chief executive of Trillium. "By locking up our order, it gives them the footprint and business case (to move forward)."

Kourtoff said Vestas' attraction to Ontario is twofold. The province has the first feed-in-tariff (FIT) program in North America that pays a fixed price of 19 cents per kilowatt-hour over 20 years for offshore wind power. Ontario also has the biggest freshwater offshore wind resource on the continent.

When contacted, a Vestas official in Toronto declined to comment, citing a company "quiet period" in advance of the release of its annual report.

But Henrik Jensen, senior sales manager of Vestas Offshore, told the Star at a wind conference in October that the company "will set up facilities where we have the demand for turbines."

That demand could easily come. Ontario's Ministry of Natural Resources has received applications to develop more than 20,000 megawatts of offshore wind power, which theoretically could supply up to half of Ontario's electricity needs over a year.

"The potential for offshore wind development on the Ontario side of the Great Lakes is tremendous," Trillium concluded in a study it released last month.

Trillium, likely the first company to develop in the Great Lakes, has four projects totalling 3,700 megawatts that would require an investment of nearly $15 billion over 12 years to build.

Across the border, New York, Ohio, Wisconsin and Michigan have plans to develop in the Great Lakes. Vestas is also eyeing offshore wind projects being planned on the U.S. east coast.

Several makers of offshore wind turbines are looking seriously at the North American market.

Multibrid, a subsidiary of French nuclear company Areva SA, announced a partnership with Trillium in 2008 in hopes of getting an early toehold on Great Lakes offshore projects.

But the companies parted ways after Areva's decision to locate its North America headquarters in Quebec instead of Ontario.

Last summer, Trillium began talks with Vestas. "They came to us," said Kourtoff.

It's still early days. Trillium must apply to the Ontario Power Authority under the FIT program for a 20-year power purchase contract, something it plans to do in September.

If it gets the go-ahead, it would proceed to sign a firm purchase order with Vestas.

Vestas' offshore operations in North America would complement its existing onshore operations, the bulk of which are located in Colorado. They include two blade factories, one tower factory and an assembly plant for nacelles, which contain the gears, motor and controlling mechanisms of turbines.

The company is expecting to employ 2,500 people in Colorado by year's end.