Rooftop solar grids transform urban infrastructure with distributed generation, photovoltaic panels, smart grid integration and energy storage, cutting greenhouse gas emissions, lowering utility costs, enabling net metering and community solar for low-carbon energy systems.

Key Points

Rooftop solar grids are PV systems on buildings that generate power, cut emissions, and enable smart grid integration.

✅ Lowers utility bills via net metering and demand offset

✅ Reduces greenhouse gases and urban air pollution

✅ Enables resiliency with storage, smart inverters, and microgrids

As urban areas expand and the climate crisis intensifies, cities are seeking innovative ways to integrate renewable energy sources into their infrastructure. One such solution gaining traction is the installation of rooftop solar grids. A recent CBC News article highlights the significant impact of these solar systems on urban environments, showcasing their benefits and the challenges they present.

Harnessing Unused Space for Sustainable Energy

Rooftop solar panels are revolutionizing how cities approach energy consumption and environmental sustainability. By utilizing the often-overlooked space on rooftops, these systems provide a practical solution for generating renewable energy in densely populated areas. The CBC article emphasizes that this approach not only makes efficient use of available space but also contributes to reducing a city's reliance on non-renewable energy sources.

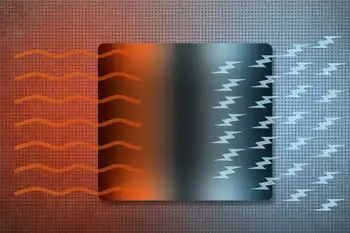

The ability to generate clean energy directly from buildings helps decrease greenhouse gas emissions and, as scientists work to improve solar and wind power, promotes a shift towards a more sustainable energy model. Solar panels absorb sunlight and convert it into electricity, reducing the need for fossil fuels and lowering overall carbon footprints. This transition is crucial as cities grapple with rising temperatures and air pollution.

Economic and Environmental Advantages

The economic benefits of rooftop solar grids are considerable. For homeowners and businesses, installing solar panels can lead to substantial savings on electricity bills. The initial investment in solar technology is often balanced by long-term energy savings and financial incentives, such as tax credits or rebates, and evidence that solar is cheaper than grid electricity in Chinese cities further illustrates the trend toward affordability. According to the CBC report, these financial benefits make solar energy a compelling option for many urban residents and enterprises.

Environmentally, the advantages are equally compelling. Solar energy is a renewable and clean resource, and increasing the number of rooftop solar installations can play a pivotal role in meeting local and national renewable energy targets, as illustrated when New York met its solar goals early in a recent milestone. The reduction in greenhouse gas emissions from fossil fuel energy sources directly contributes to mitigating climate change and improving air quality.

Challenges in Widespread Adoption

Despite the clear benefits, the adoption of rooftop solar grids is not without its challenges. One of the primary hurdles is the upfront cost of installation. While prices for solar panels have decreased over time, the initial financial outlay remains a barrier for some property owners, and regions like Alberta have faced solar expansion challenges that highlight these constraints. Additionally, the effectiveness of solar panels can vary based on factors such as geographic location, roof orientation, and local weather patterns.

The CBC article also highlights the importance of supportive infrastructure and policies for the success of rooftop solar grids. Cities need to invest in modernizing their energy grids to accommodate the influx of solar-generated electricity, and, in the U.S., record clean energy purchases by Southeast cities have signaled growing institutional demand. Furthermore, policies and regulations must support solar adoption, including issues related to net metering, which allows solar panel owners to sell excess energy back to the grid.

Innovative Solutions and Future Prospects

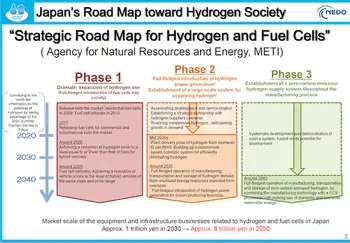

The future of rooftop solar grids looks promising, thanks to ongoing technological advancements. Innovations in photovoltaic cells and energy storage solutions are expected to enhance the efficiency and affordability of solar systems. The development of smart grid technology and advanced energy management systems, including peer-to-peer energy sharing, will also play a critical role in integrating solar power into urban infrastructures.

The CBC report also mentions the rise of community solar projects as a significant development. These projects allow multiple households or businesses to share a single solar installation, making solar energy more accessible to those who may not have suitable rooftops for solar panels. This model expands the reach of solar technology and fosters greater community engagement in renewable energy initiatives.

Conclusion

Rooftop solar grids are emerging as a key element in the transition to sustainable urban energy systems. By leveraging unused rooftop space, cities can harness clean, renewable energy, reduce greenhouse gas emissions, and, as developers learn that more energy sources make better projects, achieve long-term economic savings. While there are challenges to overcome, such as initial costs and regulatory hurdles, the benefits of rooftop solar grids make them a crucial component of the future energy landscape. As technology advances and policies evolve, rooftop solar grids will play an increasingly vital role in shaping greener, more resilient urban environments.

Related News