Environmental, economic benefits of solar energy

By The Fayetteville Observer

NFPA 70b Training - Electrical Maintenance

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

There are no telltale signs of a power plant — no long lines of railroad cars filled with coal, no cooling towers releasing steam clouds, no smokestacks or big transformers.

As the sun grows the corn, it also makes power on the roof of a metal building — anywhere from 150 to 750 kilowatt hours per day, or enough to meet the needs of 15 typical houses.

The solar power plant at the Hamlin Cos.' shop near Benson, which makes duct work, is a sign of what may come. The 107,000-watt system is among the largest in the state but will soon be eclipsed by even bigger systems.

Solar energy, proponents say, is on the cusp of a big wave. They are optimistic because: the solar-energy industry is no longer in its infancy. The technology, and those who install it, have made great strides with more efficient systems and more professional installers.

Solar energy makes sense for environmental and economic reasons, experts say. A solar water heater system can cut residential utility bills by as much as 30 percent.

North Carolina's legislators are pushing renewal energy. By 2021, utilities must get 12.5 percent of customers' power needs from renewal energy such as solar power or through energy efficiencies.

The potential of solar power is affecting all segments of the market — from energy giant Duke Power to small companies in Fayetteville.

In June, Duke Power announced plans to install up to 850 solar panels throughout North Carolina at a cost of $100 million. Homes, schools, stores and factories will get solar panels. The idea is to produce power where it is used, rather than at large plants.

Duke is also partnering with SunEdison on a solar farm in Davidson County. The proposed 16-megawatt facility would be the largest photovoltaic solar facility in the country. SunEdison hopes to be operational by late 2010. All of the electricity generated would go to Duke. The solar panels would supply enough energy to meet the demands of 2,600 homes.

Progress Energy Carolina and SunPower Corp. are developing a 1-megawatt solar farm in Cary.

Manufacturers are also taking advantage of the growing interest in solar power.

The DuPont plant in northern Bladen County makes components used in about 40 percent of solar panels produced annually, said Steve Kalland of the North Carolina Solar Center. The center is part of N.C State University and is the state's clearinghouse for renewable energy programs and research.

Sencera International Corp. announced recently it will invest $36.8 million to build a solar-module factory in Mecklenburg County. The state gave the company $62,000 from the One North Carolina Fund and $100,000 from the state's Green Business fund. Charlotte and Mecklenburg County will give Sencera about $1 million over three years — equal to 90 percent of what the company will pay in property taxes during that time — to satisfy the local match requirements of the Green Fund grant.

It's not only the big boys who see opportunity. Hamlin has been in the roofing business for 54 years. When company officials started looking at solar energy, they soon realized it was more than an add-on.

"This is not a roofing accessory," said William Hamlin, the executive vice president of Hamlin Energy Solutions. "This is a power plant on someone's roof."

In March, the company installed 24,000 square feet of photovoltaic strips on the roof of the Benson plant. The panels are connected so that if one panel goes out, the remaining panels continue to work.

The panels have semi-conductors that turn sunlight into power. Peak production is between 11 a.m. and 3 p.m.

Inverters convert the electricity to alternating current. The output immediately goes to a transformer owned by South River Electric Membership Corp.

The solar panels provide about 30 percent of the shop's needs.

Hamlin invested about $760,000 in its solar roof. A scaffolding allows people to climb up to see the thin, purple tiles.

The company uses the roof for both training and demonstrations. Most of all, Hamlin said, they try to show potential customers that solar energy is "clean, simple and safe."

Alternative Energy Concepts of Fayetteville is another company that spun into the business.

When the owners of Intelect Inc. — an electrical contractor in Fayetteville — looked into solar, they also decided they needed their own separate company. They formed Alternative Energy Concepts.

"We knew electrical work — there was no mystery there," said Joseph Sheffield of Alternative Energy Concepts.

But there was a learning curve in understanding solar, he said. The inquiries have been nonstop since the company opened several months ago. It can install solar, wind or hydroelectric systems.

Some of the interest has been in installing solar hot water-heating systems. During the mid-1970s, such systems were popular but bulky and not always reliable.

Today's technology still uses large panels that are 4 feet by 8 feet. But they are more efficient. Distilled water circulating through the panels heats up, then runs through a control panel. Water from a hot-water heater also flows through the control panel.

The systems are separate, but the heat is transferred. That decreases the need for the water heater's electrical element.

Fayetteville lawyer Graham Gurnee and his wife, Elizabeth, consulted the book "Solar Energy For Dummies" when they considered installing a system.

They decided to install a system at their home. Elizabeth Gurnee said the foremost reason was environmental. The second was economic; with federal and state tax credits, their system will pay for itself in about four years.

Tax credits can pay for as much as 65 percent of a solar-energy system. The credits are needed, said Kalland of the North Carolina Solar Center, to offset the high cost. But the costs are coming down, and Kalland predicts by 2020 the cost of producing solar power should be about the same as conventional electricity.

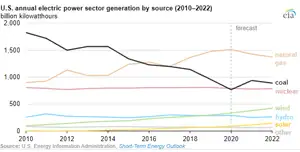

Kalland does not expect solar to supplant conventional plants. He noted that today's largest solar plant produces about 20 megawatts of power. In comparison, the average conventional coal plant produces 800 megawatts daily.