Power outages anger, frustrate Pakistanis

By Associated Press

High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Traffic lights have been switched off, making already treacherous roads even more so. Dinner parties often take place by candlelight. And air conditioners and fans are idle as temperatures rise.

"Our lives have been made miserable," said 40-year-old Zubaida Bibi.

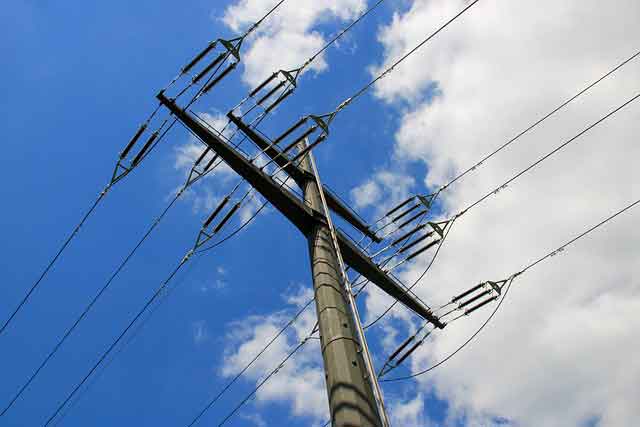

The rising demand and inadequate energy infrastructure in this South Asian nation of 160 million people has precipitated the nationwide electricity outages, fueling protests that have turned violent and helping to sink the economy.

The outages threaten to increase public frustration with Pakistan's young government, which is already facing a challenge from Islamic militancy and is mired in political disputes.

Officials at the Ministry of Water and Power estimate that Pakistan is between one quarter and a third short of the power it needs.

Prime Minister Yousuf Raza Gilani has said the government is committed to resolving the electricity crisis and is aware of people's hardships. He also urged the population to conserve electricity.

To save energy, the government ordered the country to observe daylight savings time at the start of June, shifting clocks forward an hour. It is supposed to save energy because people have more daylight in the evening and do not have to turn on lights.

Daylight savings was tried about six years ago, but quickly abandoned as many people, especially in rural areas, ignored it.

The government says it will also ask many shops and businesses to close by 9 p.m., though it is unclear whether the rule will be enforced. Government offices are supposed to reduce air conditioner use, and even billboard lights face restrictions.

Notions such as daylight savings are viewed as Band-Aid solutions in a place where many mark time by calls to prayer from mosques.

Getting compliance, however, may prove difficult in a country with low literacy rates and a lack of information on conservation, said Sultan Hasan, spokesman for the Karachi Electric Supply Company.

In April in Multan, a textile hub where many operate looms out of their homes and routinely go 10 hours a day without power, people attacked the office of the state electricity company, torching a bank and leaving at least 13 people injured.

The government says it has tried to limit the impact on industry. Many large factories, for instance, are not subject to daytime power cuts, though they must close one day a week.

But the central bank recently said the impact of the power crisis on key industries such as metals, textiles and chemicals was contributing to a slowdown in the economy.

Zubaida Bibi has seen her wages shrink due to the electricity cuts at the thread manufacturer where she works in Multan.

"Now we earn half of what we would earn before," she said.

At the Islamabad-area factory of Shaheen Pipe Industry, which must now close on Mondays, officials said they recently had to lay off 20 workers and are losing money.

Meanwhile, the new government is pushing ahead with a handful of power projects already in the works while pursuing plans for new power plants. Some projects are expected to be ready next year, which could help ease the shortage.

The energy and economic problems are adding pressure to the already unstable ruling coalition. The two main parties, in office for just two months, are embroiled in a dispute over how to restore judges ousted last year by President Pervez Musharraf.

The government's stability is a concern for the U.S., which counts on Pakistan's backing for the war on terrorism, particularly in stopping militancy along its border with Afghanistan.

The electricity situation, however, is almost too much to bear for some in a country where summer temperatures soar past 104 degrees.

Kabir Ali, a 36-year-old postal worker in Karachi, can hardly sleep at night because power outages cut off the air conditioner and the fans despite the stifling heat.

In the morning, when he's rushing to get to work, the electric pump that sends water to his tank won't function.

"That irks me all the day if I don't take a bath in the morning," Ali said. "I feel drowsy while riding on my bike and am more likely to have an accident."