Coal profits mask lack of U.S. economic activity

By Associated Press

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Fresh from reporting third-quarter earnings, coal producers say booming Asian economies are increasingly hungry for energy even as the hardest-hit mining regions in the U.S. see little prospect for a comeback in coming months.

Big coal producers such as St. Louis-based Peabody Energy and Arch Coal say the rising demand for metallurgical coal, a key ingredient in steelmaking, is largely a foreign phenomenon.

The top U.S. producer of metallurgical coal, Alpha Natural Resources, said it's planning to up production 1 million tons next year to take advantage and CEO Kevin Crutchfield said orders are starting to come in from Eastern and Western Europe.

America, on the other hand, remains in the doldrums.

"Nobody is seeing any effect of the stimulus in the U.S.," said steel industry analyst Charles Bradford of Affiliated Research Group. "There is recovery in world steel output."

That's not much help for domestic mines or U.S. mineworkers. Metallurgical coal commands premium prices, but accounts for a relative sliver of U.S. production. The bulk of U.S. coal goes to electric power plants and they're not interested in buying these days.

There have been massive piles of unused coal outside of U.S. plants, a symptom of a country that is in a deep industrial funk.

As of August, electric plant stockpiles were up nearly 40 percent from the previous year, according to U.S. Department of Energy.

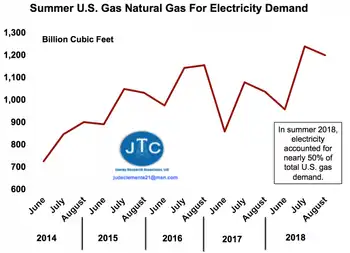

The recession, a very cool summer and cheap natural gas has slashed the amount of coal that power can use.

Producers have now idled enough U.S. mines to trim approximately 100 million tons of coal — roughly 9 percent — from production this year. Hundreds of miners in West Virginia, Kentucky and other key coal states have lost their jobs.

The cuts are continuing.

International Coal Group shuttered a West Virginia mine employing about 70 people in late September after electric utility Allegheny Energy stopped taking shipments.

Alpha trimmed another 1 million tons from its production guidance for mines in Wyoming's Powder River Basin.

Most U.S. producers believe things will not improve before next year, including Crutchfield. He suggested the market might begin to turn closer to 2011.

The problems at home only highlight the sharp rebound in Asia.

A half dozen U.S. producers including Peabody, Consol Energy, ICG, Alpha and Arch Coal reported stronger than expected third-quarter financial results on the strength of sales in China, in addition to high-priced contracts signed in 2008 and lower costs.

For the foreseeable future, the action is in China, where steel plants are operating at better than 90 percent capacity.

Peabody Energy quickly boosted activity in Australia because it is close to China, even opening a trading hub in Singapore during the third quarter.