Is the sun setting on solar power in Spain?

By Scientific American

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Its scalding 250-degree-Celsius steam drives a turbine generating a peak capacity of 11 megawatts (MW) of electricity for the national grid. This "power tower" is the first of nine to be built by Spanish engineering giant Abengoa Solar, which all told will produce enough electricity for 153,000 homes by 2013.

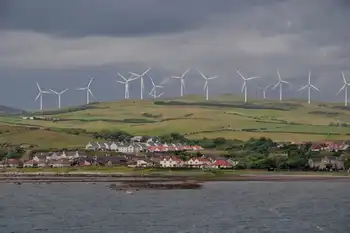

From power towers to parabolic trough plants and from photovoltaic farms to roof-mounted solar panels, solar energy is booming in Spain. This month, Europe's first commercial solar-thermal parabolic trough plant — 24-kilometer curved mirror complex dubbed Andasol that focuses light on collector tubes with synthetic oil bubbling to 400 degrees C — revs up in Andalusia. Vast acres of solar farms using photovoltaics made from semiconductors to convert sunlight to electricity now span southern Spain.

Celebrated ground-mounted photovoltaic (PV) plants include La Magascona and Jumilla with their array of 120,000 modules on 120 single-axis "follow-the-sun" trackers.

Even carmakers want a piece of the Spanish sun. In July General Motors said it will build the world's biggest rooftop solar power station in Spain, carpeting 185,800 square meters of the roof at its Zaragoza automobile plant with 85,000 flexible solar panels. And the 50-megawatt Andasol plant is also the world's largest facility employing molten salts to store renewable energy: 28,500 tons of molten potassium and sodium nitrate salt in two tanks that bank excess solar heat for more than seven hours.

Plentiful sunshine isn't the only reason entrepreneurs and industry have flocked to Spain.

The Spanish advantage includes abundant land, strong demand for air conditioning, mammoth infrastructural firms to fast-track projects, and, most importantly, generous subsidies. The nation's feed-in tariffs guarantee 25 years of up to triple the market price for solar energy, making it the world's hottest solar market, trailing only subsidy-richer Germany as well as the U.S. with its historical lead in developing solar technology.

"Feed-in tariffs shift competition to manufacturers, creating an incentive for innovation," says Wilson Rickerson, a Boston-based energy consultant. "Manufacturers that can produce the most efficient and cost-effective ways of generating energy gain most."

In fact, money committed for Spanish PV projects (mostly ground-based) shot up nearly 500 percent from 2006 to 2007 to a total of $3.45 billion, according to London-based New Energy Finance, a renewable energy market research firm.

But obscuring the light are a few clouds. This month Spain slashed the maximum capacity of solar farms that can claim subsidies from 1,200 MW to just 500 MW. Installed PV capacity has already tripled to 1,500 MW in under a year, should double again by 2010 to 3,000 MW, and more than triple to 10,000 MW by 2020. Spain also cut PV feed-in tariffs by about a third to around 33 eurocents per kilowatt hour. Solar-thermal executives fear the same fate within 24 months as new plants add solar power.

That's led many companies to mull other markets. Though Spain backpedaled on severe cuts after panel makers balked, companies like Energias de Portugal Renovables are pulling out because of profit worries and, in August, BP shelved plans for the world's largest solar panel plant in Spain. Critics have warned that when subsidies dry up, so will solar's appeal.

"PV project developers rushed to Spain because subsidies guaranteed returns well above the cost of generating power," explains Nathaniel Bullard, a solar associate at New Energy Finance. "Cuts will drive developers to other markets with high subsidies."

Companies are already eyeing the area's "Club Med" countries where similar feed-in tariffs exist, such as France, Greece and Italy; swathes of sunny Latin America are a possibility; and the U.S. is the ultimate objective as the world's largest electricity market with abundant potential in its sun-soaked Southwest. Healthy tax credits for solar energy in the U.S., extended for eight years in October are also a draw. Abengoa is already building the world's largest solar plant, 280-MW Solana, in Arizona.

"We've been in Spain since 1999 where 80 percent of our revenues originate because its south has double Germany's sunshine and attractive feed-in tariffs," says Henner Gladen, chief technology officer at solar-thermal firm Solar Millennium. That share should fall as the company's new U.S. projects gain ground. "And China, Australia, the Middle East and Africa are the markets of tomorrow."

Spain is already charging into North Africa, which is bathed in 40 percent more sunlight. With World Bank backing, Abengoa is breaking ground on the first hybrid solar-thermal and natural gas burning power plants in Morocco and Algeria, online by 2010. "With abundant radiation and land in its deserts, our neighbor, North Africa, is this region's Southwest," says Michael Geyer, director of international business development at Abengoa, noting that Algeria already has feed-in tariffs. Solar-thermal plants are also planned for Egypt, Israel, Jordan, Libya and the United Arab Emirates.

Most importantly, the initial African power plants and Spain's solar-thermal test bed pave the way for energy export from planned solar farms in the Sahara Desert across a high-voltage direct current trans-sea line to Europe, pending political will and public funds. French President Nicolas Sarkozy resurrected the idea this year in a Plan Solaire.

Studies show that harnessing just 0.3 percent of the sunshine on North African and Middle Eastern deserts could power those regions and Europe. Optimists, such as Nikolai Ulrich, head of renewables Europe at Germany's Nordbank, foresee energy export from Africa within seven years. Imminent milestones include talks in Algeria and Tunisia for transmission lines to Italy, planned for next year. Spain has an edge, because it has been swapping electricity with Morocco over their own two-way line for about a dozen years.

And Spain's solar revolution at home may only slow — not stall. Spain has ample sun, legislation that calls for solar on all new buildings, and PVs poised to deliver low-cost electricity. "Spain is a leader in CSP [concentrated solar power] and hybrid solar/natural gas systems," says Paolo Frankl, head of renewable energy at the International Energy Agency. "And in Spain I expect a shift from ground-mounted plants to solar installations in industrial sites, buildings and other infrastructure like highways. Competition helps innovation."