Fewer, more efficient customers cut Exelon profits

By Associated Press

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

So many industrial power users have cut back production and payrolls that Exelon said the earliest it might see a rebound is in the middle of next year.

"There is no simple or exact answer to the question of when this recession will end," Matthew Hilzinger, Exelon's senior vice president and chief financial officer, told analysts after the company reported a 10 percent drop in earnings for the quarter.

Exelon, based in Chicago, said it made $633 million, or 96 cents per share, for the quarter, compared with $706 million, or $1.07 per share, a year ago as a weak economy, a cool summer and falling electricity prices cut into the company's bottom line. Excluding charges, Exelon reported profit of $757 million, or $1.14 per share, for the quarter.

Exelon's revenue fell to $4.4 billion for the quarter from $5.2 billion a year ago.

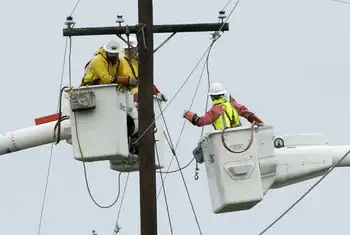

Part of the reason are new efficiency programs that have consumers using less electricity, but Exelon also has fewer customers than before because power is being shut off at so many homes in the areas where it operates, which include Philadelphia and Chicago.

Exelon's Commonwealth Edison utility in the Chicago area saw its customer base drop by 0.5 percent from the third quarter of 2008.

Conditions were not as bleak in the Philadelphia area, but electricity consumption for the company's PECO utility was down from a year ago and the number of customers declined by 0.4 percent.

Most utilities are slashing costs to offset lower revenues.

Exelon has reduced spending on operations and maintenance by at least $150 million on operations and maintenance and the company is on track to cut even more before year end, Hilzinger said.

The weather did not help, either.

The Chicago area had the region's coolest summer in 17 years. Electricity delivery fell by 9.8 percent from the second quarter with declines for every level of customer, from businesses to homes.

The company recorded a $6 million charge, or 1 cent per share, related to the termination of its bid to buy NRG Energy in a deal that would have created the nation's largest power generator. The company said that it is focused on boosting profits rather than new acquisitions.

Exelon narrowed its full-year profit outlook to $4 to $4.10 per share from $4 to $4.30 per share. The outlook assumes normal weather for the rest of the year and excludes one-time charges.

Exelon Chairman and CEO John Rowe, an outspoken proponent of legislation pending in Congress that would limit emissions from greenhouse gases from power plants and other sources, said the company continues to work with Congress to get a bill passed that would put caps on emissions.

"We are absolutely convinced... that cap and trade legislation is the way to deal with climate that offers the best chance of keeping costs down for our customers and creating an earnings opportunity for our shareholders," he told analysts.