MidAmerican Energy acquires Constellation

By Washington Post

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

The quick sale, arranged in about 48 hours, was designed to end what a Standard & Poor's analyst called "an acute crisis of confidence" that had wiped out half the company's value on September 15 and 16.

MidAmerican chief executive Gregory E. Abel said his Des Moines-based holding company will bring "financial stability" to Constellation, which needed to raise new collateral for its energy trading arm. Berkshire Hathaway will give MidAmerican the cash for the purchase. Constellation will raise $1 billion right away by issuing preferred stock to MidAmerican. The rest of the $26.50-a-share cash deal needs approval from shareholders and Maryland regulators.

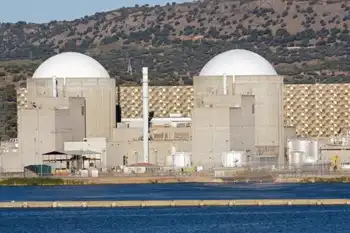

In buying Constellation for half of what the company was worth a week ago, MidAmerican acquires one of the nation's biggest generators of electricity. Constellation operates five nuclear reactors, numerous coal plants, a major energy trading business and Baltimore Gas & Electric.

Abel said Constellation's operations will remain largely autonomous since MidAmerican has no presence on the East Coast. Buffett, who has been beefing up his stake in the energy sector, said the acquisition "will prove beneficial to all constituents."

Constellation's shares fell 57 cents, or 2.3 percent, to close at $24.20 September 18. That was well off their 52-week high of $107.97 on Jan. 8. Shares dipped as low as $13.

Constellation's shares had fallen 70 percent since July 31 as investor concerns increased over the liquidity needs of the company's energy-trading business, which was growing until this year. That business relies heavily on financing that has all but disappeared with the turmoil in the financial markets.

Investor and lender confidence was damaged by chief executive Mayo A. Shattuck III's August disclosure that Constellation had dramatically underestimated the collateral it would need to put up if its credit rating were downgraded. Then late last month, the company took several steps to raise capital, selling off some natural gas reserves. That appears to have been too little, too late.

Abel declined to comment on Shattuck's future.

At a news conference in Baltimore, Abel said he did not expect any short-term changes in electricity rates for BGE's 1.2 million customers in the Washington suburbs and Baltimore, whose bills have soared under deregulation.

"They won't see any increases or decreases as a result of this transition," Abel said. "What we hope is that we bring long-term benefits and stability."

He also said the sale would not affect Constellation's plans to build a third nuclear reactor at its Calvert Cliffs plant in Lusby, a deal for which the company is seeking federal loan guarantees.

"We're a very big proponent of nuclear energy," Abel said.

Abel said Constellation's energy-trading business would continue, but that it would probably be scaled down.

MidAmerican owns six energy firms, including ones in California and Britain. Constellation is one of the Washington area's largest employers, with 7,500 workers in Maryland. It also owns 83 power plants, which were a big draw for MidAmerican.

"We think they have exceptional assets," Abel said.

Constellation's problems are likely to revive the debate over deregulation of utilities, which helped pave the way for expanded energy trading by utility holding companies and investment banks. In Maryland, the switch to competitive electricity markets also triggered a political battle between Constellation executives and Gov. Martin O'Malley (D). When O'Malley took office last year, he faced a consumer revolt over a 72 percent rate increase for BGE customers.

In April, O'Malley and the company reached a legal settlement to give 1.1 million customers in the Washington-Baltimore area a one-time $170 credit and other rate relief. To head off a threat of blackouts in three years if the demand for electricity outpaces supply, the Maryland Public Service Commission has threatened to force BGE and other utilities to build new power plants.

O'Malley praised the sale as good news for Maryland customers.

"Given the volatility of the markets we've seen this week and the wreckage of this mismanaged economy, this appears to be a pretty good result," O'Malley said. "You couldn't find a more reputable, stronger white knight than Warren Buffett."

Buffett is on the board of The Washington Post Co.

The deal ended speculation that Electricite de France, the French nuclear power giant, would make an offer for Constellation.

Because BGE is a regulated utility, the Maryland Public Service Commission must approve the deal. The commission said it would weigh whether the sale is "consistent with the public interest" and does not harm consumers.

The companies said the deal is expected to close within nine months.