Police look for unlicensed contractors

By St. Petersburg Times

Electrical Testing & Commissioning of Power Systems

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

A surveillance camera captured their conversations as armed police officers stood nearby, handcuffs at the ready. The man was really an undercover detective, and the workers were about to be hit with $5,000 fines and charges of contracting without a license.

Tampa police have set up occasional stings to catch unlicensed contractors since 2008, but with a new detective at the helm of the three-man unit, they're planning more - perhaps up to one a week, said investigator Bill Darrow.

"People want it, and we have a lot of victims," Darrow said.

In last month's sting, police arrested seven men. Just recently, they sent a Dunedin worker to jail on charges of grand theft and contracting without a license. Police say Richard L. Goodwin, 56, swindled a South Tampa couple out of almost $10,000.

Construction fraud is a major problem with potentially dire consequences, said Tampa police Detective Wayne Robinson, who joined the unit in June.

Victims are sometimes cheated out of tens of thousands of dollars for work that's promised but never done. And it's dangerous to hire people who have little or no training, Robinson said.

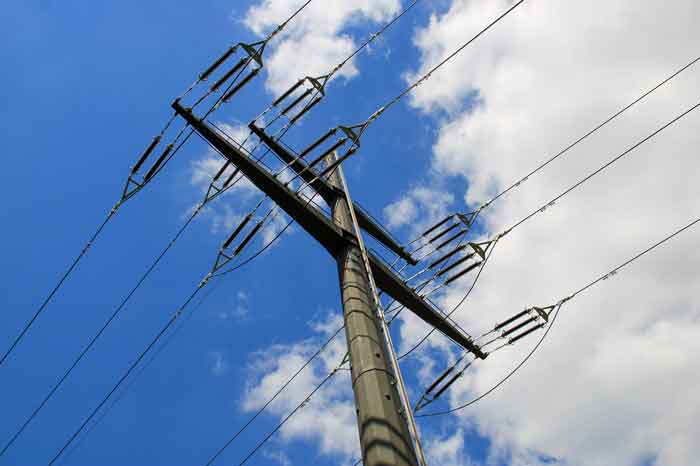

"You could have a fire if there's a bad electrical job," Robinson said. "That's obviously why these people have to be licensed. You have to pass minimum standards and there can be recourse."

Tampa's three construction fraud investigators work on tips they get from the state's Department of Business and Professional Regulation, the city's construction services division and ads they come across.

In unincorporated Hillsborough County, the Sheriff's Office's white-collar crime unit investigates this type of fraud, along with the county's building services division.

County code investigator Roberto Bustamante said they get about a half-dozen calls each week.

"It's a big problem that we see increasing," Bustamante said.

They've been seeing more workers who are employed by licensed contractors go out on their own on nights and weekends to make some extra money. That's illegal, he said.

Darrow estimates the city hears of only 5 to 10 percent of all the potential construction fraud. Most of the time, victims think there's nothing they can do or they're told to get an attorney because it's a civil matter, Robinson said.

It's only a civil matter when the argument is about the quality of the job, such as accusations that tiles aren't straight or a paint job is shoddy, he said.

Contracting without a license is a misdemeanor the first time and a felony the second time.

When Tampa plumber Joseph Gonzalez, 39, heard about the South Tampa couple police say Goodwin victimized, Gonzalez offered to do their plumbing work at cost.

It's not the first time the third-generation plumber has cleaned up after suspected scammers.

A couple of years ago, he helped a woman fix her bathroom.

The previous worker was unlicensed and left a mess of improperly installed plumbing and exposed electrical wires, Gonzalez said.

It's dangerous, he said, to employ untrained people. Plumbing could be contaminated with sewage, improperly installed water heaters could scald someone and bad electrical work could cause a fire, he said.

On top of that, if they're not doing the work they've been paid for, it's theft, he said.

"They're literally stealing money, without a mask and without a gun," he said. "And they need to be stopped."