Gas power plant feels the heat

By Toronto Star

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

From Port Credit to The Beach and, now, the Town of Georgina, the future of gas power plant development in Ontario is being fought neighbourhood by neighbourhood as Premier Dalton McGuinty pushes his plan to close coal-fired electricity plants.

It has, some say, created a clash of cultures. To local councillors, residents and activists in the Town of Georgina, plans to build a 350-megawatt gas-fired electricity plant in northern York Region hail from a bygone era, before energy conservation and cleaner technology.

To McGuinty's government, the single-cycle natural gas generator planned for the area means reliable electricity, and if not very green, it is better than the coal plants he has promised to close by 2014 as part of a massive restructuring of the way energy will be produced in Ontario.

"I think the people are way ahead of the decision makers," says Georgina town councillor David Szollosy. "They (the decision makers) keep falling back on the old technologies, the old way of thinking, that we have to have these mega plants.

"This is not a rejection of electricity. It is the decision to restrict discussion to one model of technology – that is what is being rejected."

Mississauga's Port Credit neighbourhood blocked plans for a plant to replace the coal-fired Lakeview Generating Station on its lakeshore, instead promoting a waterfront renaissance.

Beach residents and others argued against the 550-megawatt Portlands Energy Centre, built on Toronto land designated for waterfront development. But their protest ultimately failed and the first stage is now up and running during peak periods, beside where the now-disabled R.L. Hearn coal-fired plant still stands. While large gas plants in Brampton and Halton Hills have been approved, residents in northern York Region are asking: Why the rush to build the least-efficient gas generator? Why not build smaller and cleaner power plants? And, why not get more aggressive on conservation?

Debbie Gordon organized "Megawhat?" – a group protesting the wisdom of the plant. The group, along with Georgina council and MPP Frank Klees (Newmarket-Aurora), want Energy Minister Gerry Phillips to reconvene an earlier working group on electricity to examine other solutions before pushing forward with the plant.

"I am not disputing that we need energy," Gordon says. "But in this day and age, when we know about climate change... I don't understand why we would build something like this when there are other options."

Momentum is growing. NDP MPP Peter Tabuns (Toronto Danforth) recently brought forward a private member's bill that would prohibit building and operating single-cycle generating stations larger than 30 megawatts in certain municipalities. And Tory MPP Julia Munro has asked the energy minister to do an environmental assessment before putting a shovel in the ground.

The Ontario Power Authority is mandated to develop electricity sources across the province. And at the government's direction, it has created a sweeping plan to produce new sources of energy, to replace the coal-fired stations, and promote energy conservation.

The OPA has chosen five private energy companies to locate a potential site in northern York Region. The formal request for proposals will be held this summer, says Brian Hay, OPA spokesperson. The "peak" plant will operate for short periods, usually on scorching summer days when air conditioners send demand for electricity soaring. Hay says emissions won't be high, because the plant does not run all year.

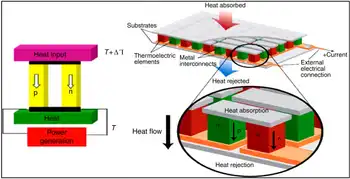

There are three types of natural gas-powered plants. The "simple single cycle" plant, proposed for northern York Region, uses a gas turbine to power a generator that spins to create electricity. It converts 35-40% of the energy that was in the natural gas into electricity.

The "combined-cycle" plant uses the same generating process as the single cycle but has more equipment that takes the heat created by the generator and uses it to make steam. It is then used to create more electricity. It has an "efficiency rate" of 40% to 60%. (The 875 megawatt plant in Brampton and the 683 megawatt station in Halton Hills will both be combined cycle.)

The "combined heat and power" plant creates electricity and steam. It needs a nearby building that can take the steam and use it. It has an efficiency rate of at least 80%.

"We did an analysis and concluded that a peaking plant of 350 megawatts was the right solution for the region," Hay says.

The OPA, counters Jack Gibbons, chair of the Ontario Clean Air Alliance, prefers the 350 megawatt station because it is easier for a bureaucracy to build one large plant than manage the complications of many smaller, more efficient generating stations in hospitals, malls, condominiums and office buildings. Gibbons says the smaller stations could be built in basements or on the rooftops of companies that use them.

"That's a lot of work," he says. "And they prefer the easy way out."