New mercury plan pushed, EPA, utilities oppose it

By Power

Arc Flash Training - CSA Z462 Electrical Safety

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

"We offer this model as an alternative to EPA's flawed and deficient federal rule," said Bill Becker, executive director of the State and Territorial Air Pollution Program Administrators and the Assn. of Local Air Pollution Control Officials.

"There seems to be a very strong level of support for us to provide tools for them to make the EPA rule far better," said Becker, who said he has spoken with state regulators and utilities about the groups' "model rule."

The STAPPA/ALAPCO model rule offers utilities options in cutting their mercury emissions ultimately by up to 95%. One option would have utilities reduce mercury emissions of their fleets in a single state on average by 80% in 2008 and then on a plant-by-plant basis by 90-95% in 2012. Another option would be for utilities to reduce their mercury emissions by 90-95% in 2008 or commit to reduce other pollutants - sulfur dioxide, nitrogen oxides and particulate matter - from up to half their in-state fleet, and then hit the mercury target of 90-95% four years later.

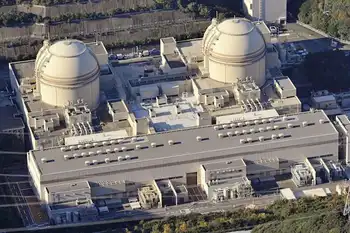

Coal-fired generating units emit about 48 tons of mercury a year. The groups say states and localities should adopt their rule, in part if not verbatim, because the administration's measure, finalized in May by the Environmental Protection Agency, does not protect health and the environment enough.

EPA's rule requires a 21% reduction in mercury emissions from electric generating units by 2010 and a 69% cut by 2018. The rule sets individual mercury emission budgets for each state in the 2010-2017 timeframe and for 2018 and thereafter. It contains a means to provide states with emission allowances for sources and sets up an interstate emissions trading system in which utilities would swap these allowances to aid their compliance at high-emitting units. This would delay actual reductions in mercury emissions until the mid-2020s by some estimates.

STAPPA/ALAPCO opposes interstate trading of mercury, a neurotoxin that enters the food chain through fish in contaminated waters and is linked to learning disabilities in children exposed in the womb.

In addition to a half-dozen states pursuing their own stricter mercury restrictions, Becker said that about 20 states and some localities have expressed "strong interest" in adopting the groups' rule, although he declined to identify them. Some 14 states and as many environmental groups have already sued EPA over its mercury rule, saying it circumvents the Clean Air Act requirements to control hazardous air pollutions and fails to protect health.

States are interested in the model because they are uninterested in interstate trading of mercury, said Becker, yet the budget under the EPA rule could require them to do just that. "State and local agencies asked us to help provide an alternative to EPA's approach."

ALAPCO President John Paul said that local air regulators want "certainty for public health, for industry to know when to put in new controls." The regulators do not want to return to power plant owners and operators and say more controls are needed, he said. "One of the big flaws of the federal rule is that there is no specific certainty for anyone until 2018 - public, industry or state regulators," said Paul.

By next November, states are required by EPA to submit implementation plans on how they will meet the minimum stringency of the agency's rule. While EPA's rule has an interstate trading mechanism, states are "not required to adopt and implement the proposed emission trading rule, but they are required to be in compliance with their statewide Hg [mercury] emissions budget," the final rule published in the May 18 Federal Register said.

Noting that the alternative does not require the permission of Congress or the EPA, Becker said states can actually go beyond the federal rule's mercury limits with the STAPPA/ALAPCO model. "EPA should be embracing it," he said.

The administration maintains that greater reductions of mercury from electric generating units are not yet technologically possible, but Becker released a statement from the Institute of Clean Air Companies, which represents firms that manufacture pollution controls, saying "the limits and timing contained in the model rule are feasible."

The administration has also argued that reductions that go beyond EPA's rule would be too costly, but Becker said that the groups' rule would add "only $1 or so a month to the average electricity bill."

"I think the public would be willing to pay that cost" for any additional health and environmental benefits related to mercury emission reductions, he said.

But EPA recently defended its rulemaking against the STAPPA/ALAPCO model, saying the cap-and-trade approach best protected public health while maintaining fuel diversity and energy security.

"By contrast, the stringent mercury emission reductions and implementation schedules in the STAPPA model rule could potentially shift large segments of the nation's generating capacity from coal to natural gas if it were adopted in a significant number of key electricity-generating states," EPA spokeswoman Eryn Witcher said. "Such a shift could result in increased natural gas prices to consumers due to supply shortages."

The utility industry also defended the administration's position compared with STAPPA/ALAPCO's. The state groups made some "wildly unrealistic assumptions" about the speed of mercury control technologies, the Edison Electric Institute said. If utilities must do more than the administration's request for mercury reductions, consumers could pay more without additional health benefits, according to the lobbying organization for investor-owned utilities.

"There's no question that significant progress is being made on the technology front, and we're optimistic that given adequate time, some of these new technologies will be available to help us meet the federal 70% mercury reduction requirement," said EEI spokesman Dan Riedinger. "But we as an industry can't invest our customers' money on technology that looks promising, but which hasn't yet been thoroughly tested. State regulators won't allow it.

"And while equipment vendors like to tout the performance of their products during limited tests, they start to get cold feet when asked to certify their performance once installed on a power plant."

Scott Segal, the director of the Electric Reliability Coordinating Council, a coal-fired-generators' lobby, said the EPA trading mechanism was key to gaining mercury reductions. "The more states that participate in the federal cap-and-trade system, the more robust the trading regime will be and the faster emissions will come down," said Segal. "Ironically, by urging states to opt into old-fashioned, command-and-control regulations, STAPPA would undermine the trading system."