Developer says investors will loan 3.5 billion for proposed nuke plant in Southwest Idaho

By Knight Ridder Tribune

NFPA 70e Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Alternate Energy Holdings Inc. said it received a letter of intent from Fairport, N.Y.-based Cobblestone Financial Group to finance the project. Don Gillispie, president and CEO of Alternate Energy Holdings, said Cobblestone represents a group of international investors. He declined to identify them. A spokesman at Cobblestone deferred all questions about the funding to Cobblestone President and CEO Lyndon Matteson, who the spokesman said was not available Tuesday. A letter of intent means the funding will be provided in stages as the company meets different milestones, Gillispie said. "This is what happens with large loans," Gillispie said.

"The funding is all phased in when we need it." Continued funding, however, depends on the company achieving its milestones. A funding commitment doesn't guarantee a project will be completed. For example, Rick Peterson, the former developer of the failed Boise Tower project at Eighth and Main streets in Downtown Boise, said he, too, had secured a financing commitment, but the money - and the tower - never materialized. Alternate Energy Holding won't qualify for the first round of loans - $100 million - until it receives local approval for the project, a spokesman said. The company needs a conditional-use permit from Owyhee County to change the zoning of the proposed site from agricultural to industrial.

Gillispie said the company plans to submit the application this summer. The first $100 million would be used to star the process of filing an application to the Nuclear Regulatory Commission for a combined operating and construction license. If the company gains local approval, Gillispie said it could start the licensing process this fall. If everything goes as planned, he said the plant could be operating by the third quarter of 2015. Gillispie said he believes he can build the 1,600 megawatt plant for about $3 billion, $500 million less than Cobblestone committed. Beatrice Brailsford, the program director for the Snake River Alliance, which has been critical of the company's financial position and its proposal, said just having a letter of intent doesn't guarantee the project will be completed.

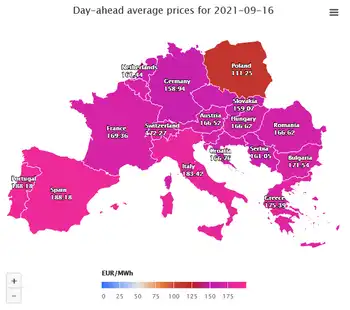

"There are still so many serious questions to be answered and so many obstacles to overcome," Brailsford said. "There are questions about the technology they will use, whether or not people in the region will allow it to come in. And where is the power going to go?" Alternate Energy trades on an over-the-counter market called the Pink Sheets under the symbol AEHI.PK. That market is for companies that do not meet the financial requirements to trade on a larger exchange. On Tuesday the stock closed at 50 cents a share, down 1 cent. Gillispie said Tuesday that the financing commitment arrived faster than he expected.

He credited a growing demand for nuclear power and a recognition that the leadership of his company has the experience to make the plant a reality. The plant would be built on private land near C.J. Strike Reservoir and would include an ethanol plant. If completed, the Idaho plant would be the nation's largest nuclear plant and provide enough electricity to meet about two thirds of Idaho's resident al electricity needs. Gillispie has consulted and helped build plants, and he worked for companies like Duke Energy and the Tennessee Valley Authority. He is a former senior vice president of nuclear assessment programs with the Nuclear Management Co. in Hudson, Wis., which operates seven nuclear power plants.