NYISO identifies future energy challenges

By Electricity Forum

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

“The immediate outlook for New York’s electric system is positive, but the sustained adequacy of power resources may be affected by a variety of emerging challenges,” said Stephen G. Whitley, NYISO president and CEO.

The report notes that developments over the past decade have contributed to a more reliable system. With planned additions in the near future, the adequacy of power resources is not an imminent concern. However, the sustained adequacy of resources may be challenged by several factors, including:

• The considerable lead-time required for power infrastructure project development, given the time frames needed to finance, permit and construct major energy projects. The planning horizons of policymakers and regulators should encompass the time required for the electric industry to address new laws and changes in regulatory requirements.

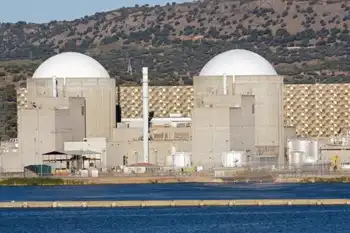

• The ability to develop adequate replacement generation to serve southeastern New York in the event of the retirement of the nuclear power units at Indian Point. These resources would be needed to prevent violation of mandatory resource adequacy reliability standards and maintain the supply of power and transmission voltage support needed to move electricity over power lines.

• The cumulative impact of impending environmental regulations on the continued operation of various existing power plants. As New York State works to sustain and enhance environmental quality, attention must be paid to the impact the array of proposed regulations is estimated to have on more than half the installed generating capacity in the state.

Statewide, the mix of fuels used to generate electricity in New York is relatively diverse and balanced among hydropower, nuclear, coal, natural gas and oil. However, fossil-fueled generation predominates in the high-demand downstate regions of New York.

The report reviews efforts to remove barriers to trade among regional power markets, increase renewable resources and energy efficiency, improve coordination among neighboring grid operators and combine the perspectives of energy system planners across the Eastern Interconnection for a more comprehensive assessment of existing assets. These efforts include “Broader Regional Markets” initiatives estimated to yield annual savings of $193 million for New York.

The report also states that the expected adequacy of New YorkÂ’s power resources over the next decade does not diminish the need to address aging generation and transmission infrastructure. As of the close of 2010, 60 percent of New York StateÂ’s power plant capacity was put into service before 1980. Similarly, 84 percent of the high-voltage transmission facilities in New York State went into service before 1980.

“Smart Grid” measures, encompassing an array of technological solutions intended to enhance the operation of the transmission and distribution systems as well as empower the end-use electricity consumer, are among the emerging changes to New York’s electric system. According to the NYISO report, the new technology may be combined with consumer access to “dynamic pricing” that involves a rate structure reflecting the changing supply and demand conditions in the wholesale electricity market.

“With access to power prices that change to reflect the actual cost of electricity, consumers would have the information needed to adjust energy usage to take advantage of lower-priced energy in low-demand hours and to limit consumption in high-demand, higher-priced hours,” the report states. “In addition to reducing their own bills, the combined effect of consumers cutting demand during peak periods can lead to a more efficient and lower-cost electric system.”

A 2009 study by the Brattle Group estimated New YorkÂ’s market-based cost savings from dynamic pricing in the range of $171 million to $579 million annually.

Among the challenges facing the electric system is an aging electric industry workforce. However, as home to various academic, industrial and government institutions engage in pioneering smart grid and clean energy initiatives, New York State can play a leadership role in developing the next generation of electric industry professionals.

“New York has a proud history of pioneering energy leadership. That legacy can serve the Empire State as it strives to successfully address its future energy needs,” Whitley said.