Are utility ratings at risk?

By The Bond Buyer

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

"Is it going to have an impact on muni issuers? Yeah, absolutely," said Christopher Jumper, a public power analyst for Fitch Ratings.

The rating agency has a stable long-term outlook for the sector, he noted, but added that negative pressure could come from national environmental mandates. It is "going to place a lot of pressures on state and local municipalities.... It's going to be very expensive," Jumper said.

The concerns stem from the EPA's long-anticipated announcement that greenhouse gases "threaten public health and welfare of the American people." The proclamation came as Congress is set to adjourn without approving climate change legislation or a cap-and-trade system and is seen by market participants as a precursor to new regulations on emissions.

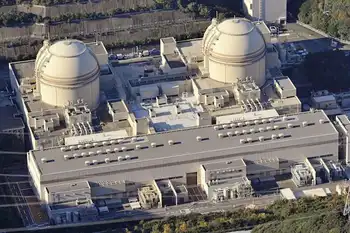

Nearly one-half of the electricity supplied by public power utilities comes from coal-fired power plants, so observers see the looming regulations as a potential challenge or threat to the sector. However, some utilities may be slightly better positioned to adjust to stricter regulations, rating analysts said.

Public power utilities represented by the American Public Power Association expect to see the EPA's regulatory proposals in the spring, said Theresa Pugh, director of environmental services for the group.

The lack of carbon dioxide control technologies to reduce emissions means that utilities have three main options, she said. Utilities could switch to natural gas or nuclear power instead of using coal as an energy source, or they could combine renewable energy sources with energy efficiency projects.

"Natural gas prices are now very low, but it is not likely they would stay low" if the entire industry starts using natural gas to replace coal, she said, adding that some parts of the country have inadequate access to natural gas.

However, an industry-wide shift to only natural gas would be a large feat and would not necessarily be advantageous because natural gas still produces emissions, credit analysts said.

The impact of new EPA regulations may be mild on the sector's credit quality, they added.

"The consensus in the industry is that cap and trade is less onerous than regulation," said Peter Murphy, a director and utilities analyst in Standard & Poor's public finance group.

Climate change legislation from Congress could allow certain groups, such as small municipal utilities, to be carved out and favored over others, and could provide a longer lead time before new rules are in effect, the analysts said.

Generally speaking, utilities with a larger carbon footprint will have a greater challenge in complying with stricter regulations, Murphy said. "Of course, utilities that are naturally less coal-heavy are already advantaged, and that advantage may become sharper," he added.

But municipal utilities' credit quality will not be doomed by proposed regulation - they have the power to set the rates they charge customers, which is one of the keys to credit quality, Murphy said.

Public power utilities and co-ops that do not rely strongly on carbon fuels, such as some utilities in the Pacific Northwest and Southeast, "may be immune or virtually immune to added costs as carbon emissions become regulated," Standard & Poor's said in a recent report.

"But we do not view low carbon intensity as a lever for enhancing the credit quality... Limited carbon intensity and an absence of a vulnerability to higher carbon and attendant pressures on financial margins do not strengthen bondholder and lender protections."