Ignatieff has a vision: a trans-Canada energy highway

By Globe and Mail

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

How much sense does it make that several pipelines are being built north-south to supply the American market while none are being built west-east to supply the eastern half of the nation? Or that we are one of the only Western countries without a strategic petroleum reserve for crisis situations?

In Canada, NEP now stands for No Energy Policy. Unlike jurisdictions elsewhere, it's pretty much laissez-faire here – even with gas prices shooting out of control and the risk of international market upheavals.

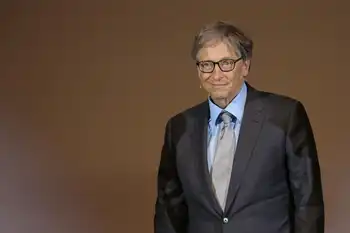

The situation has caught the special focus of Liberal deputy leader Michael Ignatieff who has brought in a group of researchers to help him explore solutions.

“I look at the east-west linkages that tie our country together,” he said recently, “and I do wonder whether they are strong enough to offset the north-south flows that dominate our economy. The oil, the natural gas, the hydro – it all flows south. Where is the national grid to share our power, the east-west pipeline to share our oil and to guarantee our energy security as a nation?”

A west-east pipeline is feasible, he says. There may be good arguments about economic viability to counter the notion. “But let's get back to the fundamentals here. An east-west continental railway was recurrently feared to be economically non-viable. But without it we wouldn't have a country.”

Mr. Ignatieff stressed that he was not speaking in the context of official Liberal policy. But when he gets focused on a big idea, it often finds a way of translating. He was out early with the “Quebec as nation” idea for the Liberals, as well as a carbon tax to address global warming.

On energy, you can sense, with his railway analogy, the national vision dancing in his head. “This,” he said, “is one of the emerging imperatives of public policy – to get a really visionary commitment to strengthening the east-west energy linkages instead of shipping it all south.”

In addition to a west-east pipeline from Alberta, he lists other areas where national linkages can be forged. Ontario has power needs that Manitoba could meet with proper new grid connections. Plans for hydroelectricity from the Lower Churchill project in Labrador envisage markets in the Maritimes and the United States. But it would make enormous sense, Mr. Ignatieff says, for Ottawa to work with the players to explore the possibility of getting some of that power piped east-west to Ontario. It would be part of the solution to Ontario's extreme dependence on environmentally damaging, coal-fired electricity generation.

The Liberal deputy leader is aware of the sensitivities. He is no Walter Gordon nationalist, he says, and he is not trying to bring in a new national energy program through the back door. There are, as he recognizes, highly complex matters of provincial jurisdiction, huge capital costs, refining capacities, environmental impacts, and lingering Western rage from the national energy program of almost three decades ago.

“Energy policy in Canada is always a national unity issue. The bottom line is that we must find a way to strengthen our union without setting ablaze the old anger and resentment of Alberta and Saskatchewan in relation to the centralizing designs of the federal government.”

He calls the notion that we're a big net exporter of oil in the West and a big net importer in the East “weird.” He says it's weird, too, that with foreign supply channels so potentially unstable, there is no talk in Ottawa of creating a national petroleum reserve. He has questions as well about the NAFTA lock-in clause that guarantees levels of U.S. supply from Canada.

Omar Alghabra, the Liberal energy critic, says his colleague is on the right track. It's too gigantic an issue for Canada to just leave to the market, he says. “We have to reduce barriers that prevent Canadian oil from being used by Canadians. We need a national energy strategy.”