Charged up for a transmission overhaul

By Calgary Herald

NFPA 70e Training - Arc Flash

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

And without a major revamp of Alberta's aging transmission system, the possibility of unscheduled dark time is growing, say transmission folk.

The transmission grid is electricity's road to get from generation plants to industry, commerce and households, and is regulated by the government, paid for by the public but powered for the main part by private corporations.

The arrangement is part of the province's unique position in Canada of having a fully deregulated power market and never having provincially owned utilities.

So who are the people and agencies that make the power lines hum in a safe, reliable and efficient manner?

They all sing the same mantra of safety, reliability and cost-effectiveness but fall in line at different times in the transmission scenario.

The Alberta Electric System Operator (AESO) takes top billing as the entity that makes the transmission wires flow those electrons in near-perfect order.

It recently announced an ambitious $14.5-billion plan to reinforce the crumbling provincial infrastructure electricity travels on, including a high-voltage, direct-current twin line between Calgary and Edmonton that would tack on about a dollar a month per billion dollars in infrastructure to consumers' bills by 2017.

An extra $14 a month is cheap for a transmission system that will ensure Albertans get all the electricity they need and want, said Dave Allwright, professor at Mount Royal College's Bissett School of Business.

"I think what they're trying to do is build a larger, more robust system that allows for some economies of scale to be built into the alternative generation or other base power generation," he said, calling the existing system decrepit.

The AESO doesn't regulate or own the transmission wires and towers. Instead, the AESO keeps its eyes on the to-and-fro of electrons on the wires, making sure supply and demand are balanced, watching trends and making plans to keep up with them.

"Transmission is an enabler of other industries," said David Erickson, interim president of the AESO.

Erickson pointed out that transmission, which brings with it a huge capital commitment, tends to be built in chunks, the last wave being built more than 25 years ago. This latest plan will tack on costs to all consumers in the province, if approved, but also will ensure new growth can be accommodated, he said.

The AESO's recent long-term vision for transmission includes five projects that are considered critical to keeping the constrained provincial system stable.

The projects target high-demand markets and growth areas of the province, leading with two 500-kilovolt high-capacity lines from Edmonton to Calgary, a 500-kV line from coal-fired power plants outside of Edmonton to a nearby industrial complex and two 500-kV lines to Fort Mc-Murray.

New transmission for southern Alberta also is being planned, driven by wind power, while a massive hydroelectric plan in Slave River could push transmission development in northern Alberta.

The thing about transmission is that it generally takes longer to build than the generation plants it ties into, hence the need to plan big, the AESO says.

Exactly how big, how much, where and when transmission should be put in is determined by the Alberta Utilities Commission.

The AUC regulates the wires and approves or votes on applications for new transmission lines, as well as sets general tariffs, OK's budgets and rates of return for the transmission facility operators.

Since transmission is seen as being a natural monopoly where only a few operators are needed to make the system run, the regulator acts as a surrogate to competition, spokesman Jim Law said.

The AUC establishes the regulated rate charged to all power consumers in the province, balancing utilities' need for a solid return on their investments and the ratepayers, Law said.

It also holds public hearings on needs applications, including for landowners and other stakeholders in the process, as well as the utilities and industrial players.

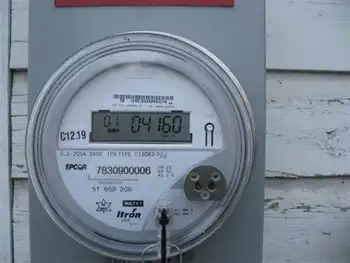

Once the needs application has been scrutinized and approved, it goes back to the AESO, which then assigns the project to one of four major transmission facility operators in the province; privately owned AltaLink in the south, or ATCO Electric in the north, Calgary utility Enmax or Edmonton utility Epcor.

AltaLink counts on the majority of southern Alberta as its territory and serves about 85 per cent of the province's actual load, spokesman Leigh Clarke said.

"We've got a responsibility to deliver safe, reliable and cost-effective transmission service, and be ready to respond when we get direction from AESO to find the best possible routes for the transmission lines and get them built in the most cost-effective, timely manner that we can," Clarke said.

As a regulated utility, AltaLink earns an 8.75 per cent rate of return on its 35 per cent equity investment in the province's transmission grid. The rest is debt financed, and covered by ratepayers. In fact, operating, maintenance and debt costs are shouldered by all power consumers in the province, as reconciled by the AUC.

ATCO Electric serves about 200,000 customers in the north of the province, operating, maintaining and building power lines and stations. As a transmission facility operator, it is in charge of picking out the best route for a line, hashing out deals with landowners and keeping the environmental footprint down.

"It's up to us to try to minimize the costs and defend the costs in front of the AESO, as well as the regulators," said Sett Policichio, president of ATCO Electric.

The costs from all the transmission facility operators are collected and turned into a tariff by the AESO, with industry picking up most of the costs, since it consumes 61 per cent of the province's power.

"Utilities are very stable, and have a rate of return set by the regulator, so, good times or bad, you know that's what you're going to make," Policichio said.

Once a project has been approved, the transmission facility operator goes back to the regulator for a permitting licence and, if approved, starts breaking ground.

In the meantime, the utility has been communicating with landowners and interested parties, working out compensation as well as alternative routes if directed to by the regulator.

Alberta's Conservative government also is in the picture, most recently with its controversial Bill 50, which would give it the power to determine what transmission is needed when. Supporters say the move was needed to make new transmission happen, while opponents say the bill would take away landowners' rights.

The move to forward Bill 50 comes as the government cut $700,000 in funding for the Utilities Consumer Advocate, which represents residential consumers in rate and facilities hearings.

While Service Alberta Minister Heather Klimchuk said the cuts to the advocate shouldn't affect the office's ability to represent and protect consumers at hearings, Jim Wachowich, spokesman for the Consumers' Coalition of Alberta, questioned the decision.

"The Utilities Consumer Advocate is supposed to be a counter-balance," he said. "There's been a real movement behind the scenes from both the utilities and politicians to say: 'Keep the interveners out of the hearing room. Limit the involvement of independent representatives and consumer representatives' — and this is a concern to us."