Barriers loom on road to plug-in cars

By GreenTech Media

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

After many years of buildup, plug-in vehicles aimed at mainstream buyers are set to come to the market starting next year. But even with the momentum around plug-ins, many questions remain unanswered over how this technology transition will impact the ailing auto industry and how the cars will be received by consumers.

"You have the feeling that we're at the beginning of something that could be very special," said David Cole, the chairman of the Center for Automotive Research, which is funded by government and corporate sources, during the opening of the Business of Plugging In conference. "There are a great many uncertainties, but we have to recognize that the key invention is here with the lithium ion battery."

The sold-out conference, which attracted about 600 people, represented the varied groups needed to deliver these vehicles: automakers and supply chain suppliers, electricity utilities, policy makers, tech entrepreneurs, and investors.

Regardless of the initial volumes of electric-vehicle sales, the stakes in this shift are high. Electric vehicles promise to reduce pollution from transportation, decrease oil imports, and provide economic opportunity for a broad number of businesses.

Compared to biofuels or hydrogen fuel cell technologies, the large automakers and several start-ups have coalesced around electrification, to a greater extent. But there still remains the question of how much money consumers are willing to pay and how easily they can adjust strong habits.

"We've placed big bets in this area... (but) the question is: will consumers want these vehicles?" Bill Ford, the chairman of Ford Motor, said. "The short answer is, it depends on how many trade-offs they need to make... and I think customers aren't prepared to make many trade-offs at all."

Plug-in cars come in various forms, but the larger battery means a higher purchase price than today's hybrids or equivalent gasoline models. If consumers are going to accept that up-front cost, automakers need to convince them that owning an electric car is cheaper in the long run. One idea that automakers are seriously considering is leasing batteries, which could make the monthly payments for a new electric car comparable to a gasoline version.

The actual prices for many cars aren't yet known, since companies have not yet decided. Nissan's all-electric Leaf sedan, set for its U.S. debut next month and availability next year, is said to be in the $25,000 to $30,000 range. Industry executives estimate that the electric Chevy Volt, due late next year, will be in the $40,000 range.

Fueling up an electric car is less expensive than running the equivalent gasoline-only vehicle, and auto industry executives say the maintenance is simpler on electric drives (no more oil changes, for example). Jonathan Lauckner, General Motors' vice president of global program management, said the cost per mile of the Volt could be a sixth of a gasoline car's, offering as much as $1,500 a year in savings. Those savings get better, if gas prices go up and if drivers can charge up more than once a day.

And consumers want this information. Surveys show that consumers are drawn to plug-ins for environmental reasons, but fuel savings are actually more important, according to a survey of U.S. drivers done by Ernst & Young. Safety, of course, is another high priority.

"We've always had a disconnect between the purchase price and the usage cost, where consumers way undervalue the usage costs, which will continue to be a problem here," Richard Curtain, of the Institute of Social Research at the University of Michigan, said during a panel. "If it got to less than a $5,000 premium, that would allay many of the concerns of the consumer."

Industry executives say volume production, a goal of the Department of Energy's $2.4 billion grant program launched in August, will help bring down costs in the coming years, much the way hybrid components fell in price. But that up-front premium is tough to totally erase, given that electrification is competing with a deeply entrenched technology: the internal combustion engine.

Battery improvements will help the cost picture as well. Many companies are working on batteries — a new generation of lithium ion batteries and other chemistries — that can pack more energy. More "energy-dense" batteries means that drivers will get a longer driving range from a battery of a given size. Ultracapacitors, another storage method, have also been proposed as way to work with batteries in vehicles.

The different routes automakers are taking to electrification affects costs. General Motors' Chevy Volt has generated plenty of buzz, but company executives say its design will make at least the first generation of the car pricey. GM hopes to wring thousands of dollars from the Volt power train, notably the battery and power electronics in the second generation of the car.

Fisker Automotive, a start-up that received a $528 million loan from the Department of Energy, is using a similar power train for its planned Karma and Nina high-end luxury cars. Called an extended-range electric vehicle or a series hybrid, these cars will run on battery charge only in the beginning — 40 miles in the case of the Volt — and then use an internal combustion engine to operate a generator for the electric motor on longer trips.

A handful of automakers — Ford, Nissan, Think, and Coda Automotive among them — are making all-electric vehicles, also called battery-electric vehicles. Because of the limited range of about 80 miles to 100 miles, these cars are being sold as second cars in the United States or Europe or for city driving.

By contrast, Toyota, which has already sold millions of Priuses, believes that the way to sell large volumes of plug-in cars is to build on the existing hybrid technology, where batteries and the gasoline engine both propel the car.

"We think that blended (mode) is going to be the only way to reach the cost parity that the consumer is going to want," said Justin Ward, the advanced power train program manager at the Toyota Technical Center. "There (are) a lot of high-end cars, but how high do you go before it becomes unattainable for the general consumer?"

Electric and hybrid cars aren't going to take over the market any time soon, because of cost and because they face competition from more efficient gasoline engines and diesels. Market researcher IHS Global Insight projects that pure-electric and range-extended electric vehicles will account for just more than 1 percent of the total market by 2014, with hybrids and plug-in hybrids being nearly 21 percent.

But even though plug-ins of various types will be a niche in the early years, utilities need to start preparing now. On a local level, utility executives are concerned that just a few plug-in cars, which can pull as much juice as a whole house when charging, will strain local power grids. That's particularly true, if consumers install faster 220-volt charging ports, which will cut charge time to about two or three hours, from six or eight.

The way to avoid stressing the grid is to charge cars at off-peak times, utility executives say. Pacific Gas & Electric, considered one of the most aggressive utilities in embracing new technologies, plans to offer customers a 220-volt charger that has a timer so consumers can take advantage of lower rates at off-peak times. Using a smart-grid technology, a car charger could pick its charge time and rate by communicating through a smart meter.

But what if someone can't charge at home? Like others, utility industry group the Edison Electric Institute advocates new building codes demanding that all new buildings are wired so that charging stations can be added in places such as underground parking garages in apartment buildings or retail areas, according to Anthony Earley, the chairman of the institute and CEO of utility DTE Energy.

A few charging stations will go a long way, according to people who spoke at the conference. "We act like this is a chicken-and-an-egg problem, but it's really not," said Mark Duvall, the director of electric transportation at the Electric Power Research Institute. "They are not enabling technologies, in my opinion, but they can help."

If plug-in electric vehicles are wildly popular with consumers and fleet owners, the industry will then face the challenge of having sufficient capital to scale up. During a discussion on battery technologies, academics said that even now, there isn't a sufficient workforce to do the engineering required for electric vehicles, with the most glaring hole in materials science.

Although higher manufacturing should significantly cut battery prices, there were regular questions about the supply of lithium at the conference. Overall, auto and battery company executives said lithium supply is not a pressing concern. Lithium could be extracted from different sources and can be recycled, said Yet Ming Chiang, the chief scientist of battery upstart A123 Systems and professor of ceramics at the Massachusetts Institute of Technology.

The U.S. auto industry has an opportunity to be reinvigorated with electric auto technologies, as it seeks to transition from the "rust belt to the green belt," Michigan Governor Jennifer Granholm said. China, meanwhile, is investing heavily in electric transportation, which national leaders see as a way to "leapfrog" to the latest technologies, said Yibing Wu, the managing director of Legend Holding, the company that makes Lenovo laptops and is moving into clean energy.

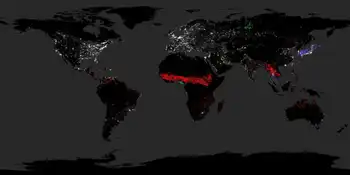

On an environmental level, plug-in hybrid cars have 30 percent lower carbon emissions, even if a car is fueled by coal-fired power plants, Earley said. That's particularly important on a global level, since hundreds of millions of cars are expected to be sold in the coming years in developing countries, said Ann Marie Sastry, a University of Michigan professor and a co-founder of a Khosla Ventures-backed battery company Sakti3.

"The small car is absolutely going to be essential for electrification and to all of us because it doesn't matter where the carbon comes from — whether we generate it or it comes from the emerging economies," Sastry said. "It's imperative (that) the United States play a role in this technology development because of our own interest in climate change."