Can Europe's atomic reactors bridge the gap to an emissions-free future?

NFPA 70e Training - Arc Flash

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

EU Nuclear Reactor Life Extension focuses on energy security, carbon-free electricity, and safety as ageing reactors face gas shortages, high power prices, and regulatory approvals across the UK and EU amid winter supply risks.

Key Points

EU Nuclear Reactor Life Extension is the policy to keep ageing reactors safely generating affordable, low-carbon power.

✅ Extends reactor operation via inspections and component upgrades

✅ Addresses gas shortages, price volatility, and winter supply risks

✅ Requires national regulator approval and cost-benefit analysis

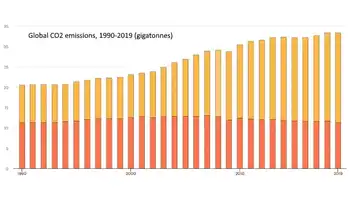

Shaken by the loss of Russian natural gas since the invasion of Ukraine, European countries are questioning whether they can extend the lives of their ageing nuclear reactors to maintain the supply of affordable, carbon-free electricity needed for net-zero across the bloc — but national regulators, companies and governments disagree on how long the atomic plants can be safely kept running.

Europe avoided large-scale blackouts last winter despite losing its largest supplier of natural gas, and as Germany temporarily extended nuclear operations to bolster stability, but industry is still grappling with high electricity prices and concerns about supply.

Given warnings from the International Energy Agency that the coming winters will be particularly at risk from a global gas shortage, governments have turned their attention to another major energy source — even as some officials argue nuclear would do little to solve the gas issue in the near term — that would exacerbate the problem if it too is disrupted: Europe’s ageing fleet of nuclear power plants.

Nuclear accounts for nearly 10% of energy consumed in the European Union, with transport, industry, heating and cooling traditionally relying on coal, oil and natural gas.

Historically nuclear has provided about a quarter of EU electricity and 15% of British power, even as Germany shut down its last three nuclear plants recently, underscoring diverging national paths.

Taken together, the UK and EU have 109 nuclear reactors running, even as Europe is losing nuclear power in several markets, most of which were built in the 1970s and 1980s and were commissioned to last about 30 years.

That means 95 of those reactors — nearly 90% of the fleet — have passed or are nearing the end of their original lifespan, igniting debates over how long they can safely continue to be granted operating extensions, with some arguing it remains a needed nuclear option for climate goals despite age-related concerns.

Regulations differ across borders, with some countries such as Germany turning its back on nuclear despite an ongoing energy crisis, but life extension discussions are usually a once-a-decade affair involving physical inspections, cost/benefit estimates for replacing major worn-out parts, legislative amendments, and approval from the national nuclear safety authority.