Russia-Ukraine Energy War disrupts infrastructure, oil, gas, and electricity, triggering supply shocks, price spikes, and inflation. Global markets face volatility, import risks, and cybersecurity threats, underscoring energy security, grid resilience, and diversified supply.

Key Points

It is Russia's strategic targeting of Ukraine's energy system to disrupt supplies, raise prices, and hit global markets.

✅ Attacks weaponize energy to strain Ukraine and allies

✅ Supply shocks risk oil, gas, and electricity price spikes

✅ Urgent need for cybersecurity, grid resilience, diversification

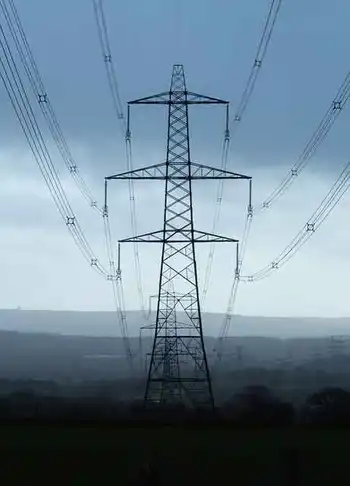

Russia's targeting of Ukraine's energy infrastructure has unleashed an "energy war" that could lead to widespread price increases, supply disruptions, and ripple effects throughout the global energy market, felt across the continent, with warnings of Europe's energy nightmare taking shape.

This highlights the unprecedented scale and severity of the attacks on Ukrainian energy infrastructure. These attacks have disrupted power supplies, prompting increased electricity imports to keep the lights on, hindered oil and gas production, and damaged refineries, impacting Ukraine and the broader global energy system.

Energy as a Weapon

Experts claim that Russia's deliberate attacks on Ukraine's energy infrastructure represent a strategic escalation, amid energy ceasefire violations alleged by both sides, demonstrating the Kremlin's willingness to weaponize energy as part of its war effort. By crippling Ukraine's energy system, Russia aims to destabilize the country, inflict suffering on civilians, and undermine Western support for Ukraine.

Impacts on Global Oil and Gas Markets

The ongoing attacks on Ukraine's energy infrastructure could significantly impact global oil and gas markets, leading to supply shortages and dramatic price increases, even as European gas prices briefly returned to pre-war levels earlier this year, underscoring extreme volatility. Ukraine's oil and gas production, while not massive in global terms, is still significant, and its disruption feeds into existing anxieties about global energy supplies already affected by the war.

Ripple Effects Beyond Ukraine

The impacts of the "energy war" won't be limited to Ukraine or its immediate neighbours. Price increases for oil, gas, and electricity are expected worldwide, further fueling inflation and exacerbating the global cost of living crisis. Additionally, supply disruptions could disproportionately affect developing nations and regions heavily dependent on energy imports, making targeted energy security support to Ukraine and other vulnerable importers vital.

Vulnerability of Energy Infrastructure

The attacks on Ukraine highlight the vulnerability of critical energy infrastructure worldwide, as the country prepares for winter under persistent threats. The potential for other state or non-state actors to use similar tactics raises concerns about security and long-term stability in the global energy sector.

Strengthening Resilience

Experts emphasize the urgent need for global cooperation in strengthening the resilience of energy infrastructure. Investments in cybersecurity, diverse energy sources, and decentralized grids are crucial for mitigating the risks of future attacks, with some arguing that stepping away from fossil fuels would improve US energy security over time. International cooperation will be key in identifying vulnerable areas and providing aid to nations whose infrastructure is under threat.

The Unpredictable Future of Energy

The "energy war" unleashed by Russia has injected a new level of uncertainty into the global energy market. In addition to short-term price fluctuations and supply issues, the conflict could accelerate the long-term transition towards renewable energy sources and reshape how nations approach energy security.

Related News