Nuclear industry faces trillion-dollar question

By Reuters

Electrical Testing & Commissioning of Power Systems

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

State-owned CEZ, central Europe's biggest utility group, plans to build two additional units at its Temelin plant near the Austrian border as well as up to two other units in neighboring Slovakia and another at its Dukovany station in the east of the Czech Republic.

In the running to build the plants are Toshiba Corp unit Westinghouse, an alliance of Russia's Atomstroyexport and Czech firm Skoda JS, and France's Areva.

Unlike Germany, which has said it will hasten its exit from nuclear energy following the crisis in Japan, and Italy, which has announced a one-year moratorium on plans to relaunch atomic power, the Czech Republic has no intention of slowing its push for more nuclear power. Less than a week after the Fukushima disaster, Prime Minister Petr Necas said that he could not imagine that Prague would ever close its plants. "It would lead to economic problems on the border of an economic catastrophe."

At the same time there's little doubt the Fukushima crisis will change the Czech Republic's thinking about safety in the new plants — and that could influence whose bid will ultimately be successful.

"Nuclear energy works on the basis of lessons learned from past events," Zavodsky told Reuters. "We will analyze what happened in Japan and will surely include recommendations arising from this analysis for suppliers in the tender."

That's just one way the Japan crisis is already changing the game for the nuclear industry.

Before Fukushima, more than 300 nuclear reactors were planned or proposed worldwide, the vast majority of them in fast-growing developing economies. While parts of the developed world might now freeze or even reduce their reliance on nuclear, emerging markets such as China, India, the Middle East and Eastern Europe will continue their nuclear drive.

But with fewer plants to bid on, the competition for new projects is likely to grow even fiercer — and more complicated. Will concern about safety benefit Western reactor builders, or will cheaper suppliers in Russia and South Korea hold their own? And what if the crisis at Fukushima drags on as appears likely? Could it still trigger the start of another ice age for nuclear power, like Chernobyl did in 1986? Or will it be a bump, a temporary dip in an upward growth curve?

With nuclear plants costing several billion dollars apiece, the answer to those questions may be worth a trillion dollars to the nuclear industry. Little wonder that the main players have rushed to reassure their clients that all is well.

On March 15, just three days after the first Fukushima reactor building blew up, Russian Prime Minister Vladimir Putin flew to Belarus to revive a $9 billion plan to build a nuclear plant there, saying that Russia had a "whole arsenal" of advanced technology to ensure "accident-free" operation.

The next day, President Dmitry Medvedev met with Turkish Prime Minister Tayyip Erdogan in Moscow and pledged to press ahead with a $20-billion deal to build a four-reactor Russian plant in Turkey. "The answer is clear: it can be and is safe," Medvedev said.

It was a similar message in France, the world's most nuclear-dependent country with 58 nuclear reactors that provide almost four-fifths of its electric power. "France has chosen nuclear energy, which is an essential element of its energy independence and the fight against greenhouse gasses," president Nicolas Sarkozy said after his government's first post-Fukushima cabinet meeting. "Today I remain convinced that this was the right choice."

The American nuclear industry has also gone on a public relations drive. The industry's main lobby group, the Nuclear Energy Institute, has been out in force in Washington since the disaster, kicking off its response with a meeting three days after the quake in which it briefed 100 to 150 key aides to U.S. lawmakers on the crisis.

"Our objective is simply to be sure policymakers understand the facts as we understand them," Alex Flint, vice president for governmental affairs at the institute told reporters. To appreciate how much is at stake for the industry it's worth remembering that until Fukushima the prospects for nuclear power had been at their brightest in more than two decades, reversing a long period of stagnation sparked by the Chernobyl disaster.

The number of new reactors under construction, up to 30 or more per year in the 1970s, dropped to low single digits in the 1990s and early 2000s by 2008 the total number of reactors in operation was 438, the same number as in 1996, International Atomic Energy Agency data show. In the past few years, that trend has reversed itself, and in 2008 construction started on 10 new reactors, the first double-digit number since 1985.

Today, there are 62 reactors under construction, mainly in the BRIC countries Brazil, Russia, India and China, with 158 more on order or planned and another 324 proposed, according to World Nuclear Association data from just before Fukushima. China, which currently has just 13 reactors in operation, has 27 more under construction and was planning or proposing another 160. India was planning or proposing 58 and Russia 44.

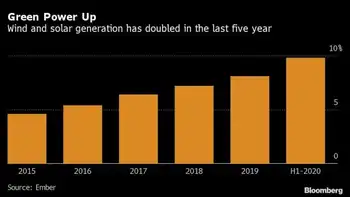

Anti-nuclear lobby activists argue that demand for safer designs will make nuclear power more expensive. That should help low-carbon renewables such as solar and wind, and end nuclear power's momentum according to Greenpeace EU Policy Campaigner Jan Haverkamp. "Fukushima will end all this talk about a nuclear renaissance. The industry says nothing will change. Forget it," Haverkamp said.

But even if Fukushima does increase public resistance to nuclear, it seems unlikely to stop the emerging market countries' nuclear ambitions altogether. For one thing, public opinion in Asia does not drive policy like it does in the West. Even India, with a democratic tradition and a post-Bhopal sensitivity to industrial disasters, seems set to keep its nuclear plans on track.

"The global socio-political and economic conditions that appear to be driving the renaissance of civil nuclear power are still there: the price of oil, demands for energy security, energy poverty and the search for low-carbon fuels to mitigate the effects of global warming," Richard Clegg, Global Nuclear Director at Lloyd's Register told Reuters.

Few companies have more at stake than France's Areva, the world's largest builder of nuclear reactors. Even before the Japan crisis, the state-owned firm touted its next-generation, 1,650 megawatt reactor — designed to withstand earthquakes, tsunamis or the impact of an airliner — as the safest way to go.

Now Areva's ramping up that message whenever it can. "Low-cost nuclear reactors are not the future," Areva CEO Anne Lauvergeon told French television just days after the first explosion at the Fukushima plant.

But Areva's new EPR reactor is not without its own issues. Originally called the "European Pressurized Water Reactor" EPR, Areva's marketeers later rebaptized it the "Evolutionary Power Reactor". Anti-nuclear activists mockingly refer to it as the "European Problem Reactor" because of its troubled building history.

Designed with multiple and redundant back-up systems to safeguard against natural disasters, the EPR's design was updated after 9/11 to be able to withstand the impact of an airliner crashing into it. Areva's Chief Technical Officer Alex Marincic says that the EPR's design reduces the probability of a core meltdown to less than one in a million per reactor per year, compared to one in 10,000 for older second-generation reactors.

Even if the worst were to occur, the EPR comes with a "core catcher" below the reactor containment vessel that is designed to prevent a melting reactor from burrowing China Syndrome-style into the ground.

Marincic said that the EPR, and in particular its back-up diesel generators, would have resisted the force of the tsunami wave in Fukushima as all buildings and doors are designed to be leak tight and to withstand the force of an external explosion.

"Had the reactor in Fukushima been an EPR, it would have survived," he said.

Construction of the first EPR started in 2005 in Olkiluoto, Finland, where Areva signed a three billion euro turnkey contract with Finnish utility TVO. But due to a string of construction problems, the project is now three years behind schedule and nearly 100 percent over budget. The reactor is not expected to come on stream before 2013 and Areva is embroiled in a bitter arbitration procedure with the Finns over who will shoulder the extra costs.

Work on a second EPR started in Flamanville, France in December 2007 and is expected to be completed in 2014, also after several years' delay. French utility group EDF says that in 2010 the investment cost for the reactor was estimated at about five billion euros.

Areva is also building two EPRs in Taishan, southern China, due to come on stream in 2013 and 2014. Areva says that contract was worth eight billion euros.

The size of nuclear deals varies widely depending on what is included. At a minimum, a vendor can sell a reactor or a license to build it. But vendors can also take on construction of the reactor building or even the entire nuclear plant. Deals often also include long-term contracts for nuclear fuel delivery or financing by firms in the vendor country. Building costs also range enormously depending on where the plants are built.

In resource-poor India, for instance, where Areva is negotiating the sale of two EPRs, the deal could include 25 years of fuel deliveries, an Areva spokesman said. CEO Lauvergeon has referred to Areva's strategy as the "Nespresso model" — Areva not only sells reactors, it enriches and sells uranium, and can recycle the spent fuel.

A French official told Reuters on condition of anonymity that Chinese authorities have told French partners that following the Fukushima disaster China now wants to use third-generation reactor designs for its smaller power plants.

This would be a huge boost for Areva, which is developing — with Japan's Mitsubishi Heavy Industries — a new 1,100 megawatt ATMEA1 pressurized water reactor designed to supply markets with lower electricity needs.

Areva spokesman Jacques-Emmanuel Saulnier said the group is currently negotiating some twenty projects in countries including the United Kingdom, the United States, India, China and the Czech Republic. The firm still hopes to capture one third of the market for new reactors by 2030, though the Fukushima events may push back that target date.

Areva's main competitor is Toshiba Corp unit Westinghouse, which is building four of its third-generation "Active Passive" AP1000 reactors in China, with the first expected to go on-line in 2013.

Considered to be the most up-to-date technology, the AP1000, rather than focusing on multiple back-up systems like the EPR, introduces the concept of "passive safety" which relies on gravity and natural convection flows of water — instead of pumps driven by electricity — to cool down the core in case of an emergency.

One of its key features is a 300,000-gallon water tank inside the containment area, above the core. Westinghouse says the AP1000 does not require backup diesel for cooling, as all water needed for an emergency will run down from the tank and begin the cooling process without the need for electricity or human intervention. The water would boil, turn to steam and condense on the inside of the steel containment vessel and then fall back into the core.

"So you have a perpetual rain forest in there," Westinghouse Electric spokesman Vaughn Gilbert said. Kind of. The passive system would "last for three days and with minimal additional use of a small diesel you can go four additional days," according to the company.

Like Areva, Westinghouse claims that its new reactor would have withstood the Fukushima earthquake and tsunami. The earthquake "would have been a non-event for the AP1000," Westinghouse chief executive officer Aris Candris told Reuters.

The firm has said it expects to finalize agreements with China this fall to build 10 power plants with Westinghouse AP1000 reactors, on top of the four already under construction. Candris says that Westinghouse is in negotiations to sell more AP1000s in other countries including the UK, the Czech Republic, Poland, Lithuania and was involved in preliminary discussions in Brazil and India.

"The share of the AP1000s in the market will go up following the events in Japan because more and more people — around the world and in China, the biggest market going forward — will see the advantages of the passive design," he added.

Experts agree that passive safety is a good idea but urge caution.

The AP1000 design has not yet been approved by the U.S. Nuclear Regulatory Commission, and the company acknowledges that the NRC may require more backup generators, batteries and other features at US nuclear plants as it integrates the lessons learned from Japan.

"No reactor that I know of can indefinitely take care of itself without external intervention," said James Acton, Associate, Nuclear Policy Program at the Carnegie Endowment for International Peace.

"Fukushima was a beyond-design basis event. The earthquake and particularly the tsunami were much larger than the plant was designed to withstand. You can have the most modern sophisticated well-run reactor in the world but if it is hit by a beyond basis event, then you cannot guarantee the safety of the reactor," he said.

Acton believes that "the industry as a whole will be damaged by the crisis in Japan and presumably General Electric" — which designed the Fukushima reactors — "will be damaged the most."

GE-Hitachi Nuclear Energy, a tie-up between the two companies, has two "Advanced Boiling Water Reactors" ABWR third-generation plants in operation in Japan and a more recent design, the ESBWR, in the planning stages.

The firm lags some distance behind Areva and Toshiba-Westinghouse and is in no mood to look for commercial opportunities while the disaster in Japan is still unfolding. Officials refused to answer questions about how Fukushima might impact the power balance in the industry, saying that the firm remains focused on providing assistance to the people of Japan.

"Now is not the time to speculate on future sales," GE Hitachi PR manager Michael Tetuan told Reuters.

Western firms do not have a monopoly on safety. Experts say that Mitsubishi Heavy Industries' APWR, the Korean APR-1400, the Russian VVER and the Chinese CNP1000 are all third-generation reactors, each with their own merits.

Privately, the big players all seem happy to criticize their rivals' reactor designs demerits. If you promise not to quote them, competitors will tell you that Areva's EPR does not have much in the way of passive safety features, for instance, while French sources rarely fail to suggest that some rival reactors are not designed to withstand the impact of an airline crash.

It's not all about safety features and price, of course. Nuclear contracts often come down to geopolitics. The firms that sell reactors are mostly state-owned which means negotiations about nuclear deals are often done government to government.

Even the privately owned U.S. reactor builders get an extraordinary level of diplomatic support. Numerous cables obtained by WikiLeaks show that U.S. missions, with the active support of the U.S. Nuclear Regulatory Commission, have led lobbying initiatives for nuclear contracts in countries such as China, Hungary, South Africa, Kuwait, Abu Dhabi and Italy.

Just one example, from a February 23, 2009 cable from the U.S. embassy in Rome illustrates the size of the stakes and how closely U.S. and French diplomats watch each other. The cable recounts how the U.S. mission orchestrated a visit by U.S. Nuclear Regulatory Commission officials who provided Italy with Washington's views on nuclear power just as the Italian government prepared to reintroduce nuclear power after a twenty-year shutdown.

"U.S.-made nuclear reactors may prove to be the best technological and commercial choice for Italy, but intense French lobbying, including by President Sarkozy, could win the day for the French. The Mission will continue our efforts to provide U.S. nuclear technology firms with an opportunity to win what could be billions of dollars in contracts," the confidential cable said.

The cable goes on to say that France was lobbying the Italian government at the highest political levels on behalf of Areva and that "all our sources conclude that a political decision by Berlusconi will likely trump any and all expert input."

American diplomats said that the U.S. mission in Italy had been "vigorously promoting a broad effort to encourage new energy technologies", paying special attention to the nuclear sector, "given the enormity of potential orders for U.S. firms".

"U.S. company representatives and their Italian allies are apprehensive that absent high-level U.S. lobbying, French pressure will push the decision toward a purchase of their technology. We clearly need to engage at the highest level. Tens of billions of dollars in contracts and substantial numbers of high-technology jobs could be involved," the cable concluded.

Areva spokesman Saulnier said that it is perfectly normal for countries to support their export industries. "In most cases we deal with private clients where the public authorities have no impact. But there are other cases, notably China, where the state-to-state relationship plays its full role and it is important that the political authorities not only give their imprimatur but work side by side with the French company," he said.

Russia seems unworried about the impact of Fukushima, or at least determined to push on regardless, even though there is little doubt that the Fukushima fallout will hit the government's ambitious goal to triple nuclear exports to $50 billion a year by 2030.

"The country that turns away from atomic energy today, will become dependent tomorrow on those who did not curtail it," Sergei Kiriyenko, the head of Russia's state-owned nuclear power monopoly Rosatom, said recently in an interview with state television.

Rosatom says it is now building more nuclear plants than anyone — 14 of the 62 reactors under construction worldwide — including projects in China, India and a controversial first plant for Iran. It says it has orders to build some 30 more. Russia also possesses about 40 percent of the world's uranium enrichment capacity, and exports some $3 billion worth of fuel a year, offering discounts to clients who buy Russian-built reactors.

Experts say that while one-third of the operating reactors in Russia are aging Chernobyl-style nuclear plants, the current export designs meet global safety standards. Rosatom's main export reactors are the VVER-1000 and the VVER-1200 which it describes as a third "plus" generation light-water pressurized reactor and which sell for between $3 billion and $6 billion each.

Rosatom boasts that the twin VVER-1000 reactors in a plant that opened in 2008 in Tianwan, China, are the first in the world to feature a core-catcher — a safety net invented by Russian physicists after the Chernobyl disaster.

The company also says its active and passive safety barriers will cool its reactor for at least 72 hours without intervention. If temperatures rise too high, containment sprinklers with fast-melting metal caps spray coolant on the reactor. Two other passive systems are designed to flood the reactor with water in case of an emergency, both relying only on gravity. Two more VVER-1000s under construction in Kudankulam, India, are also outfitted with vents to allow excess heat to escape from the sealed reactor and be cooled at the roof of the containment dome, capping temperatures within.

"The Fukushima accident is the result of unlearnt lessons of Chernobyl," Rosatom spokesman Sergei Novikov said. "We have been learning our lessons for the past 25 years."

Novikov said the fallout from Japan will force nuclear energy companies to protect against even more negligible risks. Work is already underway to protect plants in Russia against the "one-in-a million chance" of a gale-force tornado. New Russia plants to be built in Bulgaria and Turkey are designed to withstand the impact of a 400-tonne plane crashing into them.

"Chernobyl was a bad experience, but an experience nevertheless which we have learned from. Our reactors are definitely up to IAEA standards," said Gennady Pshakin, a former International Atomic Energy Agency official who now heads a Russian institute in Obninsk.

But Norwegian environmental group Bellona, an authority on the Russian industry, has its doubts. In its latest report the group said that in order to reduce costs, Russia cuts corners on safety, from rushing licensing to using poor equipment and cheaper unskilled labor.

"Russia and Rosatom traditionally save money and beat their competitors with a quite low level of safety," which should average about 40 percent of the capital cost, said Greenpeace energy expert Vladimir Chuprov, one of the authors of the report.

Environmentalists say that as Rosatom works to make its reactors as safe as Western models, it is becoming less competitive. "Prices are approaching those of the French EPR reactor series. If earlier Russian reactors were at least trusted to sell well because of the lower prices, this hope is now vanishing fast," Russian environmental group Eco-Defense's Vladimir Slivyak wrote in a comment on the Bellona site.

Russia's ex-deputy minister for atomic energy Bulat Nigmatulin concedes that the Russian industry regularly scores export contracts by offering generous export credits to underbid competitors. Nigmatulin told Reuters that he had personally lobbied Putin to convince him of the importance of the nuclear industry, arguing that it is one of the few high-tech sectors in which Russia can compete globally. "It's the only industry that we are not behind in and we must grow it, but there remains one big but: we must be governed by real economic logic," he said.

As customers rethink the balance between safety and price, will safety now win out?

Just over a year ago, price was still a potent factor.

In early December 2009, Areva was convinced it would win a landmark contract with Abu Dhabi to build four reactors — the first nuclear power plants in the Gulf Arab region. Also in the running were Westinghouse, GE Hitachi and a consortium of South Korean firms with no prior experience of selling reactors abroad.

The final offers, according to a WikiLeaks cable, were "followed by intense political lobbying by Korean, French, Japanese and U.S. officials, including French President Sarkozy", and the Japanese and Korean prime ministers "who all repeatedly called the Crown Prince." South Korean President Lee Myung-bak even flew to the United Arab Emirates to personally defend the Korean bid with UAE President Sheikh Khalifa bin Zayed al-Nahayan.

In the end it came down to price. The consortium led by GE Hitachi dropped its final price by "double-digit billions" according to a WikiLeaks cable. But the Gulf state chose the rookie South Korean nuclear consortium, which proposed a price per kilowatt/hour that was 82 percent lower again according to a U.S. embassy cable obtained by WikiLeaks and seen by Reuters.

The winning consortium was led by state-run utility Korea Electric Power Corp KEPCO and included Hyundai Engineering and Construction and Samsung C&T Corp.

The Emirates Nuclear Energy Corporation ENEC said the value of the contract for the construction, commissioning and fuel loads for the four 1,400-MW APR1400 reactors was about US $20 billion, with a high percentage of the contract offered under a fixed-price arrangement.

In the end "the difference between the South Korean and the French reactors is a very safe reactor and an extremely safe reactor," said James Acton at the Carnegie Endowment for International Peace.

Insiders say that it was not just price or safety considerations that drove ENEC's decision. "Areva's schedule slippage of over three years and cost overrun of over $3 billion on Olkiluoto did not help Areva," an industry source told Reuters.

The French still hope that Abu Dhabi might change its mind and the market has been thick with rumors about a possible review, although industry watchers say these may have been spread by French diplomats in order to test Abu Dhabi's resolve.

A spokesperson at Emirates nuclear corporation ENEC said that the UAE will continue to work with the South Koreans and is not looking to change partners.

The biggest prize remains China, which is buying reactors from American, French and Russian builders while working hard on developing its own.

Beijing favored Westinghouse's plant over Areva's in March 2007 when the Toshiba-owned firm signed a technology transfer agreement worth about $5.3 billion that put the AP1000 at the core of China's plans to develop its own "localized" reactors.

Industry experts say that Areva's failure was caused by its reluctance to give away its patents. In 2007, China ditched plans to build two EPRs in Yangjiang on the southeast coast, choosing to use its own second-generation CPR1000 designs instead after growing frustrated at the pace of negotiations.

So far, the AP1000 is on budget and on schedule in China.

But Areva has fought back and has subsequently won its own deal to build two EPRs at Taishan, also in the southeast, after finally agreeing to transfer key technology to the China Guangdong Nuclear Power Corporation.

Beijing's impatience over third-generation plants has led to the fast-tracking of dozens of second-generation reactors, which led to charges of corner-cutting even before the Japanese quake.

In a paper published in January, scholars at the State Council Research Office said China was moving too fast and that many regions were bucking worldwide industry trends by building less reliable second-generation reactors. It recommended that apart from plants that have already been approved, all new nuclear projects should "in principle" be based on third-generation designs.

Li Ning, a nuclear expert and director of the Energy Research Center at China's Xiamen University, told Reuters that because of the Fukushima crisis China's focus will now shift further to third-generation technology.

That could give Westinghouse and Areva a competitive advantage, although it may not last very long. Just as Areva precursor Framatome adopted U.S. technology in the 1960s, the Chinese are learning quickly from their Western suppliers. Li expects that in the near future China will be capable of building projects abroad.

"When China localizes technology, manufacturing and construction it will be able to export to the rest of the world, sooner rather than later because the world will demand such newer technologies. China will have the advantage in manufacturing and skills and this advantage should not be restricted to the domestic market," Li said.

U.S.-based independent nuclear consultant John Polcyn, who has worked in the nuclear industry worldwide for utilities as well as reactor vendors, expects that the Chinese will align with both Areva and Westinghouse to sell third-generation reactors abroad.

"The Chinese have publicly stated they can build nuclear power plants, including the EPR for 30 percent less than Areva. It could help Areva to be more cost-competitive," Polcyn said.

He believes the two big Chinese firms will also market, build and operate China's indigenous CNP1000 reactor. "The Chinese will claim the CNP1000 as a Generation III nuclear power plant, and I cannot disagree. The plants are designed to today's latest requirements, have state-of-the-art, world-class digital control systems and use the latest materials," he said.

He said that a number of Chinese entities are already marketing the CNP1000, notably in South Africa, Argentina and Saudi Arabia, where Chinese companies have been meeting with top officials.

The Chinese arrival on the reactor market will put pressure on the existing reactor suppliers, forcing them to take more cost and schedule risk for plant completions. Fukushima might buy the incumbents a bit more time, as China tries to incorporate the lessons learned, but not much.

"The Chinese announced their intent to begin exporting their nuclear power plant technology starting in 2013. I expect that due to the recent events in Japan there will be some delay, to 2014 or 2015. They are looking for opportunities," Polcyn said. Even with the crisis in Japan, those opportunities aren't likely to vanish.