Democrats abandon comprehensive energy bill

By Associated Press

CSA Z462 Arc Flash Training - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Obama had hoped to add a climate bill to the two biggest legislative successes of his presidency, a comprehensive health care bill and a broad reform of the U.S. banking and financial sector.

Senate Majority Leader Harry Reid said no Republican was willing to back a comprehensive energy bill, a development he called "terribly disappointing."

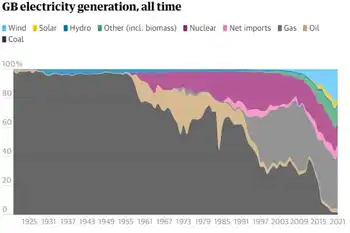

Democrats have been trying for more than a year to pass a plan that charges power plants, manufacturers and other large polluters for their heat-trapping carbon emissions, which contribute to global warming. The House voted 219-212 last year for a "cap and trade" plan featuring economic incentives to reduce carbon emissions from power plants, vehicles and other sources.

Republicans slammed the bill as a "national energy tax" and jobs killer, arguing that the costs would be passed on to consumers in the form of higher electricity bills and fuel costs that would lead manufacturers to take their factories overseas. Moderate House Democrats who voted for the bill, particularly freshmen from Republican-leaning districts, are among the GOP's top takeover targets in the November election.

In recent weeks, Senate Democrats floated a more modest approach that would limit the carbon tax to the electricity sector. That plan, which drew support from the White House and words of encouragement from Republican Sen. Olympia Snowe of Maine, was never formally proposed. But it, too, failed to attract the 60 votes needed to advance it in the 100-member Senate.

Instead, Reid and other Democrats said they would focus on a narrower bill that responds to the oil spill in the Gulf of Mexico and improves energy efficiency.

"We've always known from Day One that to pass comprehensive energy reform you've got to have 60 votes," Sen. John Kerry, D-Mass., said at a Capitol news conference with Reid and White House energy adviser Carol Browner. "As we stand here today we don't have one Republican vote."

Sen. Lindsey Graham, R-S.C., had been negotiating with Kerry and Sen. Joe Lieberman, I-Conn., for months, but Graham withdrew his support in May, saying it was impossible to pass the legislation because of disagreements over offshore drilling and efforts by Democratic leaders to focus on immigration reform.

Browner said Obama continues to support a comprehensive bill that includes a cap on carbon emissions but that the president supports Reid's decision to go forward with a narrower bill.

Reid said the new bill will likely focus on holding oil giant BP PLC responsible for the Gulf spill, as well as ways to improve energy efficiency, boost incentives for natural gas vehicles and increase spending on land and water conservation.

Sen. Bob Casey, D-Pa., said he was frustrated that Senate leaders were giving up on the carbon tax, but acknowledged that a bill focused on the Gulf oil spill "is probably the best we can do now." Casey said he and others would continue to work for a comprehensive approach.

Sen. Ben Nelson, D-Neb., who opposed the planned carbon tax, said he thought he could support the more limited energy package, but wanted to see the details.

Nelson said Reid and Kerry were wise to withdraw the carbon tax, which many environmental groups say is the best way to combat global climate change.

"It takes 60 votes. And if you can't get 60 votes for a package, there's no reason to bring it to the floor," Nelson said.

John Gentzel, a spokesman for Snowe, said the Maine senator remains interested in a utility-only bill. But he said Snowe "believes our primary focus right now should be on creating jobs and passing a long-overdue small business jobs bill."

David Hawkins, director of climate programs at the Natural Resources Defense Council, said Reid had delivered bad news to the American people. He called climate change a "real and present danger" that Congress needs to address after the August recess.

"Don't fail us," Hawkins said, addressing his remarks to lawmakers. "Don't fail our children."