Carbon price floor would boost nuclear

By The Independent

High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

The recent coalition agreement between the Conservatives and the Liberal Democrats included a whole section on the Environment. The new Liberal Democrat Environment Secretary, Chris Huhne, will preside over priorities that include the creation of a smart grid to improve the efficiency of electricity consumption in the UK, the establishment of a green investment bank to help finance infrastructure investments, and the creation of an emissions performance standard to boost use of carbon capture and storage CCS technology.

Many of the policies follow broadly the same trajectory as those of the out-going Labour government. But one clear break with the past is the commitment to set a floor price below which the cost of carbon emission permits cannot fall.

Alongside sighs of relief that Liberal Democrats' opposition to new nuclear power stations will not dominate the new government's policies, the measure on the carbon price floor was explicitly welcomed across the energy industry, particularly by companies aiming to take part in Britain's "nuclear renaissance". EDF warned last year that unless the finances for such massive capital investment can be made to work, its plans for four new nuclear reactors will not go ahead.

With a slew of the UK's existing capacity due to shut down over the next decade, new nuclear power stations are critical to avoiding either a major increase in gas-fired generation or energy shortages, leaving the UK unduly reliant on foreign fuel supplies.

Part of the problem is nuclear's high upfront cost. The European Emissions Trading Scheme EU ETS is designed to address market blindness to environmental issues by forcing carbon-intensive industries to pay a premium for their emissions. But the scheme is yet to fully bed in.

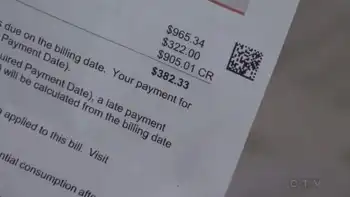

Teething problems in the first phase saw the price of permits crash to zero. And although some of the issues were rectified in the current, second phase, the price is still languishing at around €16. The Committee on Climate Change has indicated a price, at around €50, to make green energy such as nuclear and renewables make commercial sense. And Britain's more aggressive green targets – a 34 per cent reduction in emissions by 2020 – cannot wait.

Would-be nuclear builders, faced with a weak current carbon price and little regulation beyond the end of the EU ETS phase three, in 2020, may have trouble building a viable business case for such a vast, long term investment. A floor under the carbon price could solve the problem. Vincent de Rivaz, the chief executive of EDF Energy, said: "The commitment is an important part of the future investment framework to encourage low carbon generation."

Similar sentiments were echoed across the energy industry. Nick Luff, the finance director of Centrica, said: "We're pleased the new government recognises the importance of new nuclear and is proposing to underpin its development through a higher carbon price that ensures the 'polluter pays' and tilts investment away from fossil fuel generation."

But behind the positive noises, experts acknowledge that "the devil will be in the detail". Richard Gledhill, at PricewaterhouseCoopers, said: "Until we know how the Government is planning to do this and what the floor level will be, we just do not know how significant it is."

The biggest question will be affordability. If the floor price is set sufficiently high to act as a real incentive to develop new nuclear, it could quickly become unaffordable for the Government. But there are also issues about the unintended consequences. The measure runs the risk of undermining the whole EU ETS market, for example. It may also produce windfall profits elsewhere.

Some argue for more fundamental reforms of Britain's electricity market, rather than tinkering with subsidy mechanisms. "Ultimately, we will get what we wish for," Tim Warham, at Deloitte, said. "If we want a mix of different generating technologies, then we either have to say that explicitly or we have to find out what each technology contributes, and what it needs, and set up systems to reward the good characteristics and penalise the bad."

One option would be to pay a premium to generators producing stable, "base load" supplies of electricity. Constant generators, such as nuclear power stations, already benefit by scooping up higher profits when demand peaks push up market prices. But by building the returns into the structure of the market, they can be built into financing plans, Mr Warham says.

"The advantage of an explicit premium is precisely that it is explicit, and therefore more bankable," he said.

Ultimately, the success of Britain's nuclear programme will depend on politics more than economics. Thus far, the development of new nuclear capacity is at an early stage. The target is for the first reactor to come online in 2017. But next-generation reactor technologies are still only at the preliminary "generic design assessment" stage with the Health and Safety Executive. And although the new government committed last week to expediting new-style national planning arrangements, there is a long way to go. Dissent within the coalition government could make a difficult task almost impossible.

"If the government of the day is committed to nuclear it will work through the problems until the plant is built," Mr Warham said. "But if the administration is schizophrenic in its approach then any conflicts cannot be resolved."