More infrastructure needed for electric vehicles

By Canada News Wire

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

To make it into the mainstream globally, however, further technological and infrastructural barriers need to be overcome first.

"Pure electric vehicles are not a new phenomenon in the auto industry," says Mark Walters, leader of the PwC Canada Tax Automotive Practice. "In the early 20th Century they were produced in greater numbers than internal combustion engine powered vehicles. Until recently, the lack of suitable battery technology has prevented manufacturers investing in them. While technological issues move closer to solutions, the lack of infrastructure for electric vehicles usage has stunted growth."

However, despite increasing local demand for zero-emissions cars and trucks and robust exports of electric vehicles, Canada will not allow them on its roads. The regulatory agency has so far certified only five models as road-worthy and two others that are no longer in production. Furthermore most provinces, which have jurisdiction over the vast majority of roads and highways in the country, have not given electric cars the green light, citing Transport Canada's safety concerns.

To date, only British Columbia allows low speed electric vehicles on its urban roads. Quebec recently announced a three-year pilot project that allows for one car and an electric truck on its roads with posted speed limits of 50 kilometres (31 miles) per hour. Manufacturers are hoping Quebec's pilot may spur other provinces to jump on the bandwagon and eventually make it possible to drive an electric car from coast to coast across all 10 of Canada's provinces.

"There is no doubt that the current discussions around climate change are indicative of an ever increasing receptive business environment for electric vehicles," says Walters. "Advancing battery development in this area will however compete with the industry's already over-burdened R&D needs while current high battery costs dictate the level of consumer demand."

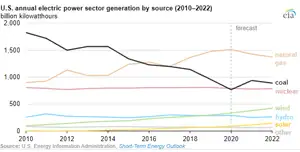

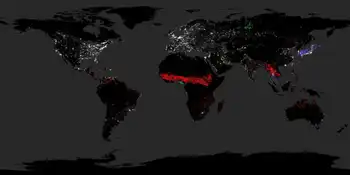

Battery costs vary significantly depending on the technology so tempering these costs will be crucial. The sustainability of electric vehicles is heavily dependent on the energy mix of a country's electricity. Using non-renewable resources to generate electricity is unlikely to achieve net reductions in CO2 emissions.

While electricity is cheaper than existing automotive fuels, and running an electric car costs less, acquisition costs are the main hurdle.

Incentivising, subsidising and promoting electric vehicles are all contributing factors to their success while letting the auto manufacturers concentrate on expanding their mobility.

For consumers, in Canada, as part of the Government of Canada's plan to protect the environment, the ecoAUTO Rebate Program encourages Canadians to buy new fuel-efficient vehicles. Applicants can apply for the rebate on eligible 2006, 2007 and 2008 model-year vehicles purchased or leased (12 months or more) between March 20, 2007 and December 31, 2008. While further incentives such as those recently announced by the U.S. government, in the form of a maximum [US]$7,500 tax credit depending on the kWh capacity of the vehicle's battery, would help.

While there are a few home-grown success stories in Canada, for instance Toronto, Ontario's Zenn Motor which has been selling its electric low speed vehicles since late 2006, many international automotive companies are getting involved in Canada, including Changan Automobile Group, Ford Motor's China partner who is set to roll out 30 electric cars developed jointly with Electrovaya in Canada before the end of this year, potentially becoming the first Chinese auto maker to tap the North American market.

Other Chinese players, such as BYD auto, an auto-making unit of Hong Kong-listed rechargeable battery maker BYD Co, are also eager to tap the clean energy vehicle market at home and overseas.