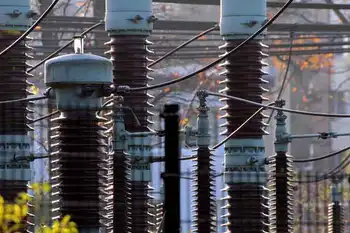

Power Grid Attacks surge across substations and transmission lines, straining critical infrastructure as DHS and FBI cite vandalism, domestic extremists, and cybersecurity risks impacting resilience, outages, and grid reliability nationwide.

Key Points

Power Grid Attacks are deliberate strikes on substations and lines to disrupt power and weaken grid reliability.

✅ Physical attacks rose across multiple states and utilities.

✅ DHS and FBI warn of threats to critical infrastructure.

✅ Substation security and grid resilience upgrades urged.

Even before Christmas Day attacks on power substations in five states in the Pacific Northwest and Southeast, similar incidents of attacks, vandalism and suspicious activity were on the rise.

Federal energy reports through August – the most recent available – show an increase in physical attacks at electrical facilities across the nation this year, continuing a trend seen since 2017.

At least 108 human-related events were reported during the first eight months of 2022, compared with 99 in all of 2021 and 97 in 2020. More than a dozen cases of vandalism have been reported since September.

The attacks have prompted a flurry of calls to better protect the nation's power grid, with a renewed focus on protecting the U.S. power grid across sectors, but experts have warned for more than three decades that stepped-up protection was needed.

Attacks on power stations on the rise

Twice this year, the Department of Homeland Security warned "a heightened threat environment" remains for the nation, including its critical infrastructure amid reports of suspected Russian breaches of power plant systems.

At least 20 actual physical attacks were reported, compared with six in all of 2021.

Suspicious-activity reports jumped three years ago, nearly doubling in 2020 to 32 events. In the first eight months of this year, 34 suspicious incidents were reported.

Total human-related incidents – including vandalism, suspicious activity and cyber events such as Russian hackers and U.S. utilities in recent years – are on track to be the highest since the reports started showing such activity in 2011.

Attacks reported in at least 5 states

Since September, attacks or potential attacks have been reported on at least 18 additional substations and one power plant in Florida, Oregon, Washington and the Carolinas. Several involved firearms.

- In Florida: Six "intrusion events" occurred at Duke Energy substations in September, resulting in at least one brief power outage, according to the News Nation television network, which cited a report the utility sent to the Energy Department. Duke Energy spokesperson Ana Gibbs confirmed a related arrest, but the company declined to comment further.

- In Oregon and Washington state: Substations were attacked at least six times in November and December, with firearms used in some cases, local news outlets reported. On Christmas Day, four additional substations were vandalized in Washington State, cutting power to more than 14,000 customers.

- In North Carolina: A substation in Maysville was vandalized on Nov. 11. On Dec. 3, shootings that authorities called a "targeted attack" damaged two power substations in Moore County, leaving tens of thousands without power amid freezing temperatures.

- In South Carolina: Days later, gunfire was reported near a hydropower plant, but police said the shooting was a "random act."

It's not yet clear whether any of the attacks were coordinated. After the North Carolina attacks, a coordinating council between the electric power industry and the federal government ordered a security evaluation.

FBI mum on its investigations

The FBI is looking into some of the attacks, including cyber intrusions where hackers accessed control rooms in past cases, but it hasn't said how many it's investigating or where.

Shelley Lynch, a spokesperson for the FBI's Charlotte field office, confirmed the bureau was investigating the North Carolina attack. The Kershaw County Sheriff's Office reported the FBI was looking into the South Carolina incident.

Utilities in Oregon and Washington told news outlets they were cooperating with the FBI, but spokespeople for the agency's Seattle and Portland field offices said they couldn't confirm or deny an investigation.

Could domestic extremists be involved?

In January, the Department of Homeland Security said domestic extremists had been developing "credible, specific plans" since at least 2020, including a Neo-Nazi plot against power stations detailed in a federal complaint, and would continue to "encourage physical attacks against electrical infrastructure."

In February, three men who ascribed to white supremacy and Neo-Nazism pleaded guilty to federal crimes related to a scheme to attack the grid with rifles.

In a news release, Timothy Langan, assistant director of the FBI’s Counterterrorism Division, said the defendants "wanted to attack regional power substations and expected the damage would lead to economic distress and civil unrest."

Why is the power grid so hard to protect?

Industry experts, federal officials and others have warned in one report after another since at least 1990 that the power grid was at risk, and a recent grid vulnerability report card highlights dangerous weak points, said Granger Morgan, an engineering professor at Carnegie Mellon University who chaired three National Academies of Sciences reports.

The reports urged state and federal agencies to collaborate to make the system more resilient to attacks and natural disasters such as hurricanes and storms.

"The system is inherently vulnerable, with the U.S. grid experiencing more blackouts than other developed nations in one study. It's spread all across the countryside," which makes the lines and substations easy targets, Morgan said. The grid includes more than 7,300 power plants, 160,000 miles of high-voltage power lines and 55,000 transmission substations.

One challenge is that there's no single entity whose responsibilities span the entire system, Morgan said. And the risks are only increasing as the grid expands to include renewable energy sources such as solar and wind, he said.

Related News