Sunrun-Tesla Virtual Power Plant Texas leverages residential solar, Tesla Powerwall battery storage, and ERCOT demand response to enhance grid resilience, cut emissions, and supply backup power via a coordinated distributed energy resources network.

Key Points

A Texas VPP using residential solar and Tesla Powerwall to aid ERCOT with grid services resilience, and less emissions.

✅ Aggregates Powerwall storage for ERCOT demand response.

✅ Enhances grid reliability with distributed energy resources.

✅ Cuts emissions by shifting solar to peak and outage periods.

In a significant development for renewable energy and grid resilience, Sunrun and Tesla have announced a groundbreaking partnership to establish a distributed power plant in Texas. This collaboration represents a major step forward in harnessing solar energy and battery storage, with advances in affordable solar batteries helping to create a more reliable and sustainable power system. The initiative aims to address the growing demand for clean energy solutions while enhancing grid stability and resilience in one of the largest and most energy-dependent states in the U.S.

The new distributed power plant, a joint venture between Sunrun, a leading residential solar provider, and Tesla, renowned for its advanced battery technology and electric vehicles, will leverage the strengths of both companies to transform how energy is generated and used. The project will deploy Tesla's Powerwall battery systems alongside Sunrun's solar panels to create a network of interconnected residential energy storage units. This network will function as a virtual power plant, aligned with emerging peer-to-peer energy sharing models that are capable of providing electricity back to the grid during periods of high demand or outages.

Texas, with its vast and growing population, has faced significant energy challenges in recent years. The state’s power grid, managed by the Electric Reliability Council of Texas (ERCOT), has experienced strain during extreme weather events and high demand periods, and instances of Texas wind curtailment during grid stress, leading to concerns about reliability and stability. The partnership between Sunrun and Tesla seeks to address these concerns by introducing a more flexible and resilient energy solution.

The distributed power plant will consist of thousands of residential solar installations, each equipped with Tesla Powerwall batteries, reflecting the broader trend of pairing storage with solar across the U.S. as it scales. These batteries store excess solar energy generated during the day and release it when needed, such as during peak demand times or power outages. By connecting these systems through advanced software, the project will create a coordinated network of distributed energy resources that can respond dynamically to fluctuations in energy supply and demand.

One of the key benefits of this distributed approach is its ability to enhance grid reliability. Traditional power plants are centralized and can be vulnerable to disruptions, whether from extreme weather, technical failures, or other issues. In contrast, a distributed power plant spreads the generation and storage capacity across numerous locations, a principle echoed by renewable power developers pursuing multi-resource projects today, reducing the risk of widespread outages and increasing the overall resilience of the power grid.

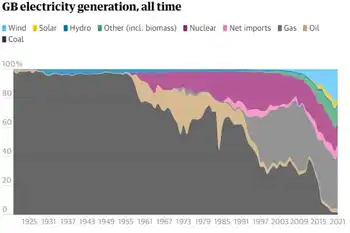

Additionally, the project will contribute to the reduction of greenhouse gas emissions. By increasing the use of solar energy and reducing reliance on fossil fuels, and amid ongoing work to improve solar and wind technologies, the distributed power plant supports Texas’s climate goals and contributes to broader efforts to combat climate change. The integration of renewable energy sources into the grid helps to decrease carbon emissions and promote a cleaner, more sustainable energy system.

The partnership between Sunrun and Tesla also underscores the growing role of technology in transforming the energy landscape. Tesla's Powerwall battery systems represent some of the most advanced energy storage technology available, and amid record solar and storage growth nationwide this decade they showcase the capability to store and manage energy efficiently. Sunrun’s expertise in residential solar installations complements this technology, creating a powerful combination that leverages the latest advancements in clean energy.

The project is expected to deliver several benefits to both individual homeowners and the broader community. Homeowners who participate in the program will have access to solar energy and battery storage at reduced costs, thanks to the economies of scale and innovative financing options provided by Sunrun and Tesla. Additionally, they will have the added security of backup power during outages, contributing to greater energy independence and resilience.

For the broader community, the distributed power plant offers a more reliable and sustainable energy system. The ability to generate and store energy at the residential level reduces the strain on traditional power plants and enhances the overall stability of the grid. Furthermore, the project will contribute to local job creation, as the installation and maintenance of solar panels and battery systems require skilled workers.

As the project moves forward, Sunrun and Tesla will work closely with local stakeholders, regulators, and utility providers to ensure the successful implementation and integration of the distributed power plant. Collaboration with these parties will be essential to addressing any regulatory, technical, or logistical challenges and ensuring that the project delivers its intended benefits.

In conclusion, the partnership between Sunrun and Tesla to create a distributed power plant in Texas represents a significant advancement in clean energy technology and grid resilience. By combining solar power with advanced battery storage, the project aims to enhance grid stability, reduce emissions, and provide reliable energy solutions for homeowners. As Texas continues to face energy challenges, this innovative initiative offers a promising model for the future of distributed energy and highlights the potential for technology-driven solutions to address pressing environmental and infrastructure issues.

Related News