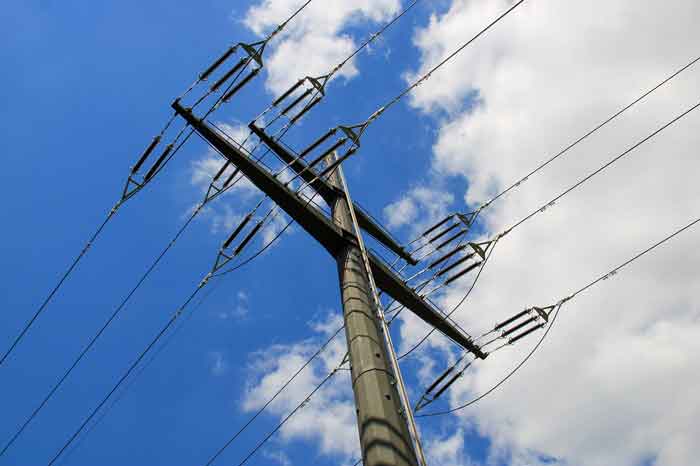

GMP upgrading 80-year-old power station

By Associated Press

NFPA 70b Training - Electrical Maintenance

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

The utility isn't changing the 1920s-technology turbine generator at the base of Danville Hill in Marshfield. It's replacing a 7,000-foot long wooden pipe that transports the reservoir's water to it with a new steel pipe in a project that could last five years. The pipe is called a penstock.

Even though the plant, known as Marshfield 6, can produce five megawatts of power and replacing the penstock is expected to cost about $7 million, keeping the plant running is still a bargain.

"It runs us around $1,000 a foot installed," said GMP Field Operations Manager Charlie Pughe, who is overseeing the project. "It's got an 80-year expected life on it and if you're pumping out five megawatts an hour down at the plant at today's market prices, it's very economical, plus it's clean. It's 100 percent non-emitting generation so it's part of our portfolio that's absolutely worth keeping online."

When the plant was installed in the mid-1920s, it was cutting edge technology. The five megawatts capacity was enough to power more than 2,000 homes. Based on the plant's average yearly output (it doesn't run all the time) the plant makes enough power for about 830 homes.

The Marshfield plant has been upgraded with technology that allows it to be controlled from GMP's central command center in Colchester, but the generating technology is the same used when Calvin Coolidge was president.

Simply, the wooden pipe, which has always leaked, has reached the end of its usable life.

"I don't think anybody is too upset about the wood pipe going. Everyone is kind of lamenting the fact that we won't have those beautiful ice sculptures along Route 2 in the wintertime anymore," Pughe said. "Some people think that's a good thing. Some people think that's a shame to lose that kind of neat looking stuff."

The wooden penstock isn't original. The entire pipe was replaced in the late 1950s with new boards.

GMP, Vermont's second-largest electric utility, has eight hydro operations that — combined — produce 37 megawatts of electricity. The smallest is West Danville, which uses a wooden penstock shorter than the one being replaced in Marshfield, produces 1 megawatt of power.

As the demand for electricity continues to grow, utilities are looking for new sources of power. But they're not forgetting hundreds of small plants.

"There's a need out there for this older equipment to be kept running and we're trying to fulfill that need," said Larry King, a field service engineer for GE Energy, Optimization and Control, of Loveland, Colo., who visits Vermont once a year or so to work on the speed control mechanisms of Marshfield 6 and some of GMP's other hydro stations.

They sometimes manufacture new parts to 1920s specifications.

"They're special," said King, who works on several dozen similar plants across North America. "You get out there working on it, it just amazes me, how in the world did they come up with this. You get them laid out in front of you and wow, they all have to work together."

GMP built a number of plants in the early years of the last century, but the Marshfield and West Danville plants are the only ones that were made with wooden pipe. The rest use steel or concrete penstocks, even the ones built around the same time as Marshfield 6, Pughe said.

He didn't know why the choice was made to use wood in Marshfield and Danville. "They had plenty of carpenters around. It was a barrel-making process," Pughe said. The wooden boards are held together by iron rings placed every six inches.

The project to replace the wooden pipe began last year. Construction workers take out a section in the fall when the water is low and then hook it back up with the steel section in place all so GMP can make power again through next fall.

Last year, they replaced 900 feet. This year they're expecting to replace about 1,400. At that rate they expect the entire project to take four or five years, Pughe said.

GMP is waiting for the Vermont Agency of Transportation to renovate a stretch of Route 2 so it can install a replacement section beneath Route 2.

"It's held up pretty well," Pughe said. "The leaks, you know, it's just water coming through it, so it's not really a big deal."