Hydro One launches Ultra-Low Overnight Electricity Price Plan

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Ultra-Low Overnight Price Plan delivers flexible electricity pricing from Hydro One and the Ontario Energy Board, with TOU, tiered options, off-peak EV charging savings, balanced billing, and an online calculator to optimize bills.

Key Points

An Ontario pricing option with ultra-low night rates, helping Hydro One customers save by shifting usage to off-peak.

✅ Four periods with ultra-low overnight rate for EV charging

✅ Compare TOU vs tiered with Hydro One's online calculator

✅ Balanced billing and due date choice support budget control

Hydro One has announced that customers have even more choice and flexibility when it comes to how they are billed for electricity with the company's launch of the Ontario Energy Board's new Ultra-Low Overnight Electricity Price Plan for customers. A new survey of Ontario customers, conducted by Innovative Research Group, shows that 74 per cent of Ontarians find having choice between electricity pricing plans useful.

"As their trusted energy advisor, we want our customers to know we have the insights and tools to help them make the right choice when it comes to their electricity plans," said Teri French, Executive Vice President, Safety, Operations and Customer Experience. "We know that choice and flexibility are important to our customers, and we are proud to now offer them a third option so they can select the plan that best fits their lifestyle."

The same survey revealed that fewer than half of Ontarians are familiar with either tiered or the new ultra-low overnight price plans. To better support its customers Hydro One is providing an online calculator to help them choose which pricing plan best suits their lifestyle. The company also offers additional flexibility and assistance in managing household budgets by providing customers with the ability to choose their billing due date and flatten usage spikes from temperature fluctuations through balanced billing.

During the pandemic, Ontario introduced electricity relief to support families, small businesses and farms, complementing these customer options.

"By offering families and small businesses more choice, we are putting them back in control of their energy bills," said Todd Smith, Minister of Energy. "Starting today Hydro One customers have a new option - the Ultra-Low Electricity Price Plan - which could help them save money each year, while making our province's grid more efficient."

Electricity price plan options

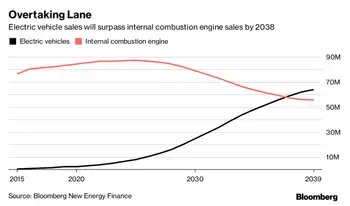

- New Ultra-Low Overnight price plan (ULO): Designed for customers who use more electricity at night, such as those who charge their electric vehicle, this new price plan can help customers keep costs down and take control of their electricity bill by shifting usage to the ultra-low overnight price period and related off-peak electricity rates when province-wide electricity demand is lower.

- This plan has four price periods that are the same in the summer as they are in the winter and includes an ultra-low overnight rate.

- Time-of-Use price plan (TOU): TOU provides customers with more control over their electricity bill by adjusting their usage habits with time-of-use rates used in other jurisdictions as well.

- In this plan, electricity prices change throughout each weekday, when demand is on-peak, and peak hydro rates can affect overall costs.

- Tiered price plan (RPP): Tiered pricing provides customers with the flexibility to use electricity at any time of day at the same low price up until the threshold is exceeded during the month, after that usage is charged at a higher price.

- For residential customers, the winter period (November 1 – April 30) threshold is 1,000 kWh per month and the summer period (May 1 – October 31) threshold is 600 kWh per month.

- For small business customers, the threshold is 750 kWh throughout the year, while broader stable electricity pricing supports industrial and commercial companies.