Newfoundland premier upset by NB Power deal

By Montreal Gazette

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

After all, it's not every day a premier buys a power company, as Charest had done earlier in the day in Fredericton, where he and New Brunswick Premier Shawn Graham signed a $10-billion deal for Hydro-Québec to acquire NB Power.

This is big-picture stuff, and a huge win for both provinces. Hydro-Québec pays $4.7 billion cash up front, and New Brunswick gets to wipe NB Power's debts off its books. It also gets a five-year guaranteed rate freeze for consumers, saving New Brunswickers another $5 billion. And New Brunswick businesses, notably the Irvings and the McCains, will get the Hydro-Québec industrial rate, giving them a 20-per-cent reduction in electricity bills at their refineries and frozen food plants.

In exchange, Hydro-Québec, already the largest utility in North America, gets a 10-per-cent increase in its capacity, adding another 3,850 megawatts to its system. This will add another $1.5 billion in revenues to Hydro-Québec's top line of $12.7 billion. It is also the beginning of an Eastern Canada energy grid, and an east-west power corridor, with another north-south interconnection for Hydro-Québec to the northeastern United States.

"My father," Charest said, "used to say a good deal is one in which the other guy makes a buck, too."

This deal has been in the works since last January's first-ministers' meeting at 24 Sussex Drive. From economics to economies of scale to leveraging additional export capacity to the U.S., it makes perfect sense. Politically, it requires the will to get it done, and most of that burden rests on the young shoulders of Premier Graham. A smaller province is selling its utility to a larger one next door, and even though NB Power will keep its brand and operations, it will become a division of Hydro-Québec.

Graham is acquiring energy security on the cheap, and taking nearly $5 billion in debt off his books. But he is giving up energy sovereignty, and that's a loaded political issue.

Since Prince Edward Island gets about 80 per cent of its electricity from New Brunswick (it takes only about 100 MW to run the whole island), they're going to be part of this Quebec-Maritime grid as well.

That leaves Nova Scotia on the outside looking in. And it leaves Newfoundland and Labrador out in the cold. Predictably, Newfoundland Premier Danny Williams went ballistic, saying the deal was "a power grab and it's despicable." Calling it a "complete capitulation by New Brunswick," he wants the federal Competition Bureau to stop the creation of this new power monopoly. Well, it already was a monopoly in New Brunswick, now it's just going to be part of a bigger one.

What's his problem? He's always unhinged about something. From the time of Joey Smallwood, Newfoundland premiers have specialized in rhetorical excess, especially when it comes to railing about the mainland. But Williams is in a class by himself, so over the top that it's impossible to take him seriously, even when he's making a certain amount of sense.

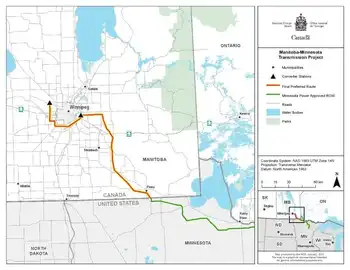

His issue with Charest is that Quebec will now control the interconnection to the U.S. that Williams was planning on using as his export route for electricity from the Lower Churchill River, which has 3,200 MW of undeveloped capacity. Williams wants to move electricity from Labrador across Newfoundland, underwater to Cape Breton, across Nova Scotia to New Brunswick, and across the Maine border into the U.S. Of course, it's a crazy idea, but Williams is a crazy kind of guy.

Who knows how much electricity would be shed along this extremely circuitous route? Williams is proposing it to avoid going through Quebec. And now Charest has blocked him off - except that the U.S. regulator requires open access, and Hydro-Québec has no intention of denying it.

Of course, it would be more sensible for Newfoundland to develop the Lower Churchill and move the power through Quebec via the Upper Churchill, where more than 5,000 MW already flow to Quebec.

But this is where Newfoundland's historical sense of grievance comes in. Smallwood signed a bad deal with Quebec to get Churchill Falls built in the 1960s, and every Newfoundland premier since has railed against the unfairness of it. Quebec has always said "a contract is a contract." The elegant thing would be to front-end load a deal on the Lower Churchill in Newfoundland's favour, to make up for some of the discrepancy and hard feelings. But Newfoundland leaders talking to Quebec about hydro are like the Palestinians talking to the Israelis about the West Bank - they'll never be able to sign, because they're afraid of losing again.

Thus, Williams on the Lower Churchill: "It will be developed and it'll be developed on our terms. As I've said before, over my dead body am I going to hand this over to Jean Charest in Quebec."