PJM electric gridÂ’s watchdog says he was muzzled

By Baltimore Sun

High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Executives at PJM Interconnection, which runs wholesale electricity markets in Maryland and a dozen other states, blocked Joseph E. Bowring from issuing critical reports, pressured him to accept changes advantageous to power companies and worked to reduce his influence and resources, according to a sworn statement Bowring gave federal authorities on June 12.

On one occasion, after determining that a generation company earned $20 million in "excess payments" over two weeks because it faced little competition at the time, Bowring wanted to formally complain to federal regulators, only to be thwarted by his PJM bosses, the statement said. The company was not identified.

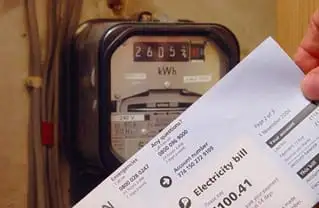

The documents raise new concerns about the fairness of the marketplace when soaring wholesale prices have forced enormous bill increases for electricity customers of Baltimore Gas and Electric Co. and other utilities that no longer are allowed to generate power themselves. They also help belie the myth, peddled by the increasingly profitable industry, that high kilowatt prices are caused solely by high costs for coal, natural gas and other generation fuels.

"When Joe comes out and says he wanted to do something about a particular event where he has the best knowledge, and he's being told he's not supposed to do that, that causes us to question the legitimacy of the markets," says David Kleppinger, a Pennsylvania lawyer who represents industrial electricity customers. "It's disturbing that there were apparently some constraints being placed on his activities."

PJM, a nonprofit group based in Norristown, Pa., declined to comment in detail on Bowring's allegations, saying it is conducting its own investigation. But in filings with the Federal Energy Regulatory Commission, it denied muzzling Bowring or depriving his department of the staff and expertise it needed.

Bowring did not return a phone call.

FERC asked Bowring to submit an affidavit and documents to support his assertion, made at a public hearing two months ago, that PJM had interfered with his independence. The documents reveal a contentious and testy relationship going back years.

"Most people felt that Bowring was doing a good job," said Gary Newell, a Washington attorney representing cities and towns who buy through PJM. "He was a honest guy, and he was willing to butt heads with management. Little did we know how much he was butting heads with management."

PJM is charged by the federal government with ensuring grid reliability and operating a "just" and "reasonable" wholesale electricity market within its territory.

As chief of PJM's market monitoring unit, Bowring is supposed to be alert for "market power" - generation companies raising prices in the absence of meaningful competition - and take steps to quash it. Consumer groups suspect such monopoly power may be widespread because electricity demand has soared in recent years while very few generation plants have been built.

In many cases, Bowring can propose wholesale price caps when he finds market power. (In some instances, FERC has exempted generators from caps, leaving him powerless even if he had full support from his bosses.) Until PJM removed him from the post three months ago, Bowring also headed a committee that formulated price caps.

But time after time in recent years, and as recently as three months ago, PJM has gagged him or ordered him to alter his findings. In the documents he submitted, PJM managers appear to have consistently favored the interests of the generation companies over those of consumers.

A year ago Bowring found that a slice of the wholesale trade called the regulation market, which pays generators for maintaining line voltage, included "dominant suppliers" that "are frequently pivotal" and "therefore have the ability to exercise market power." As a remedy he wanted to cap dominant suppliers' prices, but his PJM bosses ordered him to remove the language, his affidavit says.

In its filing, PJM blames this and other interventions on Bowring's supposed "delays in circulating recommendations or supporting analyses" for internal review, saying it didn't agree with his research or he didn't support his points.

What? He's the expert. He's the market monitor. Why does anybody need to review him?

Early this year PJM Executive Vice President Audrey Zibelman objected to what she said were "inflammatory" slides prepared by Bowring for a committee of PJM consumers, generators and other participants, according to an e-mail Bowring sent a colleague. The slides purported to show that the wholesale market in a section including Western Maryland was often uncompetitive last summer even though it is exempt from price caps. Zibelman forbade Bowring from showing them, the e-mail said.

In another instance, Bowring wanted to formally ask FERC to address anti-competitive behavior by an unidentified generator that had collected $20 million in excess payments. "PJM refused," he said in his filing.

At other times PJM delayed or changed Bowring's findings on wholesale competition and prevented him from analyzing an electricity auction for New Jersey's Board of Public Utilities, according to his statement.

He also alleged that PJM deprived his unit of resources and plans to replace it by outsourcing its duties to a consulting firm. Three months ago PJM Vice President of Markets Andrew Ott "proceeded to threaten" one of Bowring's employees "in forceful terms," saying that the unit would be disbanded, Bowring said in an e-mail.

Bowring doesn't seem to be indicting the entire deregulated electricity market. The instances in which he says he was stymied relate only to segments of the business, some of them small. But there may be more of the iceberg.

"How much market power is being exerted that we are not finding or seeing?" wonders Kleppinger, the Pennsylvania lawyer.

At the least, this is additional, troubling evidence that wholesale electricity regulation is deeply flawed. To the Enron outrages in California and the Texas Public Utility Commission's recent decision to fine TXU $210 million for alleged market manipulation, add the Bowring episode.

Why is the "independent" market monitor employed by the grid operator in the first place? PJM's board has no financial ties to generation companies or anybody else in the business, but it seems to have inhaled deeply when the deregulation bong got passed around.

"The relationship between the market monitoring unit and PJM is in substantial need of structural reform," says Robert A. Weishaar, another attorney representing industrial customers.