TECO may be target for merger

By St. Petersburg Times

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

The 112-year-old Tampa-based independent utility is already a small fish among Florida power providers. If the proposed merger of Duke Energy and Progress Energy is approved, TECO, with about 1 million customers, will find itself operating next to the nation's largest utility with a customer base seven times larger.

"TECO has been talked about as a target for a very long time," said Roger Conrad, editor of the Utility Forecaster and a leading utility analyst. "They're always on a short list of companies that might be attractive to someone."

"Utilities that have neighboring service territories — all things being equal — tend to be candidates for takeover," said Paul Franzen, a senior utilities analyst for St. Louis-based Edward Jones.

A smaller neighbor becomes increasingly appealing to a utility that sees an opportunity to consolidate operations and bolster revenues — the same thinking behind the Duke-Progress merger.

The TECO electric and natural gas service area abuts that of both Progress Energy, which operates throughout Central and North Florida, and FPL Group Inc., which operates from Manatee County southward and along Florida's eastern seaboard.

As a matter of policy, Progress Energy and FPL do not comment on speculative deals.

A merger might benefit consumers. "Generically, utility mergers offer the potential for relatively lower rates for customers," Franzen said. "In an environment of rising rates for customers, rates may still go up but they go up less than if the two companies had not merged."

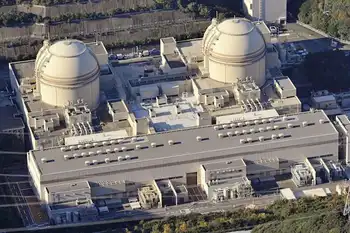

Whether existing TECO customers would benefit from a takeover is unclear. They already pay lower rates $107.02 per 1,000 kilowatt hours than consumers across Tampa Bay $119.34. In part, that's because Progress customers are already paying for a nuclear power plant still in the planning and permitting stage.

Executives at Duke and Progress said their combined assets will make it easier to raise money for new plants and services, a benefit smaller utilities do not have.

TECO, which owns Tampa Electric and TECO Peoples Gas, emerged in recent years from $1 billion in debt that weighed down its value.

In the late 1990s and early 2000s, the utility's stock price was just over $12 a share, and observers often referred to it as "troubled TECO Energy."

But in the past six years, the company has paid off the debt, and, in the words of chief executive officer John Ramil, "regained the confidence of Wall Street."

Ramil took over as head of TECO last August, replacing former CEO Sherrill Hudson, who retired. He heads a company with 4,000 employees and a customer base that includes 667,000 electric customers in the Tampa Bay area and 334,000 natural gas customers in about three dozen Florida counties. The utility has $3.5 billion in revenue and $3.5 billion in market capitalization.

TECO also owns coal mines, which makes it more diverse than some other utility companies.

Its stock now goes for more than $18 a share, which Ramil said makes his company less likely to be a takeover target.

Ramil said he is seeing an uptick in the customer base as the economy slowly improves. Utility customers that the company lost because of vacant rental properties seem to be picking up, setting the stage to continue strong growth.

"There are good, positive signs," Ramil said.

"Why would anyone want to buy us now,'' he said, "when they could have paid less a few years ago?"

Despite TECO's higher stock price, Franzen, the utilities analyst, said — and Ramil acknowledges — larger companies will not be deterred from going after the company, if they see it as beneficial to their portfolios.

Franzen added that other utility companies are increasingly in a better position to purchase smaller companies as their own value grows.

"While company 'B' is up, company 'A' is up, too," Franzen said.

Another reason TECO's increased value might not deter a takeover: Many deals, including the Duke-Progress merger, involve an exchange of stock rather than cash.

Utility analyst Conrad said TECO and other smaller utilities should expect to be approached by bigger utilities.

"I think, eventually, most of these companies will get offers," he said. "My view is more of these utilities will face merger or takeover situations for a long time to come."