Iraq Nuclear Power Plan targets eight reactors and 11 GW to ease blackouts, curb emissions, and support desalination, with financing via partners like Rosatom and Kepco amid OPEC-linked demand growth and chronic grid shortages.

Key Points

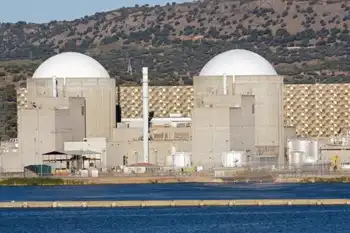

A $40B push to build eight reactors adding 11 GW, easing blackouts, cutting emissions, and supporting desalination.

✅ $40B, 20-year payback via partner financing

✅ Talks with Rosatom, Kepco; U.S. and France consulted

✅ Parallel solar buildout to meet 2030 demand

Iraq is working on a plan to build nuclear reactors as the electricity-starved petrostate seeks to end the widespread blackouts that have sparked social unrest.

OPEC’s No. 2 oil producer – already suffering from power shortages and insufficient investment in aging plants – needs to meet an expected 50% jump in demand by the end of the decade. Building atomic plants could help to close the supply gap, though the country will face significant financial and geopolitical challenges in bringing its plan to fruition.

Iraq seeks to build eight reactors capable of producing about 11 gigawatts, said Kamal Hussain Latif, chairman of the Iraqi Radioactive Sources Regulatory Authority. It would seek funding from prospective partners for the $40 billion plan and pay back the costs over 20 years, he said, adding that the authority had discussed cooperation with Russian and South Korean officials, as Iran-Iraq energy cooperation progresses across the sector.

Plunging crude prices last year deprived Iraq of funds to maintain and expand its long-neglected electricity system, though grid rehabilitation deals have been finalized to support upgrades. The resulting outages triggered protests that threatened to topple the government.

“We have several forecasts that show that without nuclear power by 2030, we will be in big trouble,” Latif said in an interview at his office in Baghdad. Not only is there the power shortage and surge in demand to deal with, but Iraq is also trying to cut emissions and produce more water via desalination — “issues that raise the alarm for me.”

Raising financing will be a major task given that Iraq has suffered budgetary crises amid volatile oil prices. Even with crude at about $70 a barrel now, the country is only just balancing its budget, according to data from the International Monetary Fund.

The government will also have to tackle geopolitical concerns around the safety of atomic energy, which have stymied nuclear ambitions elsewhere in the region, even as Europe's nuclear decline underscores broader energy challenges.

Nuclear power, which doesn’t produce carbon dioxide, would help Gulf states’ efforts to cut emissions as governments worldwide, including India's nuclear push to expand capacity, look to become greener. The technology would also allow them to earmark more of their valuable hydrocarbons for export. Saudi Arabia, which is building a test reactor, burns as much as 1 million barrels of crude a day in power plants during its summer months when temperatures soar beyond 50 degrees Celsius (122 Fahrenheit).

The Iraqi cabinet is reviewing an agreement with Russia’s Rosatom Corp. to cooperate in building reactors, Latif said. South Korean officials this year said they wanted to help build the plants and offered the Iraqis a tour of UAE nuclear reactors run by Korea Electric Power Corp. Latif said the nuclear authority has also spoken with French and U.S. officials about the plan.

Kepco, Rosatom

Kepco, as the Korean energy producer is known, is not aware of Iraq’s nuclear plans and hasn’t been in touch with Iraqi officials or been asked to work on any projects there, a company spokesman said Tuesday. Rosatom didn’t immediately comment when asked about an agreement with Iraq.

Even if Iraq builds the planned number of power stations, that still won’t be sufficient to cover future consumption. The country already faces a 10-gigawatt gap between capacity and demand and expects to need an additional 14 gigawatts this decade, Latif said.

With this in mind, Iraq plans to build enough solar plants to generate a similar amount of power to the nuclear program by the end of the decade.

Iraq currently boasts 18.4 gigawatts of electricity, including 1.2 gigawatts imported from Iran into the grid. Capacity additions mean generation will rise to as much as 22 gigawatts by August, but that’s well short of notional demand that stands at almost 28 gigawatts under normal conditions. Peak usage during the hot summer months of July and August exceeds 30 gigawatts, according to the Electricity Ministry. Demand will hit 42 gigawatts by 2030, Latif said.

The nuclear authority has picked 20 potential sites for the reactors and Latif suggested that the first contracts could be signed in the next year.

It won’t be Iraq’s first attempt to go nuclear. Four decades ago, an Israeli air strike destroyed a reactor under construction south of Baghdad. The Israelis alleged the facility, called Osirak, was aimed at producing nuclear weapons for use against them. Iraq suffered more than a decade of violence and upheaval after the 2003 U.S. invasion, which was also motivated by allegations that Iraq wanted to develop weapons.

Related News