ChinaÂ’s green energy gap

By International Herald Tribune

NFPA 70e Training - Arc Flash

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

The plant would be ready sooner, but only four companies in China make the specialized precision boilers that the biomass plant requires. And all those companies are plagued by backed-up orders and delivery delays. Similar problems bedevil the wind turbine industry in China.

The same big utility company building the green plant in Boxing, CLP, has just opened a coal-fired plant in southernmost China. On schedule and built for half what it would cost in the West, that plant will generate 1,200 megawatts of electricity — compared with 6 megawatts from the Boxing biomass plant. CLP is so impressed that it is bidding to build coal-fired plants in India with Chinese technology.

These are the realities faced by companies seeking to make themselves more environmentally friendly in China, where coal is king. Coal-fired plants are quick and cheap to build and easy to run. While the Chinese government has set goals for increasing the use of a long list of alternative energies — including wind, biomass, hydroelectric, solar and nuclear — they all face obstacles, from bureaucracy to bottlenecks in manufacturing. CLP's differing energy choices are a case study in how one company grapples with the need to provide electricity to hundreds of millions of impoverished Asians even as it is under a self-imposed goal of trying to limit emissions of global warming gases.

Controlled by the Kadoorie family — one of Hong Kong's wealthiest, with a long history of supporting environmental causes — CLP's board began considering a plan to limit greenhouse gas emissions.

While the details are still being worked out, the company plans to commit itself to "material and dramatic reductions" in such emissions in industrialized countries like Australia, while seeking to control growth in emissions in developing countries, like China, said Andrew Brandler, CLP's chief executive.

"We think the world has to address the issue of climate change as a matter of urgency," Brandler said.

Yet CLP's operations are growing so quickly in China, India and other developing countries in response to soaring electricity demand that Brandler said the company's total emissions of global warming gases may actually increase in the short term.

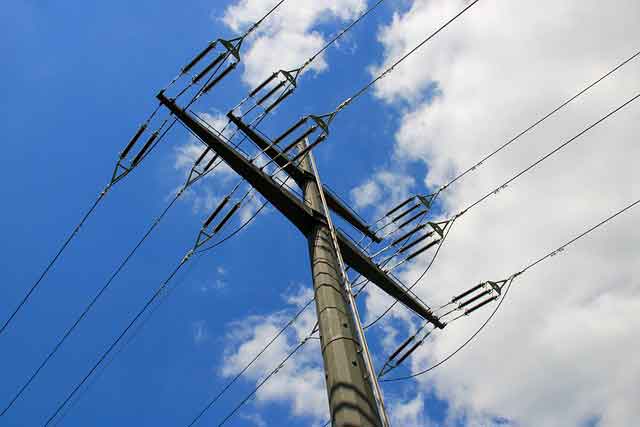

The problem is particularly acute because governments across Asia, from China and India to Indonesia and the Philippines, are turning mainly to coal to meet their soaring electricity needs and prevent blackouts, even though coal produces more global warming gases than any other major source of electricity.

China's increase has been the most substantial. The country built 114,000 megawatts of fossil-fuel-based generating capacity last year alone, almost all coal-fired, and is on course to complete 95,000 megawatts more this year.

For comparison, Britain has 75,000 megawatts in operation, built over a span of decades. The most talked-about alternative to coal in China involves plans to quadruple the country's share of power from nuclear energy by 2020. But the plan, which contemplates dozens of reactors, still amounts to just 31,000 megawatts of nuclear power over the next dozen years.

"That's minuscule," said Jonathan Sinton, a China expert at the International Energy Agency. China builds more coal-fired capacity than that every four months.

Two big questions linger over even those modest goals: can equipment be manufactured for dozens of nuclear reactors, and can China train enough workers to run them?

At CLP's Daya Bay nuclear plant in Shenzhen, a house-sized dome of specially hardened steel sat next to an immense crane one recent morning, waiting to be swung and bolted into position as part of the site's sixth reactor.

But at least Daya Bay's dome is here — reactors elsewhere in China wait up to several years. Only a handful of steel mills around the world can cast the thick domes, and only now are the first two mills in China taking delivery of equipment to make them.

The plant's 1,750 employees, meanwhile, are training 500 interns at a time, according to Stephen Lau, the first deputy general manager of the plant; the government-owned nuclear power company asked that 1,000 be trained at a time, but the joint venture running the plant could not handle that many.

By contrast, there is no shortage of workers to run coal-fired power plants. China is dotted with decrepit state-owned coal-fired plants that each employ 900 to 1,000 people to produce just 50 to 100 megawatts. The government frequently asks companies to close one of these inefficient, heavily polluting operations and provide jobs or money to the workers before allowing the construction of a new coal-fired plant.

CLP's modern coal-burning plant in Fangchenggang in southernmost China — a pair of 260-foot gray towers looming over a tropical landscape of woods and emerald rice fields dotted by gray oxen — employs just 270 workers to generate 1,200 megawatts.

Before the Fangchenggang plant could be built, the local government had to buy the land from residents of a nearby fishing village, setting off discussions about whose land should be sacrificed, said Zhang Zhengde, a village elder.

"We would prefer to have a smaller site — if there were more land, it would disrupt our lives, and government compensation cannot solve that," he said.

But coal's problems are nothing compared with the challenges facing the wind-energy industry, which requires much more land and is troubled by years-long shortages of a wider range of parts, as well as contradictory regulatory policies. For instance, Beijing has mandated that power transmission companies pay at least 6.5 cents per kilowatt hour to buy wind-generated electricity from approved power producers, not much above the 4.5 cents an hour they pay for coal-generated power. But the premium is so small that only one-third of 1 percent of the nationally regulated wind power projects approved in 2004 have actually been built, and none of those approved in the last two years, said Vivek Kher, a spokesman for Suzlon Energy, an Indian manufacturer of wind turbines.

Some provincial governments have ordered payments of 8.1 cents for wind projects they regulate, he said, and these projects are being built.

Plans have slowed to expand the use of natural gas, which burns more cleanly and produces less greenhouse gas than coal or oil. It has proved costly and difficult to build pipelines from gas fields in western China, while liquefied natural gas for transport in ships is in short supply.

The future of hydroelectric power in China is clouded by severe environmental problems at the Three Gorges Dam on the Yangtze River.

One of the strangest features of China's energy policy is the paucity of environmental controls on coal-fired plants, because rules governing them were written long ago.

Renewable energy projects actually face a more stringent review of their environmental impact.

China has begun telling companies that build coal-fired plants that they should choose so-called supercritical technology. Such technology increases construction costs, but the plant then requires 10 percent less coal to run, reducing emissions and long-term costs.

CLP's new coal-fired plant at Fangchenggang, near the Vietnamese border, uses supercritical technology. But it still produces considerably more global warming gases than burning natural gas, using nuclear power or turning to renewable energy sources like biomass.

Now CLP wants an international consensus on a broad successor to the Kyoto Protocol, which set some limits on greenhouse gas emissions through 2012. Clear limits on future emissions would force utilities to avoid projects that contribute to global warming, and, unlike Kyoto, might extend to more of Asia. Kyoto exempts developing countries like China and India from emissions limits.

One reason CLP seeks a new consensus is the bruising lesson it recently received. The company had proposed building a coal-fired plant in the Philippines employing supercritical technology and burning very low-sulfur coal, a more expensive but less polluting variety of coal.

In the end, though, the developer found an American private equity firm that was willing to bankroll a low-tech subcritical plant using a variety of coal that pollutes more, said Brandler, declining to identify the project or the participants. (Greenpeace officials said that they were also not aware of which project it might be among many in the Philippines.)

"You've got to get the rest of the industry to come along," Brandler said. "That's why we will be agitating more."