FutureGen 2.0 far from a sure bet

By New York Times

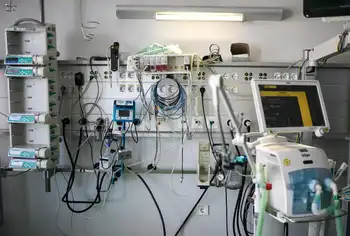

NFPA 70e Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

The project aims to retrofit an oil-fired power plant in Meredosia, Ill., with oxycombustion technology that would burn coal in an enriched oxygen environment, then capture 90 percent of carbon dioxide emissions in condensed water so the CO2 can be stored underground.

The project is the third iteration of FutureGen, the carbon capture and sequestration CCS project that President George W. Bush announced in 2003.

"This is fundamentally a shift in the definition of the project," said Sarah Forbes, a senior associate at the World Resources Institute, a nonprofit think tank. "FutureGen, the restructured FutureGen and FutureGen 2.0 are essentially different projects. They are all different efforts for storing CO2."

Gone from the original FutureGen is the integrated gasification combined cycle IGCC technology that turns coal into gas before drawing out pollutants and a component for producing hydrogen.

There are now several IGCC projects going forward, DOE says, so wrapping it into FutureGen is no longer necessary. But critics disagree, saying no IGCC projects are large enough to test the technology on a massive scale or in combination with carbon sequestration components.

Also gone from the new FutureGen is the old missing project site, Mattoon, in Coles County, Ill. Out the window with that site are environmental reviews, state permits and land rights secured for that property. DOE and its partners are hunting for another CO2 storage site and face a new round of permitting and efforts to calm neighbors concerned about living on top of sequestered CO2 that could affect their health and property values.

The Coles County deal collapsed after DOE announced the original site would only sequester the carbon emissions and house a training center and not be the site of a job-generating power plant or research center.

Nonetheless, Jeff Phillips, senior program manager at the Electric Power Research Institute, the research and development arm of the electric industry, said DOE's latest FutureGen push "is a very positive development for CO2 capture and storage."

"Until now, DOE had not selected any oxycombustion project for funding," he said. "We were struggling to see how oxycombustion could move forward without government-supported demonstration. This definitely meets that need."

He added, "I don't want to minimize all the efforts to the original FutureGen concept, but I think it had become very clear that they were not going to come up with the nongovernmental cost share for that project as originally envisioned, and that meant it would become a pumpkin on Sept. 30," the deadline Congress has given the administration for distributing cash from the stimulus law.

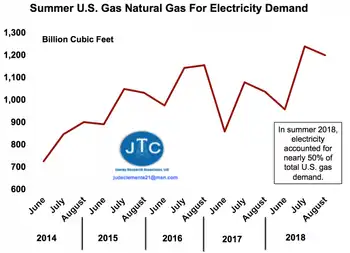

Oxycombustion technology may also prove to be more useful in the next 10 years, as it can be used to retrofit a power plant, as opposed to the construction of a new power plant required to make IGCC economically feasible, he said. The recession has dramatically lowered electricity demands, so there's little need to build new power plants.

Matt Rogers, DOE's senior adviser on stimulus funding, said the combination of the need to fill a gap in oxycombustion demonstration, budgetary constraints of the original project and a looming stimulus deadline led to the new project direction.

"The single biggest difference between now and what has gone in the past is we have $1 billion in appropriations," Rogers said. "We are now in a position where we can obligate those funds. We are going to start writing the checks Oct. 1 to these participants so that project can move forward."

What the project has going for it is a large pile of federal cash, Phillips said.

"What makes Futuregen 2.0 different from all the rest is it has $1 billion that has already been approved," he said. "That is 80 percent of the cost of the project. I don't think there is any other CCS project in the world that involves a coal power plant that has 80 percent lined up storing 1 million tons of CO2 each year."

DOE and companies involved in FutureGen 2.0 — Ameren Energy Resources, which owns the power plant, and Babcock & Wilcox Co. and Air Liquide Process & Construction Inc., which has developed the oxycombustion technology — plan to begin construction by 2012 and complete the project in 2015.

In addition to retrofitting the power plant and building the sequestration repository, FutureGen 2.0 would build pipelines to carry the CO2 and a research, visitor and training center focused on oxycombustion retrofits and CCS. The project will bring 1,000 temporary and about 150 permanent jobs to southern Illinois, DOE said.

But good intentions don't assure a successful project, according to Angela Griffin, president and CEO of Coles Together, the county's economic development organization, which spearheaded efforts to lure FutureGen to Mattoon.

Griffin said the new project doesn't provide her county the same economic benefits as the original project, so Mattoon opted out.

DOE's loss of the Mattoon site creates a void for FutureGen 2.0.

It took two years for project organizers to complete National Environmental Policy Act NEPA reviews for Mattoon and several million dollars to acquire the more than 400 acres of surface and subsurface rights to the project site, Griffin said. No other site, she said, has a community that supports CCS and has rights to a sandstone formation capable of sequestering 1 million tons of CO2 for 30 years.

"This community didn't just accept it they embraced it," she said. "That is a bigger challenge than the NEPA process because the NEPA process is proscribed, and you don't deviate from it. The community education piece is completely unique for every community and completely unique for every individual in that community."

The goal in Mattoon, she said, was to make the area a destination for anyone interested in cutting-edge technology for curbing emissions from coal-burning power plants.

"We invested almost five years and millions of dollars locally for a project to create 100 to 150 jobs," Griffin said. "If you look at it like that with blinders on, that is not sound economic development policy. So what this community was able to see was all of the potential beyond that and why it was sound economic development policy and why it represented so much more than the job numbers on paper."

When the proposed power plant was moved away from Coles County, the community lost prestige and jobs, Griffin said.

The FutureGen Alliance — a consortium of nine coal-industry companies that backed the original project — will develop, construct and operate the CO2 pipeline and injection site for the new project. The alliance announced that it would join the project and find another injection site. The site must be within 100 miles of Meredosia and include at least 10 acres, according to DOE.

DOE's Rogers said he was not daunted by the challenge of finding a new site, as many prospective sites have already undergone partial reviews.

"The environmental permitting process is not the long pole in the tent from a project development standpoint," Rogers said. The companies involved are starting on the detailed engineering and design plans this fall, and the alliance expects the siting and review process to run in parallel and within the time frame of finishing those designs, he said.

But the World Resource Institute's Forbes cautioned DOE and its partners not to underestimate the people element of the project.

"They need to involve people, not just provide information," Forbes said. "Communication with a local community needs to happen at the very earliest stages of a project. Where possible, communities need to be brought into decisionmaking where key aspects will affect them," she said.

FutureGen 2.0 will still be at least three years behind its predecessor's original timeline, and it's unclear if it will be able to push the United States to the forefront of CCS technology development.

"FutureGen was a project that garnered a lot of international attention because of the way it was devised," Forbes said. "It also brought international attention for some time after the original project was canceled, and it impacted international feelings about the ability to do a CCS demonstration project.

"The country who gets the very, very big one through has the advantage."

The FutureGen Alliance includes several international companies, including the British mining company Anglo American PLC, the Australian mining company BHP Billiton Ltd. and China Huaneng Group, the largest coal-based power company in China.

"We believe there is going to be a tremendous amount of international interest in 2.0," Rogers said. "This oxycombustion technology has broad applicability in China, India and also major trading partners in Europe.... This is a great opportunity for the U.S. to have a leadership role in one of the most important technologies in the world."

There are 178 CCS demonstration projects that are either already operating or under development around the world, according to the National Energy Technology Laboratory project database. About 77 are in the United States, but most of them will capture 10,000 tons of CO2 or less per day. There are only two oxycombustion projects in the world, one in Bakersfield, Calif., and a proposed venture in Worsham-Steed, Texas, according to NETL.

FutureGen is not the only weapon in DOE's CCS arsenal: There are four projects in the Clean Coal Power Initiative and about 69 projects testing a full spectrum of carbon sequestration technology and testing sites. All of the $3.4 billion in stimulus funds for CCS projects are obligated, Rogers said.

Forbes called DOE's CCS program "one of the most ambitious, with the most small-scale projects in the world."

There may also be a bright side to the collapse of the original FutureGen effort.

The project's "shovel ready" site in Coles County has grabbed the attention of several companies looking to proceed on CCS projects, said Griffin, the county's economic development booster. "We are the only community with our hand in air asking for CCS," she said.

But CCS promoters know it's a long, hard road between grand proposal and spades in the ground.

"Until we see these projects under construction," EPRI's Phillips said, "I am not going to celebrate."