Total Cost of EV Ownership: New Data Reveals Long-Term Savings

NFPA 70e Training - Arc Flash

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Electric vehicles may cost more upfront but often save money long-term. A new MIT study shows the total cost of EV ownership is lower than gas cars when factoring in fuel, maintenance, and emissions.

Total cost of EV ownership is the focus of new MIT research showing electric vehicles offer both financial and environmental benefits over time.

✅ Electric vehicles cost more upfront but save money over their lifetime through lower fuel and maintenance costs

✅ MIT study confirms EVs have lower emissions and total ownership costs than most gas-powered cars

✅ New interactive tool helps consumers compare climate and cost impacts of EVs, hybrids, and traditional vehicles

Electric vehicles are better for the climate than gas‑powered cars, but many Americans are still reluctant to buy them. One reason: The larger upfront cost.

New data published Thursday shows that despite the higher sticker price, electric cars may actually save drivers money in the long-run.

To reach this conclusion, a team at the Massachusetts Institute of Technology calculated both the carbon dioxide emissions and full lifetime cost — including purchase price, maintenance and fuel — for nearly every new car model on the market.

They found electric cars were easily more climate friendly than gas-burning ones. Over a lifetime, they were often cheaper, too.

Jessika Trancik, an associate professor of energy studies at M.I.T. who led the research, said she hoped the data would “help people learn about how those upfront costs are spread over the lifetime of the car.”

For electric cars, lower maintenance costs and the lower costs of charging compared with gasoline prices tend to offset the higher upfront price over time. (Battery-electric engines have fewer moving parts that can break compared with gas-powered engines and they don’t require oil changes. Electric vehicles also use regenerative braking, which reduces wear and tear.)

As EV adoption continues to boom, more consumers are realizing the long-term savings and climate benefits. Ontario’s investment in EV charging stations reflects how infrastructure is beginning to catch up with demand. Despite regional energy pricing differences, EV charging costs remain lower than gasoline in nearly every U.S. city.

The cars are greener over time, too, despite the more emissions-intensive battery manufacturing process. Dr. Trancik estimates that an electric vehicle’s production emissions would be offset in anywhere from six to 18 months, depending on how clean the energy grid is where the car is charging.

In some areas, EVs are even being used to power homes, enhancing their value as a sustainable investment. Recent EPA rules aim to boost EV sales, further signaling government support. California leads the nation in EV charging infrastructure, setting a model for nationwide adoption.

The new data showed hybrid cars, which run on a combination of fuel and battery power, and can sometimes be plugged in, had more mixed results for both emissions and costs. Some hybrids were cheaper and spewed less planet-warming carbon dioxide than regular cars, but others were in the same emissions and cost range as gas-only vehicles.

Traditional gas-burning cars were usually the least climate friendly option, though long-term costs and emissions spanned a wide range. Compact cars were usually cheaper and more efficient, while gas-powered SUVs and luxury sedans landed on the opposite end of the spectrum.

Dr. Trancik’s team released the data in an interactive online tool to help people quantify the true costs of their car-buying decisions — both for the planet and their budget. The new estimates update a study published in 2016 and add to a growing body of research underscoring the potential lifetime savings of electric cars.

Take the Tesla Model 3, the most popular electric car in the United States. The M.I.T. team estimated the lifetime cost of the most basic model as comparable to a Nissan Altima that sells for $11,000 less upfront. (That’s even though Tesla’s federal tax incentive for electric vehicles has ended.)

Toyota’s Hybrid RAV4 S.U.V. also ends up cheaper in the long run than a similar traditional RAV4, a national bestseller, despite a higher retail price.

Hawaii, Alaska and parts of New England have some of the highest average electricity costs, while parts of the Midwest, West and South tend to have lower rates. Gas prices are lower along the Gulf Coast and higher in California. But an analysis from the Union of Concerned Scientists still found that charging a vehicle was more cost effective than filling up at the pump across 50 major American cities. “We saw potential savings everywhere,” said David Reichmuth, a senior engineer for the group’s Clean Transportation Program.

Still, the upfront cost of an electric vehicle continues to be a barrier for many would-be owners.

The federal government offers a tax credit for some new electric vehicle purchases, but that does nothing to reduce the initial purchase price and does not apply to used cars. That means it disproportionately benefits wealthier Americans. Some states, like California, offer additional incentives. President-elect Joseph R. Biden Jr. has pledged to offer rebates that help consumers swap inefficient, old cars for cleaner new ones, and to create 500,000 more electric vehicle charging stations, too.

EV sales projections for 2024 suggest continued acceleration, especially as costs fall and policy support expands. Chris Gearhart, director of the Center for Integrated Mobility Sciences at the National Renewable Energy Laboratory, said electric cars will become more price competitive in coming years as battery prices drop. At the same time, new technologies to reduce exhaust emissions are making traditional cars more expensive. “With that trajectory, you can imagine that even immediately at the purchase price level, certain smaller sedans could reach purchase price parity in the next couple of years,” Dr. Gearhart said.

EF Partner Media

Bushing Monitoring: What's the Difference Between Sum of Currents and Voltage Reference

Article

Bushing Monitoring: What's the Difference Between Sum of Currents and Voltage Reference

Article

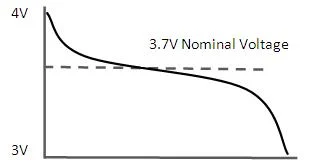

How to Read Nominal Voltage: Electrical System Engineering

Brochure

How to Read Nominal Voltage: Electrical System Engineering

Brochure

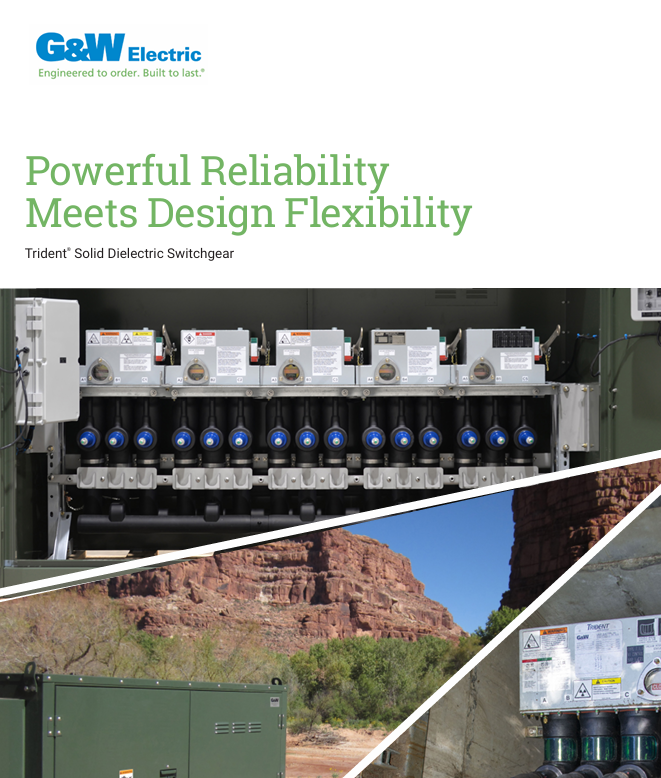

Powerful Reliability Meets Design Flexibility – Trident® Solid Dielectric Switchgear

Product

Powerful Reliability Meets Design Flexibility – Trident® Solid Dielectric Switchgear

Product

Viper-HV sub-transmission overhead recloser

Viper-HV sub-transmission overhead recloser

Related Pages:

EV Boom Unexpectedly Benefits All Electricity Customers

Ontario Invests in New EV Charging Stations

EV Charging Cost Still Beats Gasoline, Study Finds

EPA Rules Expected to Boost U.S. Electric Vehicle Sales

California Takes the Lead in Electric Vehicle and Charging Station Adoption

EVs to Power Homes: New Technology Turns Cars Into Backup Batteries

U.S. Electric Vehicle Sales Soar Into 2024