Brazil government considers emergency Coronavirus loans for power sector

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Brazil Energy Emergency Loan Package aims to bolster utilities via BNDES as coronavirus curbs electricity demand. Aneel and the Mines and Energy Ministry weigh measures while Eletrobras privatization and auctions face delays.

Key Points

An emergency plan supporting Brazilian utilities via BNDES and banks during coronavirus demand slumps and payment risks.

✅ Modeled on 2014-2015 sector loans via BNDES and private banks

✅ Addresses cash flow from lower demand and bill nonpayment

✅ Auctions and Eletrobras privatization delayed amid outbreak

Brazil’s government is considering an emergency loan package for energy distributors struggling with lower energy use and facing lost revenues because of the coronavirus outbreak, echoing strains seen elsewhere such as Germany's utility troubles during the energy crisis, an industry group told Reuters.

Marcos Madureira, president of Brazilian energy distributors association Abradee, said the package being negotiated by companies and the government could involve loans from state development bank BNDES or a pool of banks, but that the value of the loans and other details was not yet settled.

Also, Brazil’s Mines and Energy Ministry is indefinitely postponing projects to auction off energy transmission and generation assets planned for this year because of the coronavirus, even as the need for electricity during COVID-19 remained critical, it said in the Official Gazette.

The coronavirus outbreak will also delay the privatization of state-owned utility Eletrobras, its chief executive officer said on Monday.

The potential loan package under discussion would resemble a similar measure in 2014 and 2015 that offered about 22 billion reais ($4.2 billion) in loans to the sector as Brazil was entering its deepest recession on record, and drawing comparisons to a proposed Texas market bailout after a winter storm, Madureira said.

Public and private banks including BNDES, Caixa Economica Federal, Itau Unibanco and Banco Bradesco participated in those loans.

Three sources involved in the discussions said on condition of anonymity that the Mines and Energy Ministry and energy regulator Aneel were considering the matter.

Aneel declined to comment. The Mines and Energy Ministry and BNDES did not immediately respond to requests for comment.

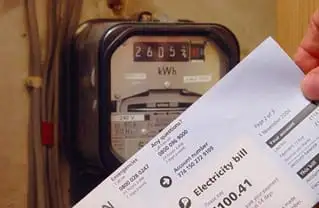

Energy distributors worry that reduced electricity demand during COVID-19 could result in deep revenue losses.

The coronavirus has led to widespread lockdowns of non-essential businesses in Brazil, while citizens are being told to stay home. That is causing lost income for many hourly and informal workers in Brazil, who could be unable to pay their electricity bills, raising risks of pandemic power shut-offs for vulnerable households.

The government sees a loan package as a way to stave off a potential chain of defaults in the sector, a move discussed alongside measures such as a Brazil tax strategy on energy prices, one of the sources said.

On a conference call with investors about the company’s latest earnings, Eletrobras CEO Wilson Ferreira Jr. said privatization would be delayed, without giving any more details on the projected time scale.

The largest investors in Brazil’s energy distribution sector include Italy’s Enel, Spain’s Iberdrola via its subsidiary Neoenergia and China’s State Grid via CPFL Energia, with Chinese interest also evidenced by CTG's bid for EDP, as well as local players Energisa e Equatorial Energia.